JetBlue Airlines 2006 Annual Report Download - page 47

Download and view the complete annual report

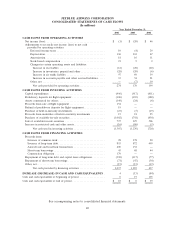

Please find page 47 of the 2006 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financing activities during 2005 consisted primarily of (1) our November 2005 public offering of

12.9 million shares of our common stock at $12.00 per share, as adjusted for our December 2005

three-for-two stock split, raising net proceeds of $153 million, (2) the sale and leaseback over 18 years

of six EMBRAER 190 aircraft for $152 million by a U.S. leasing institution, (3) the financing of

15 Airbus A320 aircraft with $498 million in floating rate equipment notes purchased with the

proceeds from our November 2004 public offering of Series 2004-2 pass-through certificates, (4) our

issuance of a $33 million 12-year fixed rate equipment note issued to a European bank secured by one

Airbus A320 aircraft, (5) our March 2005 issuance of $250 million of 3

3

⁄

4

%convertible debentures due

2035, raising net proceeds of approximately $243 million, (6) the financing of flight training devices

with $50 million in secured loan proceeds from Export Development Canada, (7) the financing of a

hangar and training center in Orlando, FL with $47 million in special facilities bonds, of which

$41 million was received by year end, and (8) scheduled maturities of $117 million of debt.

None of our lenders or lessors are affiliated with us. Our short-term borrowings consist of two

floating rate facilities, each with a group of commercial banks to finance aircraft predelivery deposits.

Capital Resources. We have been able to generate sufficient funds from operations to meet our

working capital requirements. We do not currently have any lines of credit, other than our short-term

aircraft predelivery deposit facilities, and virtually all of our property and equipment is encumbered.

We typically finance our aircraft through either secured debt or lease financing. At December 31,

2006, we operated a fleet of 119 aircraft, of which 47 were financed under operating leases, two were

financed under capital leases and the remaining 70 were financed by secured debt. Financing in the

form of secured debt or operating leases had been arranged for seven of our 12 Airbus A320 aircraft

and for eight of our 10 EMBRAER 190 aircraft scheduled for delivery in 2007. Although we believe

that debt and/or lease financing should be available for our remaining aircraft deliveries, we cannot

assure you that we will be able to secure financing on terms attractive to us, if at all. While these

financings may or may not result in an increase in liabilities on our balance sheet, our fixed costs will

increase significantly regardless of the financing method ultimately chosen. To the extent we cannot

secure financing, we may be required to modify our aircraft acquisition plans or incur higher than

anticipated financing costs.

Working Capital. We had working capital of $73 million at December 31, 2006, compared to a

working capital deficit of $41 million at December 31, 2005. We expect to meet our obligations as they

become due through available cash, investment securities and internally generated funds,

supplemented as necessary by debt and/or equity financings and proceeds from aircraft sale and

leaseback transactions. We expect to generate positive working capital through our operations.

However, we cannot predict what the effect on our business might be from the extremely competitive

environment we are operating in or from events that are beyond our control, such as continued

unprecedented high fuel prices, the impact of airline bankruptcies or consolidations, U.S. military

actions or acts of terrorism. Assuming that we utilize the predelivery short-term borrowing facilities

available to us and obtain financing for the seven remaining aircraft scheduled for delivery in 2007, we

believe the working capital available to us will be sufficient to meet our cash requirements for at least

the next 12 months.

37