Konica Minolta 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

01

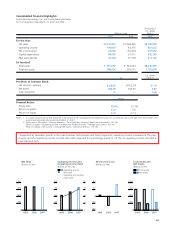

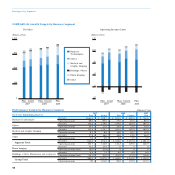

Consolidated Financial Highlights

Konica Minolta Holdings, Inc. and Consolidated Subsidiaries

For the fiscal years ended March 31, 2007 and 2006

For the Year:

Net sales

Operating income

Net income (loss)

Capital expenditure

R&D expenditures

At Year-End:

Total assets

Total net assets

¥1,068,390

83,416

(54,306)

67,571

67,178

¥ 944,054

296,571

2007 2006

Millions of yen

Thousands of

U.S. dollars

(Note 1)

2007

Per Share of Common Stock:

Net income—primary

Net assets

Cash dividends

¥(102.29)

553.50

—

Yen

U.S. dollars

(Note 1)

Financial Ratios:

Equity ratio

Return on assets

Return on equity

31.1%

9.0

(17.1)

Percent

Notes: 1. U.S. dollar amounts above and elsewhere in this report for the Company are translated from yen, for convenience only, at the rate of ¥118.05=US$1, the

approximate exchange rate prevailing at March 31, 2007.

2. Equity ratio = (Net assets – Minority interests) ÷ (Total Liabilities, minority interests and net assets) × 100 (%)

Return on assets = (Operating income + Interest and dividend income) ÷ Average total assets × 100 (%)

Return on equity = Net income ÷ Average (Net assets – Minority interests) × 100 (%)

*Supported by favorable growth in the main Business Technologies and Optics segments, operating income increased 24.7% year-

on-year and the operating income to total sales ratio improved 2.3 percentage points to 10.1% as operating income recorded a

new historical high.

¥1,027,631

104,007

72,542

64,000

72,142

¥ 951,052

368,624

$8,705,040

881,033

614,502

542,143

611,114

$8,056,349

3,122,609

¥136.67

692.39

10

$1.16

5.87

0.08

38.6%

11.2

21.9

*

Total assets

Net assets

Operating income

(left scale)

Operating income Ratio

(right scale)

2005 2006 2007

Net Sales

(Billions of Yen)

2005 2006 2007

Total Assets and

Net Assets

(Billions of Yen)

0

300

600

900

1,200

0

300

600

900

1,200

2005 2006 2007

Operating Income and

Operating Income Ratio

(Billions of Yen, %)

0

30

60

90

120

0

3

6

9

12

2005 2006 2007

Net Income (Loss)

(Billions of Yen)

–80

–40

0

40

80