Intel 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTEL CORP

FORM 10-K

(Annual Report)

Filed 02/22/10 for the Period Ending 12/26/09

Address 2200 MISSION COLLEGE BLVD

RNB-4-151

SANTA CLARA, CA 95054

Telephone 4087658080

CIK 0000050863

Symbol INTC

SIC Code 3674 - Semiconductors and Related Devices

Industry Semiconductors

Sector Technology

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2010, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

INTEL CORP FORM 10-K (Annual Report) Filed 02/22/10 for the Period Ending 12/26/09 Address 2200 MISSION COLLEGE BLVD RNB-4-151 SANTA CLARA, CA 95054 4087658080 0000050863 INTC 3674 - Semiconductors and Related Devices Semiconductors Technology 12/31 Telephone CIK Symbol SIC Code Industry Sector ... -

Page 2

Table of Contents -

Page 3

... Boulevard, Santa Clara, California (Address of principal executive offices) 94-1672743 (I.R.S. Employer Identification No.) 95054-1549 (Zip Code) Registrant's telephone number, including area code (408) 765-8080 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name... -

Page 4

...a shell company (as defined in Rule 12b-2 of the Act). Yes 3 No Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 26, 2009, based upon the closing price of the common stock as reported by The NASDAQ Global Select Market* on such date... -

Page 5

... to a Vote of Security Holders 1 15 21 21 22 22 PART II Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Item 6. Selected Financial Data Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations Item... -

Page 6

... through long life-cycle support, software and architectural scalability, and platform integration. • Digital Home Group. Delivering Intel architecture-based products for next-generation consumer electronics devices with interactive Internet content and traditional broadcast programming. • Ultra... -

Page 7

... processor frequency when applications demand more performance; and • Intel ® Hyper-Threading Technology , which allows each processor core to process two software tasks or threads simultaneously. We also offer, and are continuing to develop, System on Chip (SoC) products that integrate our core... -

Page 8

..., services, and support. In developing our platforms, we may include components made by other companies. Platforms based on our latest generation Intel Core microarchitecture using our 32nm process technology integrate a memory controller and graphics functionality into each microprocessor, and... -

Page 9

... desktop market segment, and wireless connectivity products. Notebooks and Netbooks Our current notebook and netbook microprocessor offerings include the: • Intel ® Core TM i7 processor Extreme Edition • Intel ® Core TM 2 Duo mobile processor ® TM • Intel Core i7 mobile processor • Intel... -

Page 10

... • Intel Core i7 processors, Intel Core i5 processors, and Intel Core i3 processors, the latest of which are manufactured using our 32nm process technology and include integrated high-definition graphics functionality. These processors are supported by the new Intel 5 Series Express Chipset family... -

Page 11

... using our 32nm process technology and with integrated high-definition graphics functionality. These processors are supported by the new Mobile Intel 5 Series Express Chipset family. • Low-power Intel Xeon processors based on our latest generation Intel Core microarchitecture, designed for use in... -

Page 12

... 26, 2009, 64% of our wafer fabrication, including microprocessors and chipsets, was conducted within the U.S. at our facilities in Arizona, Oregon, New Mexico, and Massachusetts. The remaining 36% of our wafer fabrication was conducted outside the U.S. at our facilities in Ireland and Israel. As... -

Page 13

... of microprocessors and chipsets, improving our platform initiatives, and developing software solutions and tools to support our technologies. Our R&D efforts enable new levels of performance and address areas such as energy efficiency, scalability for multi-core architectures, system manageability... -

Page 14

...revenue and related costs of sales is deferred. Our standard terms and conditions of sale typically provide that payment is due at a later date, generally 30 days after shipment or delivery. Our credit department sets accounts receivable and shipping limits for individual customers to control credit... -

Page 15

... Itanium trademarks make up our processor brands. We promote brand awareness and generate demand through our own direct marketing as well as co-marketing programs. Our direct marketing activities include television, print, and web-based advertising, as well as press relations, consumer and trade... -

Page 16

...Contents We believe that our network of manufacturing facilities and assembly and test facilities gives us a competitive advantage. This network enables us to have more direct control over our processes, quality control, product cost, volume, timing of production, and other factors. These facilities... -

Page 17

...for wireless and wired connectivity; the communications infrastructure, including network processors; and networked storage. Our WiFi and WiMAX products currently compete with products manufactured by Atheros Communications, Inc., Broadcom, QUALCOMM, and other smaller companies. Competition Lawsuits... -

Page 18

... major sites for several years. At the beginning of 2008, we announced plans to purchase renewable energy certificates under a multi-year contract. The purchase placed Intel at the top of the EPA's Green Power Partnership for 2008 and 2009. The purchase was intended to help stimulate the market for... -

Page 19

... VP, Chief Financial and Enterprise Services Officer • Member of Columbia Sportswear Company Board of Directors • Member of McKesson Corporation Board of Directors • Joined Intel 1981 William M. Holt , age 57 • 2006 - present, Senior VP, GM, Technology and Manufacturing Group • 2005 - 2006... -

Page 20

... in the level of customers' components inventories; • competitive pressures, including pricing pressures, from companies that have competing products, chip architectures, manufacturing technologies, and marketing programs; • changes in customer product needs; • strategic actions taken by our... -

Page 21

... return on our investments. We make investments in companies around the world to further our strategic objectives and support our key business initiatives. Such investments include equity or debt instruments of public or private companies, and many of these instruments are non-marketable at the time... -

Page 22

... of operations and financial condition by increasing our expenses and reducing our revenue. Varying tax rates in different jurisdictions could harm our results of operations and financial condition by increasing our overall tax rate. We maintain a program of insurance coverage for various types... -

Page 23

... us or our customers alleged patent, copyright, trademark, or other intellectual property rights to technologies that are important to our business. As described in "Note 28: Contingencies" in Part II, Item 8 of this Form 10-K, we are currently engaged in a number of litigation matters involving... -

Page 24

... use or publication of our trade secrets and other confidential business information as a result of such an incident could adversely affect our competitive position and reduce marketplace acceptance of our products; the value of our investment in R&D, product development, and marketing could be... -

Page 25

...and competition for experienced employees in the semiconductor industry can be intense. To help attract, retain, and motivate qualified employees, we use share-based incentive awards such as employee stock options and non-vested share units (restricted stock units). If the value of such stock awards... -

Page 26

...in our consolidated statements of operations to fluctuate include: • fixed-income, equity, and credit market volatility; • fluctuations in foreign currency exchange rates; • fluctuations in interest rates; • changes in our cash and investment balances; and • changes in our hedge accounting... -

Page 27

... of Publicly Announced Plans Period Total Number of Shares Purchased Average Price Paid Per Share December 28, 2008-March 28, 2009 March 29, 2009-June 27, 2009 June 28, 2009-September 26, 2009 September 27, 2009-December 26, 2009 Total Our purchases in 2009 were executed in privately negotiated... -

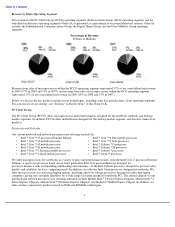

Page 28

... stockholder returns for our common stock, the Dow Jones U.S. Technology Index, and the S&P 500 Index are based on our fiscal year. Comparison of Five-Year Cumulative Return for Intel, the Dow Jones U.S. Technology Index*, and the S&P 500* Index 2004 2005 2006 2007 2008 2009 Intel Corporation... -

Page 29

.... 26, 2009 Dec. 27, 2008 2 Dec. 29, 2007 2 Dec. 30, 2006 2 Dec. 31, 2005 2 Property, plant and equipment, net Total assets Long-term debt Stockholders' equity Employees (in thousands) 1 2 Beginning in 2006, we adopted new standards that changed the accounting for employee equity incentive plans... -

Page 30

... chips and platforms for the worldwide digital economy. Our primary component-level products include microprocessors, chipsets, and flash memory. To better align our major product groups around the core competencies of Intel architecture and our manufacturing operations, we completed the... -

Page 31

...the "tick-tock" manufacturing process technology and product development cadence. Additionally, our Intel Atom processors and related chipsets continue their strong ramp, with revenue having increased nearly $900 million in 2009 compared to 2008. We believe our total inventory levels of $2.9 billion... -

Page 32

... generate financial returns, further our strategic objectives, and support our key business initiatives. Our investments, including those made through our Intel Capital program, generally focus on investing in companies and initiatives to stimulate growth in the digital economy, create new business... -

Page 33

... driving Intel architecture as a solution for embedded applications by delivering long life-cycle support, software and architectural scalability, and platform integration; • continuing to develop and offer products that enable handhelds to deliver digital content and the Internet to users in new... -

Page 34

...other long-term assets on the consolidated balance sheets. Non-marketable equity investments are inherently risky, and a number of the companies in which we invest could fail. Their success is dependent on product development, market acceptance, operational efficiency, and other key business factors... -

Page 35

... between the asset grouping's carrying value and its fair value. Fair value is the price that would be received from selling an asset in an orderly transaction between market participants at the measurement date. Long-lived assets such as goodwill; intangible assets; and property, plant and... -

Page 36

... in the development of our short-term manufacturing plans to enable consistency between inventory valuation and build decisions. Product-specific facts and circumstances reviewed in the inventory valuation process include a review of the customer base, the stage of the product life cycle of our... -

Page 37

... increased, compared to 2008, primarily due to the ramp of Intel Atom processors and chipsets, which generally have lower average selling prices than our other microprocessor and chipset products. Revenue from the sale of NOR flash memory products and communications products declined $740 million... -

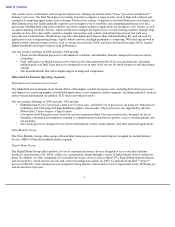

Page 38

...of Contents MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) Revenue in the Asia-Pacific region increased 2% compared to 2008, while revenue in the Europe, Japan, and Americas regions decreased by 26%, 15%, and 4%, respectively, compared to 2008. Our... -

Page 39

-

Page 40

... of Contents MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) Data Center Group The revenue and operating income for the Data Center Group (DCG) for the three years ended December 26, 2009 were as follows: (In Millions) 2009 2008 2007 Microprocessor... -

Page 41

... in Oregon; and ending production at our 200mm wafer fabrication facility in California. We do not expect significant future charges related to the 2009 plan. The following table summarizes charges for the 2009 restructuring plan during 2009: (In Millions) 2009 Employee severance and benefit... -

Page 42

... as a result of market conditions related to the Colorado Springs facility during 2007 and additional charges in 2008. We sold the Colorado Springs facility in 2009. In addition, during 2007 we recorded land and building write-downs related to certain facilities in Santa Clara, California. We also... -

Page 43

... OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) The following table summarizes the restructuring and asset impairment activity for the 2006 efficiency program during 2008 and 2009: Employee Severance and Benefits Asset Impairments (In Millions) Total Accrued restructuring balance as... -

Page 44

... NOR flash memory market segment. Our equity method losses were primarily related to Numonyx ($31 million in 2009 and $87 million in 2008), Clearwire LLC ($27 million in 2009), and Clearwire Corporation ($184 million in 2008 and $104 million in 2007). See "Note 11: Non-Marketable Equity Investments... -

Page 45

...the EC fine of $1.447 billion with no associated tax benefit. In addition, our 2008 effective tax rate was negatively impacted by the recognition of a valuation allowance on our deferred tax assets due to the uncertainty of realizing tax benefits related to impairments of our equity investments. Our... -

Page 46

-

Page 47

Table of Contents MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) Status of Business Outlook We expect that our corporate representatives will, from time to time, meet privately with investors, investment analysts, the media, and others, and may ... -

Page 48

... of Contents MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) Liquidity and Capital Resources (Dollars in Millions) Dec. 26, 2009 Dec. 27, 2008 Cash and cash equivalents, debt instruments included in trading assets, and short-term investments Loans... -

Page 49

... taxes and timing of payments. Changes in assets and liabilities for 2009 compared to 2008 included the following: • Inventories decreased due to lower chipset and raw materials inventory. • Accounts payable decreased due to timing of payments, despite higher production spending. • Accounts... -

Page 50

... and assembly and test, working capital requirements, and potential dividends, common stock repurchases, and acquisitions or strategic investments. Fair Value of Financial Instruments Fair value is the price that would be received from selling an asset or paid to transfer a liability in an orderly... -

Page 51

... trades and the average weekly trading volume in relation to the total outstanding shares of that security. The remaining marketable equity securities of $97 million were classified as Level 2 because their valuations were either based on quoted prices for identical securities in less active markets... -

Page 52

-

Page 53

... on our consolidated balance sheets as of December 26, 2009, as we had not yet received the related goods or taken title to the property. Capital purchase obligations decreased from $2.9 billion as of December 27, 2008 to $1.8 billion as of December 26, 2009, primarily due to the timing of the... -

Page 54

... rights, and R&D funding related to NAND flash manufacturing and IMFT. The obligation to purchase our proportion of IMFT's inventory was $100 million as of December 26, 2009. See "Note 11: Non-Marketable Equity Investments" in Part II, Item 8 of this Form 10-K. The expected timing of payments of the... -

Page 55

... primarily to manage currency exchange rate and interest rate risk, and to a lesser extent, equity market and commodity price risk. All of the potential changes noted below are based on sensitivity analyses performed on our financial positions as of December 26, 2009 and December 27, 2008. Actual... -

Page 56

... of equity market prices affect our non-marketable equity investments, although we cannot always quantify the impact directly. Financial markets and credit markets are volatile, which could negatively affect the prospects of the companies we invest in, their ability to raise additional capital, and... -

Page 57

... FINANCIAL STATEMENTS Page Consolidated Statements of Operations Consolidated Balance Sheets Consolidated Statements of Cash Flows Consolidated Statements of Stockholders' Equity Notes to Consolidated Financial Statements Reports of Ernst & Young LLP, Independent Registered Public Accounting... -

Page 58

... of Contents INTEL CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS Three Years Ended December 26, 2009 (In Millions, Except Per Share Amounts) 2009 2008 2007 Net revenue Cost of sales Gross margin Research and development Marketing, general and administrative Restructuring and asset impairment... -

Page 59

...2009 Assets Current assets: Cash and cash equivalents Short-term investments Trading assets Accounts receivable, net of allowance for doubtful accounts of $19 ($17 in 2008) Inventories Deferred tax assets Other current assets Total current assets Property, plant and equipment, net Marketable equity... -

Page 60

... from government grants Excess tax benefit from share-based payment arrangements Issuance of long-term debt Proceeds from sales of shares through employee equity incentive plans Repurchase and retirement of common stock Payment of dividends to stockholders Net cash used for financing activities Net... -

Page 61

... INTEL CORPORATION CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Common Stock and Capital in Excess of Par Value Number of Shares Amount Accumulated Other Comprehensive Income (Loss) Three Years Ended December 26, 2009 (In Millions, Except Per Share Amounts) Retained Earnings Total Balance... -

Page 62

...). Customer credit balances are included in other accrued liabilities and were $293 million as of December 26, 2009 ($447 million as of December 27, 2008). We have evaluated subsequent events through the date that the financial statements were issued on February 22, 2010. Note 2: Accounting Policies... -

Page 63

... promotion of business and strategic objectives. To the extent that these investments continue to have strategic value, we typically do not attempt to reduce or eliminate the equity market risks through hedging activities. We record the realized gains or losses on the sale or exchange of marketable... -

Page 64

... INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Derivative Financial Instruments Our primary objective for holding derivative financial instruments is to manage currency exchange rate and interest rate risk, and to a lesser extent, equity market and commodity price... -

Page 65

... Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Loans Receivable We make loans to third parties that are classified within other current assets or other long-term assets. We may elect the fair value option for loans when the interest rate or foreign exchange rate... -

Page 66

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Goodwill We record goodwill when the purchase price of an acquisition exceeds the fair value of the net tangible and intangible assets as of the date of acquisition. We perform a quarterly review of goodwill... -

Page 67

-

Page 68

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Advertising Cooperative advertising programs reimburse customers for marketing activities for certain of our products, subject to defined criteria. We accrue cooperative advertising obligations and record ... -

Page 69

... of our trading assets and determined that our marketable debt instruments will be classified on the statement of cash flows as investing activities, as they are held with the purpose of generating returns. Activity related to equity securities offsetting deferred compensation remained classified... -

Page 70

...consolidated financial statements. See "Note 7: Available-for-Sale Investments" for further discussion. In the third quarter of 2009, we adopted amended standards for the fair value measurement of liabilities. These amended standards clarify that in circumstances in which a quoted price in an active... -

Page 71

61 -

Page 72

... these new standards to significantly impact our consolidated financial statements. Note 5: Fair Value Fair value is the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining... -

Page 73

... paper Corporate bonds Government bonds 1 Bank time deposits Marketable equity securities Asset-backed securities Municipal bonds Loans receivable Derivative assets Money market fund deposits Equity securities offsetting deferred compensation Total assets measured and recorded at fair value... -

Page 74

... 3) for 2009 and 2008: Fair Value Measured and Recorded Using Significant Unobservable Inputs (Level 3) Corporate Asset-Backed Derivative Derivative Long-Term Total Gains Bonds Securities Assets Liabilities Debt (Losses) (In Millions) Government Bonds Balance as of December 27, 2008 $ Total gains... -

Page 75

... were not eligible to apply hedge accounting provisions due to the use of non-derivative hedging instruments. The 2007 Arizona bonds are included within the long-term debt balance on our consolidated balance sheets. As of December 26, 2009 and December 27, 2008, no other instruments were similar to... -

Page 76

...parent company, Clearwire Corporation. The effects of adjusting the quoted price for premiums that we believe market participants would consider for Clearwire LLC, such as tax benefits and voting rights associated with our investments, were mostly offset by the effects of discounts to the fair value... -

Page 77

... share; costs; and discount rates based on the risk profile of comparable companies. Estimates of market segment size, market segment share, and costs are developed by the investee and/or Intel using historical data and available market data. The valuation of these non-marketable equity investments... -

Page 78

...INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Our non-marketable equity investments include our investment in Numonyx. In February 2010, we signed a definitive agreement with Micron Technology, Inc. and Numonyx under which Micron agreed to acquire Numonyx in an all-stock... -

Page 79

... (In Millions) Adjusted Cost Fair Value Adjusted Cost Fair Value Commercial paper Corporate bonds Government bonds 2 Bank time deposits 3 Marketable equity securities Asset-backed securities Money market fund deposits Total available-for-sale investments 1 $ 5,444 $ 3,688 2,205 1,317 387... -

Page 80

... during 2008 and 2009 on these investments that were sold. Note 8: Derivative Financial Instruments Our primary objective for holding derivative financial instruments is to manage currency exchange rate risk and interest rate risk, and to a lesser extent, equity market risk and commodity price risk... -

Page 81

70 -

Page 82

... other, net. As of December 27, 2008, we held equity securities, which were classified as trading assets, to generate returns that sought to offset changes in liabilities related to the equity market risk of certain deferred compensation arrangements. During 2009, we sold these securities and began... -

Page 83

... of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Volume of Derivative Activity Total gross notional amounts for outstanding derivatives (recorded at fair value) as of December 26, 2009 and December 27, 2008 were as follows: (In Millions) 2009 2008 Currency... -

Page 84

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Fair Values of Derivative Instruments in the Consolidated Balance Sheets The fair values of our derivative instruments as of December 26, 2009 and December 27, 2008 were as follows: 2009 2008 Other Other ... -

Page 85

...revenue for 2009 and 2008, and 35% of net revenue for 2007. Additionally, these two largest customers accounted for 41% of our accounts receivable as of December 26, 2009 and December 27, 2008. We believe that the receivable balances from these largest customers do not represent a significant credit... -

Page 86

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Note 10: Other Long-Term Assets Other long-term assets as of December 26, 2009 and December 27, 2008 were as follows: (In Millions) 2009 2008 Non-marketable equity method investments Non-marketable cost ... -

Page 87

...for product purchases and services provided was $75 million as of December 26, 2009 and $190 million as of December 27, 2008. During 2009, $419 million was returned to Intel by IMFT, which is reflected as a return of equity method investment within investing activities on the consolidated statements... -

Page 88

... lease. The deferred income will generally offset the related depreciation over the lease term. • We entered into supply and service agreements that involve the manufacture and the assembly and test of NOR flash memory products for Numonyx through 2008. The fair value of these agreements was $110... -

Page 89

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Subsequent to the end of 2009, in February 2010, we signed a definitive agreement with Micron and Numonyx under which Micron agreed to acquire Numonyx in an all-stock transaction. Under the terms of the ... -

Page 90

... in benefits for our existing operations. The combined consideration for acquisitions completed during 2009 was allocated as follows: (In Millions) Fair value of net tangible assets acquired Goodwill Acquired developed technology Other identified intangible assets Share-based awards assumed Total... -

Page 91

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) During the second quarter of 2008, we completed the divestiture of our NOR flash memory business. We exchanged certain NOR flash memory assets and certain assets associated with our phase change memory ... -

Page 92

...-term assets on the consolidated balance sheets. Identified intangible assets consisted of the following as of December 26, 2009: (In Millions) Gross Assets Accumulated Amortization Net Intellectual property assets Acquisition-related developed technology Other intangible assets Total identified... -

Page 93

... and asset impairment activity for the 2009 restructuring plan during 2009: (In Millions) Employee Severance Asset and Benefits Impairments Total Accrued restructuring balance as of December 27, 2008 Additional accruals Adjustments Cash payments Non-cash settlements Accrued restructuring balance as... -

Page 94

... as a result of market conditions related to the Colorado Springs facility during 2007 and additional charges in 2008. We sold the Colorado Springs facility in 2009. In addition, during 2007 we recorded land and building write-downs related to certain facilities in Santa Clara, California. We also... -

Page 95

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Note 20: Borrowings Short-Term Debt Short-term debt included the current portion of long-term debt of $157 million and drafts payable of $15 million as of December 26, 2009 (drafts payable of $100 million ... -

Page 96

... Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Both the 2005 and 2009 debentures are convertible, subject to certain conditions, into shares of our common stock. Holders can surrender the 2005 debentures for conversion at any time. Holders can surrender the 2009... -

Page 97

..., 2009, 51% of our U.S. Profit Sharing Fund was invested in equities, and 49% was invested in fixed-income instruments. Most assets are managed by external investment managers. For the benefit of eligible U.S. employees, we also provide a non-tax-qualified supplemental deferred compensation plan for... -

Page 98

...of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Non-U.S. Pension Benefits. We also provide defined-benefit pension plans in certain other countries. Consistent with the requirements of local law, we deposit funds for certain plans with insurance companies, with... -

Page 99

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) The following table summarizes the amounts recognized on the consolidated balance sheets as of December 26, 2009 and December 27, 2008: U.S. Pension Benefits 2009 2008 Non-U.S. Pension Benefits 2009 2008 ... -

Page 100

... flows approximated the estimated benefit payments of our pension plans. In other countries, we analyzed current market long-term bond rates and matched the bond maturity with the average duration of the pension liabilities. The expected long-term rate of return on plan assets assumptions take into... -

Page 101

... of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Fair Value of Plan Assets Fair value is the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The... -

Page 102

...of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Non-U.S. Plan Assets The investments of the non-U.S. plans are managed by insurance companies, third-party trustees, or pension funds, consistent with regulations or market practice of the country where the assets... -

Page 103

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Concentration of Risk We manage a variety of risks, including market, credit, and liquidity risks, across our plan assets through our investment managers. We define a concentration of risk as an ... -

Page 104

...week closing-price high as of October 30, 2009. A total of 217 million eligible stock options were tendered and cancelled in exchange for 83 million new stock options granted. The new stock options have an exercise price of $19.04, which is equal to the market price of Intel common stock (defined as... -

Page 105

... weighted average assumptions used in calculating these values, on estimates at the date of grant, as follows: 2009 Stock Options 2008 2007 Stock Purchase Plan 2009 2008 2007 Estimated values Expected life (in years) Risk-free interest rate Volatility Dividend yield $4.72 $5.74 $5.79 $4.14 $5.32... -

Page 106

... of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Restricted Stock Unit Awards Information with respect to outstanding restricted stock unit activity is as follows: Weighted Average Grant-Date Fair Value (In Millions, Except Per Share Amounts) Number of Shares... -

Page 107

... INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Additional information with respect to stock option activity is as follows: Weighted Average Exercise Price Aggregate Intrinsic Value 1 (In Millions, Except Per Share Amounts) Number of Shares December 30, 2006 Grants... -

Page 108

...INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Stock Purchase Plan Approximately 80% of our employees were participating in our stock purchase plan as of December 26, 2009. Employees purchased 30.9 million shares in 2009 for $344 million under the 2006 Stock Purchase Plan... -

Page 109

...was anti-dilutive. In the future, we could have potentially dilutive shares if the average market price is above the conversion price. Note 26: Comprehensive Income The components of total comprehensive income were as follows: (In Millions) 2009 2008 2007 Net income Other comprehensive income (loss... -

Page 110

... of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) The components of other comprehensive income (loss) and related tax effects were as follows: 2009 Tax 2008 Tax 2007 Tax (In Millions) Before Tax Net of Tax Before Tax Net of Tax Before Tax Net of Tax Change... -

Page 111

... INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Note 27: Taxes Income before taxes and the provision for taxes consisted of the following: (Dollars in Millions) 2009 2008 2007 Income before taxes: U.S. Non-U.S. Total income before taxes Provision for taxes: Current... -

Page 112

...) 2009 2008 1 Deferred tax assets Accrued compensation and other benefits Deferred income Share-based compensation Inventory Unrealized losses on investments and derivatives State credits and net operating losses Investment in foreign subsidiaries Capital losses Other, net Gross deferred tax assets... -

Page 113

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Long-term income taxes payable include uncertain tax positions, reduced by the associated federal deduction for state taxes and non-U.S. tax credits, and may also include other long-term tax liabilities that... -

Page 114

...of our competitive practices, contending generally that we improperly condition price rebates and other discounts on our microprocessors on exclusive or near-exclusive dealing by some of our customers. We believe that we compete lawfully and that our marketing practices benefit our customers and our... -

Page 115

...previous license agreement, and Intel paid AMD $1.25 billion. We recorded the related charge within marketing, general and administrative on the consolidated statements of operations. Intel also agreed to abide by a set of business practice provisions. As a result, AMD dropped all pending litigation... -

Page 116

... violations of federal and state antitrust laws. The lawsuit alleges that Intel has engaged in a systematic worldwide campaign of illegal, exclusionary conduct to maintain its monopoly power and prices in the market for x86 microprocessors through the use of various alleged actions, including... -

Page 117

... In June 2009, the Court granted the defendants' motion to dismiss the plaintiffs' consolidated complaint, with prejudice. In June 2008, a third plaintiff, Christine Del Gaizo, filed a derivative suit in the Santa Clara County Superior Court against the Board, a former director of the Board, and six... -

Page 118

... to purchase shares of Intel common stock. Under the terms of the agreement, Intel provided a $1.0 billion pre-payment to Lehman, in exchange for which Lehman was required to purchase $1.0 billion in shares of Intel common stock, calculated at a volume weighted average price from August 26, 2008 to... -

Page 119

... includes various handheld devices; and products for the consumer electronics market segments. Our NAND Solutions Group, Wind River Software Group, Software and Services Group, and Digital Health Group operating segments do not meet the quantitative thresholds to qualify as reportable segments and... -

Page 120

...) 2009 2008 2007 Net revenue PC Client Group Microprocessor revenue Chipset, motherboard, and other revenue Data Center Group Microprocessor revenue Chipset, motherboard, and other revenue Other Intel architecture operating segments Other operating segments Corporate Total net revenue Operating... -

Page 121

... of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Geographic revenue information for the three years ended December 26, 2009 is based on the location of the customer. Revenue from unaffiliated customers was as follows: (In Millions) 2009 2008 2007 Asia-Pacific... -

Page 122

...& YOUNG LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders, Intel Corporation We have audited the accompanying consolidated balance sheets of Intel Corporation as of December 26, 2009 and December 27, 2008, and the related consolidated statements of operations... -

Page 123

... with the standards of the Public Company Accounting Oversight Board (United States), the 2009 consolidated financial statements of Intel Corporation and our report dated February 22, 2010 expressed an unqualified opinion thereon. /s/ Ernst & Young LLP San Jose, California February 22, 2010 112 -

Page 124

... Consolidated Financial Statements of this Form 10-K. Intel's common stock (symbol INTC) trades on The NASDAQ Global Select Market and is quoted in the Wall Street Journal and other newspapers. All stock prices are closing prices per The NASDAQ Global Select Market. During the fourth quarter of 2008... -

Page 125

...Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Management's assessment included evaluation of elements such as the design and operating effectiveness of key financial reporting controls, process documentation, accounting policies... -

Page 126

... control system's objectives will be met. The design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Further, because of the inherent limitations in all control systems, no evaluation of controls... -

Page 127

...communications. In addition, the Code incorporates guidelines pertaining to topics such as complying with applicable laws, rules, and regulations; reporting Code violations; and maintaining accountability for adherence to the Code. The full text of our Code is published on our Investor Relations web... -

Page 128

...price does not take into account the shares issuable upon vesting of outstanding restricted stock units, which have no exercise price. Includes 102.5 million shares issuable upon vesting of restricted stock units granted under the 2006 Equity Incentive Plan, including a maximum of 3.8 million market... -

Page 129

... representations and warranties were made or at any other time. Investors should not rely on them as statements of fact. Intel, Intel logo, Intel Inside, Intel Atom, Celeron, Intel Centrino, Intel Core, Intel vPro, Intel Xeon, Itanium, Moblin, and Pentium are trademarks of Intel Corporation in the... -

Page 130

* Other names and brands may be claimed as the property of others. 118 -

Page 131

... 26, 2009, December 27, 2008, and December 29, 2007 (In Millions) Balance at Beginning of Year Additions Charged (Credited) to Expenses Net (Deductions) Recoveries Balance at End of Year Allowance for doubtful receivables 1 2009 2008 2007 Valuation allowance for deferred tax assets 2009 2008 2007... -

Page 132

... Notice of Grant of Restricted Stock Units Form of Intel Corporation Nonqualified Stock Option Agreement under the 2004 Equity Incentive Plan Standard Terms and Conditions relating to Restricted Stock Units granted to U.S. employees under the Intel Corporation 2004 Equity Incentive Plan 8-K 8-K 10... -

Page 133

120 -

Page 134

... April 17, 2008 under the Intel Corporation 2006 Equity Incentive Plan (under the ELTSOP RSU Program) Standard Terms and Conditions relating to Non-Qualified Stock Options granted to U.S. employees on and after May 17, 2006 under the Intel Corporation 2006 Equity Incentive Plan (for grants under the... -

Page 135

121 -

Page 136

... Terms and Conditions relating to Nonqualified Stock Options granted to U.S. employees on and after May 17, 2006 under the Intel Corporation 2006 Equity Incentive Plan (for grants under the ELTSOP Program) International Nonqualified Stock Option Agreement under the 2006 Equity Incentive Plan... -

Page 137

...NonQualified Stock Options granted to A. Douglas Melamed on January 22, 2010 under the Intel Corporation 2006 Equity Incentive Plan (standard option program) Settlement Agreement Between Advanced Micro 8-K 000-06217 Devices, Inc. and Intel Corporation, dated November 11, 2009 Statement Setting Forth... -

Page 138

... duly authorized. INTEL CORPORATION Registrant By: /s/ STACY J. SMITH Stacy J. Smith Senior Vice President, Chief Financial Officer, and Principal Accounting Officer February 22, 2010 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 139

... vesting date set forth in your Notice of Grant, your unvested RSUs and dividend equivalents will be cancelled. 3. CONVERSION OF RSUs The conversion rate of RSUs into the right to receive a number of shares of Common Stock depends on the Corporation's Total Stockholder Return ("Intel TSR") relative... -

Page 140

... any dividends paid or payable with respect to a record date that occurs during the Performance Period, divided (to the third decimal point) by b. the closing sale price on the grant date; Tech 15 TSR is the median TSR of the fifteen technology companies included in the Corporation's peer group for... -

Page 141

... date. Any dividend paid in other property shall be valued based on the value assigned to such dividend by the paying company for tax purposes. Any company included in the Tech 15 TSR or S&P 100 TSR on the grant date that does not have a stock price that is quoted on a national securities exchange... -

Page 142

...your tax withholding obligations as specified under Section 11 of these Standard Terms and you have completed, signed and returned any documents and taken any additional action that the Corporation deems appropriate to enable it to accomplish the delivery of the shares of Common Stock. The shares of... -

Page 143

... Terms, if your employment by the Corporation terminates for any reason, whether voluntarily or involuntarily, other than on account of death, Disablement (defined below) or Retirement (defined below), all RSUs and dividend equivalents not then vested shall be cancelled on the date of employment... -

Page 144

... exceeds 75 ("Rule of 75"). 11. TAX WITHHOLDING RSUs and dividend equivalents are taxable upon vesting based on the Market Value on the date of vesting. To the extent required by applicable federal, state or other law, you shall make arrangements satisfactory to the Corporation for the payment and... -

Page 145

INTEL CONFIDENTIAL account for rounding and market fluctuations, and to pay such tax withholding to the Corporation. The shares may be sold as part of a block trade with other participants of the 2006 Plan in which all participants receive an average price. For this purpose, "Market Value" will be ... -

Page 146

... in any given amount. (b) To the extent that the grant of RSUs and dividend equivalents refers to the Common Stock of Intel Corporation, and as required by the laws of your country of residence or employment, only authorized but unissued shares thereof shall be utilized for delivery upon vesting in... -

Page 147

...these Standard Terms, the Notice of Grant or the 2006 Plan to the contrary, if, at the time of your termination of employment with the Corporation, you are a "specified employee" as defined in Section 409A of the Internal Revenue Code ("Code"), and one or more of the payments or benefits received or... -

Page 148

... to the RSUs and dividend equivalents and/or any proceeds or payments from or relating to such shares as it determines to be necessary or appropriate to comply with applicable law or to address, comply with or offset the economic effect to the Corporation of any accounting or administrative matters... -

Page 149

... vesting date set forth in your Notice of Grant, your unvested RSUs and dividend equivalents will be cancelled. 3. CONVERSION OF RSUs The conversion rate of RSUs into the right to receive a number of shares of Common Stock depends on the Corporation's Total Stockholder Return ("Intel TSR") relative... -

Page 150

... any dividends paid or payable with respect to a record date that occurs during the Performance Period, divided (to the third decimal point) by b. the closing sale price on the grant date; Tech 15 TSR is the median TSR of the fifteen technology companies included in the Corporation's peer group for... -

Page 151

... date. Any dividend paid in other property shall be valued based on the value assigned to such dividend by the paying company for tax purposes. Any company included in the Tech 15 TSR or S&P 100 TSR on the grant date that does not have a stock price that is quoted on a national securities exchange... -

Page 152

... date on which shares are issued or credited to your account may include a delay in order to provide the Corporation such time as it determines appropriate to calculate Intel TSR and CG TSR, for the Committee (as defined below) to certify performance results, to calculate and address tax withholding... -

Page 153

... not a participant in a then-current Long Term Disability Plan maintained by the Corporation or the Subsidiary that employs you, "Disablement" shall have the same meaning as disablement is defined in the Intel Long Term Disability Plan, which is generally a physical condition arising from an illness... -

Page 154

... terminate employment with the Corporation and as of the termination date when your age plus years of service (in each case measured in complete, whole years) equals or exceeds 75 ("Rule of 75"). 11. TAX WITHHOLDING RSUs and dividend equivalents are taxable upon vesting based on the Market Value in... -

Page 155

...equivalents or the subsequent sale of any of the shares of Common Stock underlying the RSUs and dividend equivalents that vest. The Corporation does not commit and is under no obligation to structure the RSU program to reduce or eliminate your tax liability. 12. RIGHTS AS A STOCKHOLDER Your RSUs and... -

Page 156

... information about you, including, but not limited to, your name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title, any shares of stock or directorships held in the Corporation, details of all RSUs or any other... -

Page 157

... issued shares of Common Stock of Intel Corporation, a Delaware corporation, an essential term of this Agreement is that it shall be governed by the laws of the State of Delaware, without regard to choice of law principles of Delaware or other jurisdictions. Any action, suit, or proceeding relating... -

Page 158

... of this Agreement, the Notice of Grant or the 2006 Plan to the contrary, if, at the time of your termination of employment with the Corporation, you are a "specified employee" as defined in Section 409A of the Internal Revenue Code ("Code"), and one or more of the payments or benefits received or... -

Page 159

... to the RSUs and dividend equivalents and/or any proceeds or payments from or relating to such shares as it determines to be necessary or appropriate to comply with applicable law or to address, comply with or offset the economic effect to the Corporation of any accounting or administrative matters... -

Page 160

... granted to U.S. employees under the Intel Corporation 2006 Equity Incentive Plan (the "2006 Plan") (other than grants made under the SOP Plus or ELTSOP programs). 2. NONQUALIFIED STOCK OPTION The option is not intended to be an incentive stock option under Section 422 of the Internal Revenue Code... -

Page 161

...of shares hereunder would violate any federal, state or other applicable laws. Notwithstanding anything to the contrary in these Standard Terms or the applicable Notice of Grant, Intel may reduce your unvested options if you change classification from a full-time employee to a part-time employee. IF... -

Page 162

... eligible for future Intel stock option grants, nor would your transfer from Intel to any Subsidiary or from any one Subsidiary to another, or from a Subsidiary to Intel be deemed a termination of employment. Further, your employment with any partnership, joint venture or corporation not meeting the... -

Page 163

... not a participant in a then-current Long Term Disability Plan maintained by the Corporation or the Subsidiary that employs you, "Disablement" shall have the same meaning as disablement is defined in the Intel Long Term Disability Plan, which is generally a physical condition arising from an illness... -

Page 164

... established solely for the benefit of you or members of your Immediate Family, or by gift to a foundation in which you and/or members of your Immediate Family control the management of the foundation's assets. (c) For purposes of these Standard Terms, "Immediate Family" is defined as your spouse... -

Page 165

...by the laws of your country of residence or employment, only authorized but unissued shares thereof shall be utilized for delivery upon exercise by the holder in accord with the terms hereof. Copies of Intel Corporation's Annual Report to Stockholders for its latest fiscal year and Intel Corporation... -

Page 166

... relating to these Standard Terms or the option granted hereunder shall be brought in the state or federal courts of competent jurisdiction in the State of California. Notwithstanding any other provision of these Standard Terms, if any changes in the law or the financial or tax accounting rules... -

Page 167

... 2009 FORM 10-K STATEMENT SETTING FORTH THE COMPUTATION OF RATIOS OF EARNINGS TO FIXED CHARGES FOR INTEL CORPORATION (In Millions, Except Ratios) Dec. 26, 2009 Dec. 27, 2008 Years Ended Dec. 29, 2007 Dec. 30, 2006 Dec. 31, 2005 Earnings 1 Adjustments: Add - Fixed charges Subtract - Capitalized... -

Page 168

... Intel Ireland Limited Intel Israel (74) Limited Intel Israel Holdings B.V. Intel Kabushiki Kaisha Intel Malaysia Sdn. Berhad Intel Massachusetts, Inc. Intel Overseas Funding Corporation Intel Products (M) Sdn. Bhd. Intel Semiconductor Limited Intel Technology Sdn. Berhad Mission College Investments... -

Page 169

... of our reports dated February 22, 2010, with respect to the consolidated financial statements and schedule of Intel Corporation, and the effectiveness of internal control over financial reporting of Intel Corporation, included in this Annual Report on Form 10-K for the year ended December 26, 2009... -

Page 170

...internal control over financial reporting and fraud and related matters (Item 5 of the certification). CERTIFICATION I, Paul S. Otellini, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Intel Corporation; Based on my knowledge, this report does not contain any untrue statement... -

Page 171

... or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ STACY J. SMITH Stacy J. Smith Senior Vice President, Chief Financial Officer, and Principal Accounting Officer Date: February 22, 2010 -

Page 172

... contained in such report fairly presents, in all material respects, the financial condition and results of operations of Intel. This written statement is being furnished to the Securities and Exchange Commission as an exhibit to such Form 10-K. A signed original of this statement has been provided...