Intel 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 20: Borrowings

Short

-Term Debt

Short-term debt included the current portion of long-term debt of $157 million and drafts payable of $15 million as of

December 26, 2009 (drafts payable of $100 million and the current portion of long-

term debt of $2 million as of December 27,

2008). We have an ongoing authorization from our Board of Directors to borrow up to $3.0 billion, including through the

issuance of commercial paper. Maximum borrowings under our commercial paper program during 2009 were $610 million.

We did not have outstanding commercial paper as of December 26, 2009 and December 27, 2008. Maximum borrowings

under our commercial paper program during 2008 were $1.3 billion. Our commercial paper was rated A-1+ by Standard &

Poor’s and P-1 by Moody’s as of December 26, 2009.

Long

-Term Debt

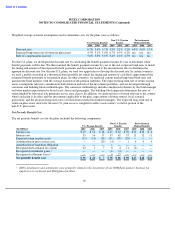

Our long-term debt as of December 26, 2009 and December 27, 2008 was as follows:

Convertible Debentures

In 2005, we issued $1.6 billion of junior subordinated convertible debentures (the 2005 debentures) due in 2035. In 2009, we

issued $2.0 billion of junior subordinated convertible debentures (the 2009 debentures) due in 2039. Both the 2005 and 2009

debentures pay a fixed rate of interest semiannually. We capitalized all interest associated with these debentures during the

periods presented.

84

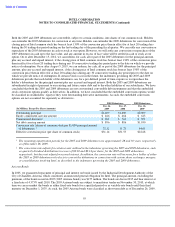

(In Millions)

2009

2008

1

2009 junior subordinated convertible debentures due 2039 at 3.25%

$

1,030

$

—

2005 junior subordinated convertible debentures due 2035 at 2.95%

896

886

2005 Arizona bonds due 2035 at 4.375%

157

158

2007 Arizona bonds due 2037 at 5.3%

123

122

Other debt

—

21

2,206

1,187

Less:

current portion of long

-

term debt

(157

)

(2

)

Total long

-

term debt

$

2,049

$

1,185

1

As adjusted due to changes to the accounting for convertible debt instruments. See

“

Note 3: Accounting Changes.

”

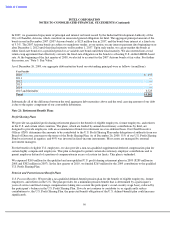

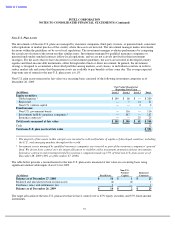

2005 Debentures

2009 Debentures

Coupon interest rate

2.95

%

3.25

%

Effective interest rate

1

6.45

%

7.20

%

Maximum amount of contingent interest that will accrue per year

2

0.40

%

0.50

%

1

The effective rate is based on the rate for a similar instrument that does not have a conversion feature.

2

Both the 2005 and 2009 debentures have a contingent interest component that will require us to pay interest based on

certain thresholds and for certain events commencing on December 15, 2010 and August 1, 2019, for the 2005 and

2009 debentures, respectively, as outlined in the indentures governing the 2005 and 2009 debentures. The fair value of

the related embedded derivative was $24 million and $15 million as of December 26, 2009 for the 2005 and 2009

debentures, respectively ($36 million as of December 27, 2008 for the 2005 debentures).