JetBlue Airlines 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

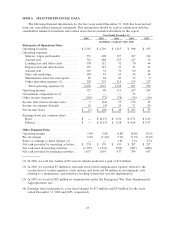

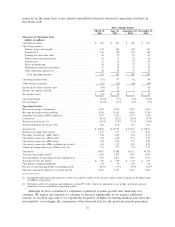

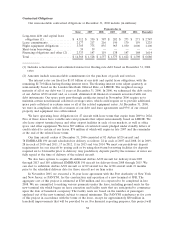

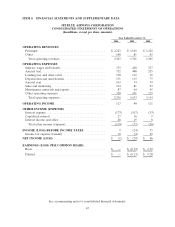

prepared on the same basis as the audited consolidated financial statements appearing elsewhere in

this Form 10-K.

Three Months Ended

March 31,

2006

June 30,

2006

September 30,

2006

December 31,

2006

Statements of Operations Data

(dollars in millions)

Operating revenues .................................. $ 490 $ 612 $ 628 $ 633

Operating expenses:

Salaries, wages and benefits ........................... 132 134 140 147

Aircraft fuel...................................... 160 192 212 188

Landing fees and other rents .......................... 38 37 42 41

Depreciation and amortization ......................... 34 37 39 41

Aircraft rent...................................... 22 25 27 29

Sales and marketing ................................ 20 30 27 27

Maintenance materials and repairs ...................... 21 23 23 20

Other operating expenses (1) .......................... 88 87 77 76

Total operating expenses ........................... 515 565 587 569

Operating income (loss) ............................... (25) 47 41 64

Other income (expense) ............................... (22) (22) (40) (34)

Income (loss) before income taxes ........................ (47) 25 1 30

Income tax expense (benefit) ........................... (15) 11 1 13

Net income (loss).................................... $ (32) $ 14 $ — $ 17

Operating margin.................................... (5.2)%7.7%6.6%10.2%

Pre-tax margin...................................... (9.7)%4.1%0.2%4.7%

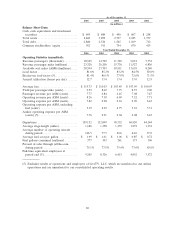

Operating Statistics:

Revenue passengers (thousands) ......................... 4,335 4,525 4,773 4,932

Revenue passenger miles (millions) ....................... 5,536 5,924 6,062 5,798

Available seat miles (ASMs) (millions)..................... 6,577 7,202 7,537 7,278

Load factor ........................................ 84.2%82.2%80.4%79.7%

Breakeven load factor (2) .............................. 92.7%79.5%79.7%76.0%

Aircraft utilization (hours per day) ....................... 12.8 13.0 12.7 12.5

Average fare ....................................... $ 106.86 $ 127.87 $ 123.41 $ 120.01

Yield per passenger mile (cents) ......................... 8.37 9.77 9.72 10.21

Passenger revenue per ASM (cents)....................... 7.04 8.03 7.82 8.13

Operating revenue per ASM (cents) ...................... 7.46 8.48 8.33 8.71

Operating expense per ASM (cents) ...................... 7.84 7.83 7.79 7.82

Operating expense per ASM, excluding fuel (cents)............ 5.40 5.17 4.98 5.24

Airline operating expense per ASM (cents) (2) ............... 7.76 7.77 7.74 7.75

Departures ........................................ 34,417 37,688 42,311 44,736

Average stage length (miles) ............................ 1,246 1,253 1,181 1,087

Average number of operating aircraft during period ........... 95.5 102.6 112.0 115.8

Average fuel cost per gallon ............................ $ 1.86 $ 2.06 $ 2.12 $ 1.92

Fuel gallons consumed (millions) ......................... 86 93 100 98

Percent of sales through jetblue.com during period ............ 82.3%79.5%78.7%76.2%

Full-time equivalent employees at period end (2) ............. 9,039 9,337 9,223 9,265

(1) During the third and fourth quarters of 2006, we sold five Airbus A320 aircraft, which resulted in gains of $7 million and

$5 million, respectively.

(2) Excludes results of operations and employees of LiveTV, LLC, which are unrelated to our airline operations and are

immaterial to our consolidated operating results.

Although we have continued to experience significant revenue growth, this trend may not

continue. We expect our expenses to continue to increase significantly as we acquire additional

aircraft, as our fleet ages and as we expand the frequency of flights in existing markets and enter into

new markets. Accordingly, the comparison of the financial data for the quarterly periods presented

35