Intel 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

In 2007, we guaranteed repayment of principal and interest on bonds issued by the Industrial Development Authority of the

City of Chandler, Arizona, which constitute an unsecured general obligation for Intel. The aggregate principal amount of the

bonds issued in December 2007 (2007 Arizona bonds) is $125 million due in 2037, and the bonds bear interest at a fixed rate

of 5.3%. The 2007 Arizona bonds are subject to mandatory tender, at our option, on any interest payment date beginning on or

after December 1, 2012 until their final maturity on December 1, 2037. Upon such tender, we can re-market the bonds as

either fixed-rate bonds for a specified period or as variable-rate bonds until their final maturity. We also entered into a total

return swap agreement that effectively converts the fixed-rate obligation on the bonds to a floating U.S.-dollar LIBOR-based

rate. At the beginning of the first quarter of 2008, we elected to account for the 2007 Arizona bonds at fair value. For further

discussion, see “Note 5: Fair Value.”

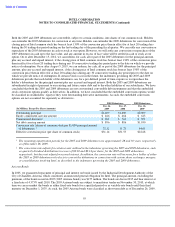

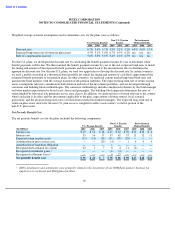

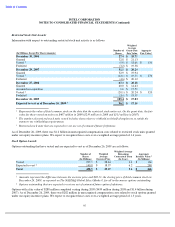

As of December 26, 2009, our aggregate debt maturities based on outstanding principal were as follows (in millions):

Substantially all of the difference between the total aggregate debt maturities above and the total carrying amount of our debt

is due to the equity component of our convertible debentures.

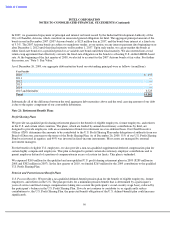

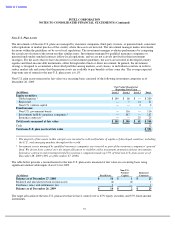

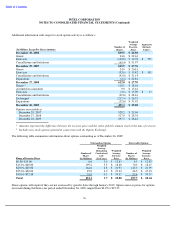

Note 21: Retirement Benefit Plans

Profit Sharing Plans

We provide tax-qualified profit sharing retirement plans for the benefit of eligible employees, former employees, and retirees

in the U.S. and certain other countries. The plans, which are funded by annual discretionary contributions by Intel, are

designed to provide employees with an accumulation of funds for retirement on a tax-deferred basis. Our Chief Executive

Officer (CEO) determines the amounts to be contributed to the U.S. Profit Sharing Plan under delegation of authority from our

Board of Directors, pursuant to the terms of the Profit Sharing Plan. As of December 26, 2009, 51% of our U.S. Profit Sharing

Fund was invested in equities, and 49% was invested in fixed-income instruments. Most assets are managed by external

investment managers.

For the benefit of eligible U.S. employees, we also provide a non-tax-qualified supplemental deferred compensation plan for

certain highly compensated employees. This plan is designed to permit certain discretionary employer contributions and to

permit employee deferral of a portion of compensation in excess of certain tax limits. This plan is unfunded.

We expensed $260 million for the qualified and non-qualified U.S. profit sharing retirement plans in 2009 ($289 million in

2008 and $302 million in 2007). In the first quarter of 2010, we funded $265 million for the 2009 contribution to the qualified

U.S. Profit Sharing Plan.

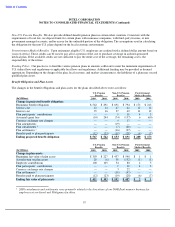

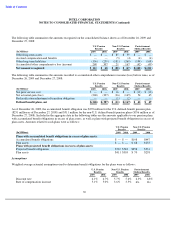

Pension and Postretirement Benefit Plans

U.S. Pension Benefits. We provide a tax-qualified defined-benefit pension plan for the benefit of eligible employees, former

employees, and retirees in the U.S. The plan provides for a minimum pension benefit that is determined by a participant’s

years of service and final average compensation (taking into account the participant

’s social security wage base), reduced by

the participant’s balance in the U.S. Profit Sharing Plan. If we do not continue to contribute to, or significantly reduce

contributions to, the U.S. Profit Sharing Plan, the projected benefit obligation of the U.S. defined-benefit plan could increase

significantly.

86

Year Payable

2010

$

157

2011

—

2012

—

2013

—

2014

—

2015 and thereafter

3,725

Total

$

3,882