Intel 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

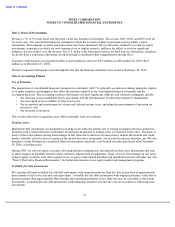

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Investments that we designate as available-for-sale are reported at fair value, with unrealized gains and losses, net of tax,

recorded in accumulated other comprehensive income (loss), except as noted in the “Other-Than-Temporary Impairment”

section below. We determine the cost of the investment sold based on the specific identification method. Our

investments include:

Non

-Marketable Equity Investments

Our non-marketable equity investments are included in other long-term assets. We account for non-marketable equity

investments for which we do not have control over the investee as:

Other-Than-Temporary Impairment

All of our available-for-sale investments and non-marketable equity investments are subject to a periodic impairment review.

Investments are considered impaired when the fair value is below the investment’s cost basis/amortized cost. Impairments

affect earnings as follows:

We record other-than-temporary impairment charges in gains (losses) on equity method investments, net for non-

marketable equity method investments and in gains (losses) on other equity investments, net for non-marketable cost

method investments.

55

•

Marketable debt instruments

when the interest rate and foreign currency risks are not hedged at inception of the

investment or when our designation for trading assets is not met. We hold these debt instruments to generate a return

commensurate with the U.S.-dollar three-month LIBOR. We record the interest income and realized gains and losses

on the sale of these instruments in interest and other, net.

•

Marketable equity securities

when the investments are considered strategic in nature at the time of original

classification or there are barriers to mitigating equity market risk through the sale or use of derivative instruments at

the time of original classification. We acquire these equity investments for the promotion of business and strategic

objectives. To the extent that these investments continue to have strategic value, we typically do not attempt to reduce

or eliminate the equity market risks through hedging activities. We record the realized gains or losses on the sale or

exchange of marketable equity securities in gains (losses) on other equity investments, net.

•

Equity method investments

when we have the ability to exercise significant influence, but not control, over the

investee. Gains (losses) on equity method investments, net may be recorded with up to a one

-

quarter lag.

• Cost method investments when the equity method does not apply. We record the realized gains or losses on the sale of

non

-

marketable

cost method investments in gains (losses) on other equity investments, net.

•

Marketable debt instruments

when the fair value is below amortized cost and (1) we intend to sell the instrument, (2) it

is more likely than not that we will be required to sell the instrument before recovery of its amortized cost basis, or (3)

we do not expect to recover the entire amortized cost basis of the instrument (that is, a credit loss exists).

Other-than-temporary impairments are separated into amounts representing credit losses, which are recognized in

earnings, and amounts related to all other factors, which are recognized in other comprehensive income (loss).

•

Marketable equity securities

based on the specific facts and circumstances present at the time of assessment, which

include the consideration of general market conditions, the duration and extent to which the fair value is below cost,

and our intent and ability to hold the investment for a sufficient period of time to allow for recovery in value in the

foreseeable future. We also consider specific adverse conditions related to the financial health of, and business outlook

for, the investee, which may include industry and sector performance, changes in technology, operational and

financing cash flow factors, and changes in the investee’s credit rating. We record other-than-temporary impairment

charges on marketable equity securities in gains (losses) on other equity investments, net.

•

Non

-marketable equity investments based on our assessment of the severity and duration of the impairment, and

qualitative and quantitative analysis, including:

•

the investee

’

s revenue and earning trends relative to pre

-

defined milestones and overall business prospects;

•

the technological feasibility of the investee

’

s products and technologies;

• the general market conditions in the investee’s industry or geographic area, including adverse regulatory or

economic changes;

• factors related to the investee’s ability to remain in business, such as the investee’s liquidity, debt ratios, and

the rate at which the investee is using its cash; and

•

the investee

’

s receipt of additional funding at a lower valuation.