Konica Minolta 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

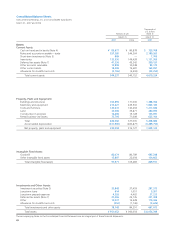

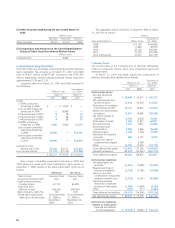

Net deferred tax assets are included in the following items in

the consolidated balance sheets:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2007 2006 2007

Current assets –

deferred tax assets ¥41,336 ¥43,242 $350,157

Fixed assets –

deferred tax assets 27,306 29,135 231,309

Current liabilities –

other current liabilities (21) (3) (178)

Long-term liabilities –

other long-term liabilities ¥ (2,191) ¥ (2,097) $ (18,560)

Net deferred tax assets ¥66,430 ¥70,276 $562,728

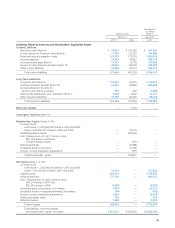

At March 31, 2007 and 2006, the reconciliation of the statutory

income tax rate to the effective income tax rate is as follows:

2007 2006

Statutory income tax rate 40.7% 40.7%

(Reconciliation)

Valuation allowance (9.3) (95.0)

Tax credits (2.6) 6.5

Non-taxable income (0.7) —

Difference in statutory tax rates

of foreign subsidiaries (0.3) —

Expenses not deductible for

tax purposes 1.7 —

Amortization of goodwill 1.9 (9.0)

Other, net (0.8) 8.0

Effective income tax rate per

consolidated statements of income 30.6% (48.8)%

8. Research and Development Costs

Research and development costs included in cost of sales and

selling, general and administrative expenses for the year ended

March 31, 2007 and 2006 are ¥72,142 million (US$611,114

thousand) and ¥67,178 million, respectively.

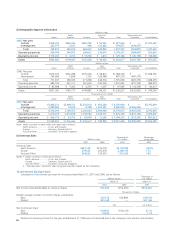

9. Net Assets

The Japanese Corporate Law effective from May 1, 2006 provides

that earnings in an amount equal to 10% of dividends of retained

earnings shall be appropriated as a capital surplus or a legal

reserve on the date of distribution of retained earnings until the

aggregated amount of capital surplus and legal reserve equals

25% of stated capital. The legal reserve is included in retained

earnings in the accompanying consolidated balance sheets. The

Japanese Commercial Code, effective until the enforcement of the

Japanese Corporate Law, provided that earnings in an amount

equal to at least 10% of appropriations of retained earnings that

were paid in cash shall be appropriated as a legal reserve until the

aggregated amount of capital surplus and legal reserve equaled

25% of stated capital.

The Board of Directors decided not to pay cash dividend for the

interim period ended September 30, 2006, due to the considerable

extraordinary losses incurred in the previous year in connection

with the exit from the Photo Imaging business.

On May 10, 2007, the Board of Directors approved cash divi-

dends to be paid to shareholders of record as of March 31, 2007,

totaling ¥5,307 million, at a rate of ¥10 per share.

10. Contingent Liabilities

The Companies were contingently liable at March 31, 2007 for

loan and lease guarantees of ¥2,236 million (US$18,941 thou-

sand) and as of March 31, 2006 for loan and lease guarantees of

¥2,620 million.

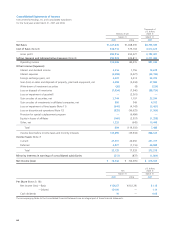

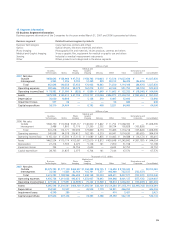

11. Loss on Impairment of Fixed Assets

The Companies have recognized loss on impairment of ¥640 mil-

lion ($5,421 thousand), for the following groups of assets as of

March 31, 2007 and 2006:

Description Classification Amount

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2007 2006 2007

Rental assets Land, ¥— ¥ 4,412 $—

Buildings and

structures

Rental business-

use assets 117 —991

Idle assets Land, 522 287 4,422

Buildings and

structures, Others

Manufacturing Buildings and —24,756 —

and sales of structures,

photographic Machinery and

paper, Film, equipment,

etc. Tools and

furniture, Others

Manufacturing Land, —3,296 —

and sales of Buildings and

except above structures

Total ¥640 ¥32,752 $5,421

(1) Identifying the cash-generating unit to which an asset belongs

Each cash-generating unit is identified based on the product

line and geographical area as a group of assets. For rental

assets, cash-generating unit is identified by the rental contract

and the geographical area. Each idle assets is also identified as

a cash-generating unit.

(2) The events and circumstances that led to the recognition of

the impairment loss

Due to the decline in real estate value and poor perfor-

mance, profitability of rental and idle assets has worsened.

Therefore, the Companies have marked the assets down

to the recoverable value.

(3) Details of Impairment of fixed assets Amount

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2007 2006 2007

Buildings and structures ¥ 87 ¥13,464 $ 737

Rental business-use assets 117 —991

Machinery and equipment —11,006 —

Tools and furniture —1,539 —

Leased asset —3,972 —

Others 435 2,769 3,685

(4) Measuring recoverable amount

The recoverable amount of a cash-generating unit is the fair

value less costs to sell. It is supported by an appraisal report

for land and buildings and structures, or the rational estimate

for rental business–use assets.

12. Loss on Discontinued Operations

In the fiscal year ended March 31, 2006, the Companies recorded

¥96,625 million of loss on discontinued operations, which was

incurred in connection with the exit from the Photo Imaging

business.

This loss included a reserve for discontinued operations

(¥58,078 million), impairment loss on fixed assets of Photo

Imaging business (¥28,609 million) and the cost for disposal of

inventories (¥18,536 million), less the proceeds from the sale of

business (–¥8,599 million).