Konica Minolta 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

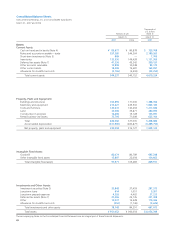

Consolidated Financial Review

Scope of Consolidated Financial Statements

The Konica Minolta Group comprises Konica Minolta Holdings, Inc., and its 120 subsidiaries, 25

unconsolidated subsidiaries and 9 affiliated companies.

The business segments of the Group are organized and segmented by type of product, the

markets in which these products are sold and the nature of the business or how it is adminis-

tered. The Group’s six business segments are Business Technologies, Optics, Medical and Graphic

Imaging, Sensing, Industrial Inkjet, and Photo Imaging. In addition, the Group nearly completed

its exit from the Photo Imaging business in the fiscal year ended March 2007.

Consolidated Business Results

Consolidated Net Sales

Consolidated net sales for the fiscal year ended March 2007 declined by ¥40.8 billion year-on-year

to ¥1,027.6 billion. While sales in the Photo Imaging business that is being wound down recorded

a large decline of ¥139.4 billion for the year, growth was recorded in sales for all other businesses.

In particular, sales for the strategic Optics business recorded 26% year-on-year growth.

In the Business Technologies business, good growth of medium- and high-speed color MFPs

mainly in European markets supported 9% growth in sales for the segment as a whole. In the

Optics business, all areas recorded good sales growth, including TAC film and viewing angle

expansion film for display applications, optical pickup lenses and glass hard disk substrates for

memory applications, micro cameras for camera-equipped mobile phones for imaging input/out-

put applications. In the Medical and Graphic Imaging business, digital X-ray input/output equip-

ment for medical imaging area and overseas film sales for the graphic imaging area recorded 8%

year-on-year growth. In the Sensing business, strong sales were recorded for color measuring

equipment used in automobile and FPD industries. In the Industrial Inkjet business, favorable sales

were supported by active development of new customers. On the other hand, sales in the Photo

Imaging business recorded a noticeable decline because of the Group’s decision to exit this

business in Japan and overseas.

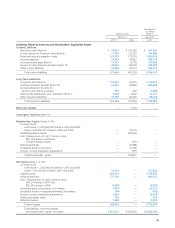

Cost of Sales, and Selling, General and Administrative Expenses

The cost of sales for the fiscal year was ¥532.7 billion, resulting in a cost of sales ratio of 51.8%.

The Group was able to offset sharply higher silver and other basic materials costs and unit price

declines because of more intense competition with Group-wide cost reduction efforts and an

improved sales mix with the introduction of new products, and the effect of foreign exchange

rates. As a result, gross profit was ¥494.9 billion, and the gross profit margin improved by 2

percentage points over the previous year, from 46.2% to 48.2%.

Selling, general and administrative expenses were reduced by ¥48.7 billion because of the exit

from the Photo Imaging business. As a result, total selling, general and administrative expenses

declined by ¥18.9 billion from the previous fiscal year to ¥390.9 billion, even though selling and

research expenses for other businesses increased by ¥29.8 billion.

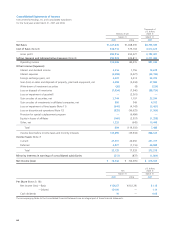

Research and Development Expenses

Research and development expenditures rose ¥5.0 billion over the previous fiscal year to ¥72.1

billion. In the Business Technologies segment, R&D expenditures rose over the previous fiscal year

to ¥42.5 billion, mainly because of expenditures for the development of new medium- and high-

speed color MFP products and R&D on software and applications to establish the capability to

provide solutions. In the Optics segment, R&D expenditures of ¥9.8 billion were used largely for

Business Technologies

Optics

Medical and Graphic Imaging

Sensing, Industrial Inkjet

Holdings, Others

Photo Imaging

Net Sales

(Billions of Yen)

0

300

600

900

1,200

2005 2006 2007

Cost of Sales

(left scale)

Cost of Sales Ratio

(right scale)

Cost of Sales and

Cost of Sales Ratio

(Billions of Yen, %)

0

15

30

45

60

0

200

400

600

800

2005 2006 2007