JetBlue Airlines 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

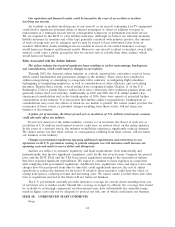

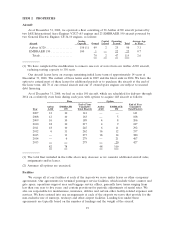

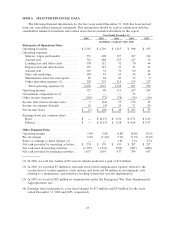

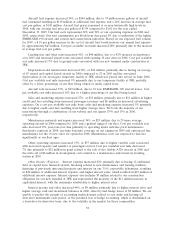

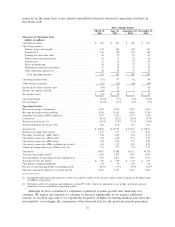

ITEM 6. SELECTED FINANCIAL DATA

The following financial information for the five years ended December 31, 2006 has been derived

from our consolidated financial statements. This information should be read in conjunction with the

consolidated financial statements and related notes thereto included elsewhere in this report.

Year Ended December 31,

2006 2005 2004 2003 2002

(in millions, except per share data)

Statements of Operations Data:

Operating revenues ..................... $ 2,363 $ 1,701 $ 1,265 $ 998 $ 635

Operating expenses:

Salaries, wages and benefits ............ 553 428 337 267 162

Aircraft fuel ......................... 752 488 255 147 76

Landing fees and other rents ........... 158 112 92 70 44

Depreciation and amortization ......... 151 115 77 51 27

Aircraft rent ......................... 103 74 70 60 41

Sales and marketing................... 104 81 63 54 44

Maintenance materials and repairs ...... 87 64 45 23 9

Other operating expenses (1)........... 328 291 215 159 127

Total operating expenses (2) ......... 2,236 1,653 1,154 831 530

Operating income....................... 127 48 111 167 105

Government compensation (3) ........... — — — 23 —

Other income (expense) ................. (118) (72) (36) (16) (10)

Income (loss) before income taxes ........ 9 (24) 75 174 95

Income tax expense (benefit)............. 10 (4) 29 71 40

Net income (loss)....................... $ (1) $ (20) $ 46 $ 103 $ 55

Earnings (loss) per common share:

Basic................................ $ — $ (0.13) $ 0.30 $ 0.71 $ 0.49

Diluted.............................. $ — $ (0.13) $ 0.28 $ 0.64 $ 0.37

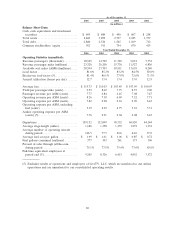

Other Financial Data:

Operating margin....................... 5.4%2.8%8.8%16.8%16.5%

Pre-tax margin ......................... 0.4%(1.4)%5.9%17.4%15.0%

Ratio of earnings to fixed charges (4) ..... — — 1.6x 3.1x 2.7x

Net cash provided by operating activities . . $ 274 $ 170 $ 199 $ 287 $ 217

Net cash used in investing activities ....... (1,307) (1,276) (720) (987) (880)

Net cash provided by financing activities. . . 1,037 1,093 437 789 657

(1) In 2006, we sold five Airbus A320 aircraft, which resulted in a gain of $12 million.

(2) In 2005, we recorded $7 million in non-cash stock-based compensation expense related to the

acceleration of certain employee stock options and wrote-off $6 million in development costs

relating to a maintenance and inventory tracking system that was not implemented.

(3) In 2003, we received $23 million in compensation under the Emergency War Time Supplemental

Appropriations Act.

(4) Earnings were inadequate to cover fixed charges by $17 million and $39 million for the years

ended December 31, 2006 and 2005, respectively.

25