JetBlue Airlines 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.shares of our common stock. At any time, we may irrevocably elect to satisfy our conversion

obligation with respect to the principal amount of the debentures to be converted with a

combination of cash and shares of our common stock.

At any time on or after March 20, 2010, we may redeem any of the debentures for cash at a

redemption price of 100%of their principal amount, plus accrued and unpaid interest. Holders

may require us to repurchase the debentures for cash at a repurchase price equal to 100%of their

principal amount plus accrued and unpaid interest, if any, on March 15, 2010, 2015, 2020, 2025 and

2030, or at any time prior to their maturity upon the occurrence of a specified designated

event. Interest is payable semi-annually on March 15 and September 15.

(6) In July 2003, we sold $175 million aggregate principal amount of 3

1

⁄

2

%convertible unsecured

notes due 2033, which are currently convertible into 6.2 million shares of our common stock at a

price of approximately $28.33 per share, or 35.2941 shares per $1,000 principal amount of notes,

subject to further adjustment and certain conditions on conversion. At any time on or after

July 18, 2008, we may redeem the notes for cash at a redemption price of 100%of their principal

amount, plus accrued and unpaid interest. Holders may require us to repurchase all or a portion

of their notes for cash on July 15 of 2008, 2013, 2018, 2023, and 2028 or upon the occurrence of

certain designated events at a repurchase price equal to the principal amount of the notes, plus

accrued and unpaid interest. Interest is payable semi-annually on January 15 and July 15.

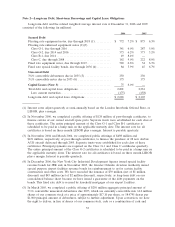

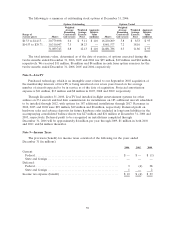

Maturities of long-term debt and capital leases for the next five years are as follows (in millions):

2007 .............................................. $ 175

2008 .............................................. 227

2009 .............................................. 136

2010 .............................................. 139

2011 .............................................. 144

We have funding facilities to finance aircraft predelivery deposits. These facilities allow for

borrowings of up to $77 million through December 2008, of which $38 million was unused as of

December 31, 2006. Commitment fees are 0.5%per annum on the average unused portion of the

facilities. The weighted average interest rate on these outstanding short-term borrowings at

December 31, 2006 and 2005 was 7.1%and 6.1%, respectively.

In 2006, we refinanced $123 million of debt associated with five owned Airbus A320 aircraft,

which eliminated all financial covenants associated with our debt agreements. We are subject to

certain collateral ratio requirements in our spare parts pass-through certificates issued in

November 2006. If we fail to maintain these collateral ratios, we will be required to provide additional

spare parts collateral or redeem some or all of the related equipment notes so that the ratios return to

compliance. In 2006, we sold five owned Airbus A320 aircraft for $154 million and repaid $105 million

in associated debt. Aircraft, engines, predelivery deposits and other equipment and facilities having a

net book value of $3.17 billion at December 31, 2006 were pledged as security under various loan

agreements. Cash payments of interest, net of capitalized interest, aggregated $133 million, $79 million

and $41 million in 2006, 2005 and 2004, respectively.

In June 2006, we filed an automatic shelf registration statement on Form S-3 with the SEC

relating to our sale in one or more public offerings of debt securities, pass-through certificates,

common stock, preferred stock and/or other securities. Through December 31, 2006, we had issued a

total of $124 million in securities under this registration statement.

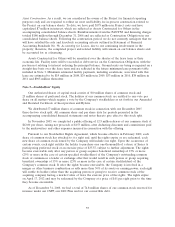

Note 3—Leases

We lease aircraft, as well as airport terminal space, other airport facilities, office space and other

equipment, which expire in various years through 2035. Total rental expense for all operating leases in

2006, 2005 and 2004 was $190 million, $137 million and $120 million, respectively. We have $97 million

in assets that serve as collateral for letters of credit related to certain of our leases, which are included

in restricted cash.

53