Intel 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

During the second quarter of 2008, we completed the divestiture of our NOR flash memory business. We exchanged certain

NOR flash memory assets and certain assets associated with our phase change memory initiatives with Numonyx for a note

receivable with a contractual amount of $144 million and a 45.1% ownership interest in the form of common stock, together

valued at $821 million. We retain certain rights to intellectual property included within the divestiture. Approximately 2,500

employees of our NOR flash memory business became employees of Numonyx. STMicroelectronics contributed certain assets

to Numonyx for a note receivable with a contractual amount of $156 million and a 48.6% ownership interest in the form of

common stock. Francisco Partners paid $150 million in cash in exchange for the remaining 6.3% ownership interest in the

form of preferred stock and a note receivable with a contractual amount of $20 million. In addition, they received a payout

right that is preferential relative to the investments of Intel and STMicroelectronics. We did not incur a gain or loss upon

completion of the transaction in the second quarter of 2008, as we had recorded asset impairment charges in quarters prior to

deal closure. For further discussion, see “Note 19: Restructuring and Asset Impairment Charges.” Subsequent to the

divestiture, in the third quarter of 2008 we recorded a $250 million impairment charge on our investment in Numonyx within

gains (losses) on equity method investments. In February 2010, we signed a definitive agreement with Micron and Numonyx

under which Micron agreed to acquire Numonyx in an all-stock transaction. For further information, see “Note 11: Non-

Marketable Equity Investments.”

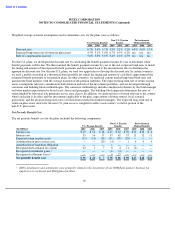

Note 17: Goodwill

At the end of 2009, we reorganized our business to better align our major product groups around the core competencies of

Intel architecture and our manufacturing operations. See “Note 29: Operating Segment and Geographic Information” for

further discussion. Due to this reorganization, goodwill was allocated from our prior operating segments to our new operating

segments, as shown below under “Transfers.” The allocation was based on the fair value of each business group within its

original operating segment relative to the fair value of that operating segment.

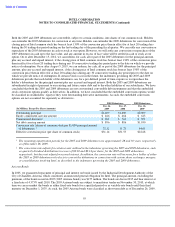

Goodwill activity for the years ended December 26, 2009 and December 27, 2008 was as follows:

During 2009, prior to our reorganization, we completed two acquisitions, including the acquisition of Wind River Systems

(see “Note 15: Acquisitions” for further discussion). Goodwill recognized from the Wind River Systems acquisition was

assigned to our Digital Enterprise Group, our Mobility Group, our Digital Home Group, and our Wind River Software Group

based on the relative expected fair value provided by the acquisition. The assignment of goodwill to our Digital Enterprise

Group, our Mobility Group, and our Digital Home Group was based on the proportionate benefits expected to be generated for

each group resulting from enhanced market presence for existing businesses.

During 2008, we completed two acquisitions that resulted in goodwill of $18 million.

80

Other Intel

Digital

Architecture

Other

Enterprise

Mobility

PC Client

Data Center

Operating

Operating

(In Millions)

Group

Group

Group

Group

Segments

Segments

Total

Goodwill, net

December 29, 2007

$

3,385

$

248

$

—

$

—

$

—

$

283

$

3,916

Additions due to

business combinations

9

—

—

—

—

9

18

Transfers

123

—

—

—

—

(

123

)

—

Other

(2

)

—

—

—

—

—

(

2

)

December 27, 2008

$

3,515

$

248

$

—

$

—

$

—

$

169

$

3,932

Additions due to

business combinations

192

142

—

—

—

155

489

Transfers

(3,707

)

(390

)

2,220

1,459

507

(89

)

—

December 26, 2009

$

—

$

—

$

2,220

$

1,459

$

507

$

235

$

4,421