Hyundai 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

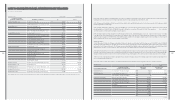

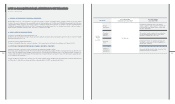

(11) Hyundai Capital Services, Inc. made a Revolving Credit Facility Agreement with the following nancial institutions for credit line:

Financial institution Credit line Commission Contract term

Mizuho Corporate Bank, KRW 65,000 million - committed : 91day CD+1.5% Dec 14, 2010 ~ Dec 13, 2011

Seoul Branch - uncommitted : 30bp

JP Morgan Seoul Branch KRW 34,000 million - committed : 91day CD+1.5% Sep 29, 2010~ Sep 28, 2011

- uncommitted : 30bp

Citibank, Seoul KRW 50,000 million - committed : 91day CD+1.5% Sep 29, 2010~ Sep 28, 2011

- uncommitted : 30bp

Standard Chartered, KRW 50,000 million - committed : 91day CD+1.8% Dec 28, 2010~ Dec 28, 2011

Seoul Branch - uncommitted : 30bp

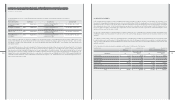

(12) According to the agreement, in order for the credibility of the asset-backed securities, several required provisions are made as a trigger clauses to be

used for early redemption calls, thereby limiting the risk that investors will have resulting from a change in quality of the assets in the future. In the event the

asset-backed securitization of the Hyundai Card Co., Ltd. violates the applicable trigger clause, Hyundai Card Co., Ltd. is obliged to make early redemption for

asset-backed securities.

(13) Hyundai WIA Corporation, a of domestic subsidiary of the Company, made general instalment nancing contracts with Doosan Capital Co., Ltd., Hyundai

Commercial Inc. and Hyundai Capital Services, Inc. in order to promote the sales of its machine tools. According to the contracts, if a user of the instalment

nancing service is in default, Hyundai WIA Corporation has to accept responsibility for the default receivable. The amounts of principal that has not matured

are₩1,858 million (US$1,631 thousand), ₩76,109 million (US$66,827 thousand) and ₩14,175 million (US$12,446 thousand) for Doosan Capital Co., Ltd.,

Hyundai Commercial Inc. and Hyundai Capital Service Inc., respectively. The ceiling amounts are ₩150,000 million (US$131,706 thousand), ₩100,000 million

(US$87,804 thousand) and₩68,157 million (US$59,845 thousand) for Doosan Capital Co., Ltd., Hyundai Commercial Inc. and Hyundai Capital Services, Inc.,

respectively, as of December 31, 2010.

Hyundai Motor Company

December 31, 2010 and 2009

29. DERIVATIVE INSTRUMENTS:

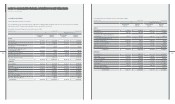

(1) The Company enters into derivative contracts including forwards, options and swaps to hedge the exposure to foreign exchange rate uctuations. As of

December 31, 2010 and 2009, the Company deferred the net income of ₩6,169 million (US$5,417 thousand) and the net loss of ₩101,135 million (US$88,801

thousand), respectively, on valuation of the effective portion of derivative instruments for cash ow hedging purposes from forecasted exports as accumulated

other comprehensive income (loss). As the forecasted transactions are expected to occur within one year from December 31, 2010; the total amount of the

net gain on valuation recorded as accumulated other comprehensive income as of December 31, 2010, is expected to be realized and charged to current

operations within one year from December 31, 2010.

For the years ended December 31, 2010 and 2009, the Company recognized net loss of ₩28,109 million (US$24,681 thousand) and ₩42,050 million

(US$36,922 thousand), respectively, related to the ineffective portion of the cash ow hedge derivative instruments and other derivative instruments in current

operations.

The Company recorded total gain on valuation of outstanding derivatives of ₩44,368 million (US$38,957 thousand) and₩35,836 million (US$31,465 thousand)

in current derivative assets as of December 31, 2010 and 2009, respectively. Also, the Company recorded total loss on valuation of outstanding derivatives

of₩71,715 million (US$62,969 thousand) and ₩179,020 million (US$157,187 thousand) in current and non-current derivative liabilities as of December 31, 2010

and 2009, respectively.

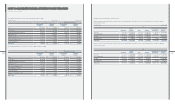

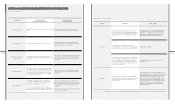

(2) The transactions of derivatives belonging to subsidiaries as of December 31, 2010 consist of the following:

Gain (loss) Other comprehensive gain (loss)

Translation into Translation into

Derivatives ₩ $ (Note 2) ₩ $ (Note 2)

Currency option ₩ 22,115 $ 19,418 ₩ (1,777) $ (1,560)

Currency forward (222) (195) 822 722

Forward exchange 931 817 - -

Currency swap (85,052) (74,679) (41,061) (36,053)

Interest rate swap 6,220 5,462 (863) (758)

Others - - (8,543) (7,502)

Total ₩ (56,008) $ (49,177) ₩ (51,422) $ (45,151)

[in millions of KRW] [in millions of KRW]Hyundai Motor Company [in thousands of US$][in thousands of US$]