JetBlue Airlines 2006 Annual Report Download - page 52

Download and view the complete annual report

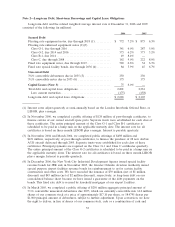

Please find page 52 of the 2006 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The risk inherent in our market risk sensitive instruments and positions is the potential loss

arising from adverse changes to the price of fuel and interest rates as discussed below. The sensitivity

analyses presented do not consider the effects that such adverse changes may have on the overall

economic activity, nor do they consider additional actions we may take to mitigate our exposure to

such changes. Variable-rate leases are not considered market sensitive financial instruments and,

therefore, are not included in the interest rate sensitivity analysis below. Actual results may differ. See

Notes 1, 2 and 13 to our consolidated financial statements for accounting policies and additional

information.

Aircraft fuel. Our results of operations are affected by changes in the price and availability of

aircraft fuel. To manage the price risk, we use crude or heating oil option contracts or swap

agreements. Market risk is estimated as a hypothetical 10%increase in the December 31, 2006 cost

per gallon of fuel. Based on projected 2007 fuel consumption, such an increase would result in an

increase to aircraft fuel expense of approximately $84 million in 2007, compared to an estimated

$73 million for 2006 measured as of December 31, 2005. As of December 31, 2006, we had hedged

approximately 38%of our projected 2007 fuel requirements. All hedge contracts existing at

December 31, 2006 settle by the end of 2007.

Interest. Our earnings are affected by changes in interest rates due to the impact those changes

have on interest expense from variable-rate debt instruments and on interest income generated from

our cash and investment balances. The interest rate is fixed for $1.03 billion of our debt and capital

lease obligations, with the remaining $1.70 billion having floating interest rates. If interest rates

average 10%higher in 2007 than they did during 2006, our interest expense would increase by

approximately $10 million, compared to an estimated $7 million for 2006 measured as of

December 31, 2005. If interest rates average 10%lower in 2007 than they did during 2006, our interest

income from cash and investment balances would decrease by approximately $3 million, compared to

$2 million for 2006 measured as of December 31, 2005. These amounts are determined by considering

the impact of the hypothetical interest rates on our variable-rate debt, cash equivalents and

investment securities balances at December 31, 2006 and 2005.

Fixed Rate Debt. On December 31, 2006, our $425 million aggregate principal amount of

convertible debt had a total estimated fair value of $437 million, based on quoted market prices. If

interest rates were 10%higher than the stated rate, the fair value of this debt would have been

$434 million as of December 31, 2006.

42