JetBlue Airlines 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

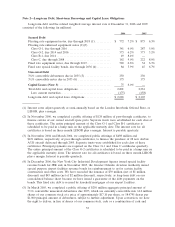

At December 31, 2006, 47 of the 119 aircraft we operated were leased under operating leases,

with initial lease term expiration dates ranging from 2009 to 2024. Five of the 47 aircraft leases have

variable-rate rent payments based on LIBOR. Forty aircraft leases generally can be renewed at rates

based on fair market value at the end of the lease term for one or two years. Thirty-seven aircraft

leases have purchase options at the end of the lease term at fair market value and a one-time fixed

price option during the term at amounts that were expected to approximate fair market value at

inception. During 2006, we entered into sale and leaseback transactions for 16 EMBRAER 190

aircraft acquired during the year that are being accounted for as operating leases. We have deferred

$11 million in gains related to these sale and leaseback transactions, which are being recognized on a

straight-line basis over the related 18-year lease terms as a reduction to aircraft rent expense.

During 2006, we entered into capital lease agreements for two Airbus A320 aircraft. At

December 31, 2006, these aircraft are included in property and equipment at a cost of $75 million and

accumulated amortization of $1 million. The future minimum lease payments under these

noncancelable leases are $8 million per year through 2010, $7 million in 2011 and $73 million in the

years thereafter. Included in the future minimum lease payments is $37 million representing interest,

resulting in a present value of capital leases of $75 million with a current portion of $4 million and a

long-term portion of $71 million.

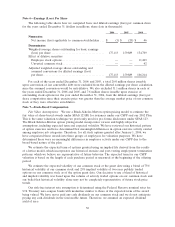

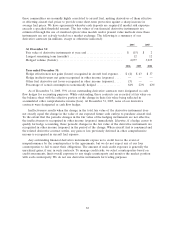

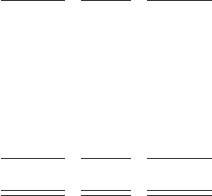

Future minimum lease payments under noncancelable operating leases with initial or remaining

terms in excess of one year at December 31, 2006, are as follows (in millions):

Aircraft Other Total

2007........................................................ $ 161 $ 56 $ 217

2008........................................................ 166 50 216

2009........................................................ 154 36 190

2010........................................................ 136 34 170

2011........................................................ 127 32 159

Thereafter................................................... 797 428 1,225

Total minimum operating lease payments ....................... $ 1,541 $ 636 $ 2,177

We hold variable interests in 37 of our 47 aircraft operating leases, which are owned by single

owner trusts whose sole purpose is to purchase, finance and lease these aircraft to us. Since we do not

participate in these trusts and we are not at risk for losses, we are not required to include these trusts

in our consolidated financial statements. Our maximum exposure is the remaining lease payments,

which are reflected in the future minimum lease payments in the table above.

Note 4—Assets Constructed for Others

In November 2005, we executed a lease agreement with the Port Authority of New York and

New Jersey, or PANYNJ, for the construction and operation of a new terminal at JFK. Under this

lease, we are responsible for construction of a 635,000 square foot 26-gate terminal, a parking garage,

roadways and an AirTrain Connector, all of which will be owned by the PANYNJ and which are

collectively referred to as the Project. The lease term ends on the earlier of the thirtieth anniversary

of the date of beneficial occupancy of the new terminal or November 21, 2039. We have a one-time

early termination option five years prior to the end of the scheduled lease term.

The aggregate cost of the Project is estimated at $740 million and is expected to be completed in

late 2008. We are making various payments under the lease, including ground rents for the new

terminal site which began on lease execution, and facility rents that are anticipated to commence upon

the date of beneficial occupancy. The facility rents are based on the number of passengers enplaned

out of the new terminal, subject to annual minimums. The PANYNJ reimburses us for the costs of

constructing the Project in accordance with the lease, except for approximately $80 million in

leasehold improvements that will be provided by us.

We have evaluated this lease and have concluded that we bear substantially all of the construction

period risk, as defined in Emerging Issues Task Force Issue 97-10, The Effect of Lessee Involvement in

54