Intel 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (Continued)

Critical Accounting Estimates

The methods, estimates, and judgments that we use in applying our accounting policies have a significant impact on the results

that we report in our consolidated financial statements. Some of our accounting policies require us to make difficult and

subjective judgments, often as a result of the need to make estimates regarding matters that are inherently uncertain. Our most

critical accounting estimates include:

Below, we discuss these policies further, as well as the estimates and judgments involved.

Non

-Marketable Equity Investments

We regularly invest in non-marketable equity instruments of private companies, which range from early-stage companies that

are often still defining their strategic direction to more mature companies with established revenue streams and business

models. The carrying value of our non-marketable equity investment portfolio, excluding equity derivatives, totaled $3.4

billion as of December 26, 2009 ($4.1 billion as of December 27, 2008). The majority of this balance as of December 26, 2009

was concentrated in companies in the flash memory market segment. Our flash memory market segment investments include

our investment in IMFT and IM Flash Singapore, LLP (IMFS) of $1.6 billion ($2.1 billion as of December 27, 2008). For

further information, see “Note 11: Non-Marketable Equity Investments” in Part II, Item 8 of this Form 10-K.

Our non-marketable equity investments are recorded using adjusted cost basis or the equity method of accounting, depending

on the facts and circumstances of each investment (see “Note 2: Accounting Policies” in Part II, Item 8 of this Form

10-K). Our non-marketable equity investments are classified in other long-term assets on the consolidated balance sheets.

Non

-marketable equity investments are inherently risky, and a number of the companies in which we invest could fail. Their

success is dependent on product development, market acceptance, operational efficiency, and other key business factors.

Depending on their future prospects, the companies may not be able to raise additional funds when the funds are needed or

they may receive lower valuations, with less favorable investment terms than in previous financings, and our investments

would likely become impaired. Additionally, financial markets and credit markets are volatile, which could negatively affect

the prospects of the companies we invest in, their ability to raise additional capital, and the likelihood of our being able to

realize value in our investments through liquidity events such as initial public offerings, mergers, and private sales. For further

information about our investment portfolio risks, see “Risk Factors” in Part I, Item 1A of this Form 10-K.

We determine the fair value of our non-marketable equity investments quarterly for disclosure purposes; however, the

investments are recorded at fair value only when an impairment charge is recognized. We determine the fair value of our non-

marketable equity investments using the market and income approaches. The market approach includes the use of financial

metrics and ratios of comparable public companies, such as projected revenues, earnings, and comparable performance

multiples. The selection of comparable companies requires management judgment and is based on a number of factors,

including comparable companies’ sizes, growth rates, industries, development stages, and other relevant factors. The income

approach includes the use of a discounted cash flow model, which may include one or multiple discounted cash flow scenarios

and requires the following significant estimates for the investee: revenue, based on assumed market segment size and assumed

market segment share; expenses, capital spending, and other costs; and discount rates based on the risk profile of comparable

companies. Estimates of market segment size, market segment share, expenses, capital spending, and other costs are developed

by the investee and/or Intel using historical data and available market data. The valuation of our non-marketable investments

also takes into account variables such as conditions reflected in the capital markets, recent financing activities by the investees,

the investees’ capital structure, and differences in seniority and rights associated with the investees’ capital.

29

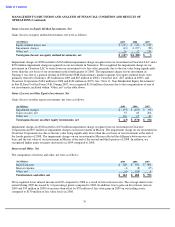

• the valuation of non-marketable equity investments and the determination of other-than-temporary

impairments, which

impact gains (losses) on equity method investments, net, or gains (losses) on other equity investments, net when we

record impairments;

• the assessment of recoverability of long-lived assets, which primarily impacts gross margin or operating expenses

when we record asset impairments or accelerate their depreciation;

• the recognition and measurement of current and deferred income taxes (including the measurement of uncertain tax

positions), which impact our provision for taxes; and

•

the valuation of inventory, which impacts gross margin.