Intel 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (Continued)

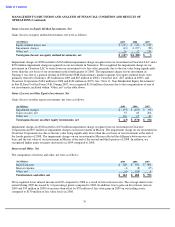

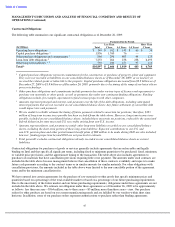

The following table summarizes the restructuring and asset impairment activity for the 2006 efficiency program during 2008

and 2009:

We recorded the additional accruals, net of adjustments, as restructuring and asset impairment charges. The 2006 efficiency

plan is complete.

From the third quarter of 2006 through 2009, we incurred a total of $1.6 billion in restructuring and asset impairment charges

related to this program. These charges included a total of $686 million related to employee severance and benefit arrangements

for 11,300 employees. A substantial majority of these employee actions affected employees within manufacturing, information

technology, and marketing. The restructuring and asset impairment charges also included $896 million in asset impairment

charges.

We estimate that the total employee severance and benefit charges incurred as part of the 2006 efficiency program result in

gross annual savings of approximately $1.1 billion. We are realizing these savings within marketing, general and

administrative; cost of sales; and R&D.

Amortization of acquisition

-related intangibles. The increase of $29 million was due to amortization of intangibles primarily

related to the acquisition of Wind River Systems completed in the third quarter of 2009. See “Note 15: Acquisitions”

in Part II,

Item 8 of this Form 10-K.

Share

-Based Compensation

Share-based compensation totaled $889 million in 2009, $851 million in 2008, and $952 million in 2007. Share-based

compensation was included in cost of sales and operating expenses.

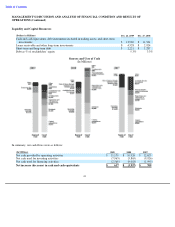

As of December 26, 2009, unrecognized share-based compensation costs and the weighted average periods over which the

costs are expected to be recognized were as follows:

37

Employee

Severance

Asset

(In Millions)

and Benefits

Impairments

Total

Accrued restructuring balance as of December 29, 2007

$

127

$

—

$

127

Additional accruals

167

344

511

Adjustments

(16

)

—

(

16

)

Cash payments

(221

)

—

(

221

)

Non

-

cash settlements

—

(

344

)

(344

)

Accrued restructuring balance as of December 27, 2008

$

57

$

—

$

57

Additional accruals

18

8

26

Adjustments

(10

)

—

(

10

)

Cash payments

(65

)

—

(

65

)

Non

-

cash settlements

—

(

8

)

(8

)

Accrued restructuring balance as of December 26, 2009

$

—

$

—

$

—

Unrecognized

Share

-

Based

Weighted

Compensation

Average

(Dollars in Millions)

Costs

Period

Stock options

$

282

1.3 years

Restricted stock units

$

1,196

1.4 years

Stock purchase plan

$

9

1 month