Intel 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

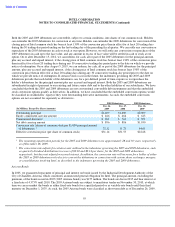

Summarized Financial Information of Equity Method Investees

The following is the aggregated summarized financial information of our equity method investees, which includes summary

results of operations information for 2009, 2008, and 2007 and summary balance sheet information as of December 26, 2009

and December 27, 2008:

Summarized financial information for our equity method investees is presented on the basis of up to a one-quarter lag and is

included for the periods in which we held an equity method ownership interest.

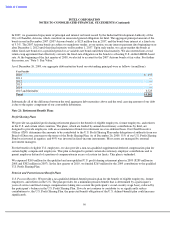

IMFT/IMFS

Micron and Intel formed IM Flash Technologies, LLC (IMFT) in January 2006 and IM Flash Singapore, LLP (IMFS) in

February 2007. We established these joint ventures to manufacture NAND flash memory products for Micron and Intel. We

own a 49% interest in each of these ventures. Initial production at the IMFS fabrication facility, including the purchase and

installation of manufacturing equipment, remains on hold. IMFT and IMFS are each governed by a Board of Managers, with

Micron and Intel initially appointing an equal number of managers to each of the boards. The number of managers appointed

by each party adjusts depending on the parties’ ownership interests. These ventures will operate until 2016 but are subject to

prior termination under certain terms and conditions.

These joint ventures are variable interest entities. All costs of the joint ventures will be passed on to Micron and Intel through

our purchase agreements. IMFT and IMFS are dependent upon Micron and Intel for any additional cash requirements. Our

known maximum exposure to loss approximated our investment balance as of December 26, 2009, which was $1.6 billion in

IMFT/IMFS ($2.1 billion as of December 27, 2008). Our investment in these ventures is classified within other long-term

assets. As of December 26, 2009, except for the amount due to IMFT/IMFS for product purchases and services, we did not

incur any additional liabilities in connection with our interests in these joint ventures. In addition to the potential loss of our

existing investment, our actual losses could be higher, as Intel and Micron are liable for other future operating costs

and/or obligations of IMFT/IMFS. In addition, future cash calls could increase our investment balance and the related

exposure to loss. Finally, as we are currently committed to purchasing 49% of IMFT’s production output and production-

related services, we may be required to purchase products at a cost in excess of realizable value.

Our portion of IMFT costs, primarily related to product purchases and start-up costs, was $735 million during 2009 ($1.1

billion during 2008 and $790 million during 2007). The amount due to IMFT for product purchases and services provided was

$75 million as of December 26, 2009 and $190 million as of December 27, 2008. During 2009, $419 million was returned to

Intel by IMFT, which is reflected as a return of equity method investment within investing activities on the consolidated

statements of cash flows ($298 million during 2008).

76

(In Millions)

2009

2008

2007

Operating results:

Net revenue

$

3,307

$

3,456

$

1,484

Gross margin

$

305

$

444

$

67

Operating income (loss)

$

(1,216

)

$

(702

)

$

(490

)

Net income (loss)

$

(1,302

)

$

(932

)

$

(674

)

Dec. 26,

Dec. 27,

(In Millions)

2009

2008

Balance sheet:

Current assets

$

3,835

$

3,257

Non

-

current assets

$

11,174

$

7,322

Current liabilities

$

1,048

$

1,316

Non

-

current liabilities

$

2,690

$

2,469

Redeemable preferred stock

$

16

$

50

Non

-

controlling interests

$

7

$

10