Hyundai 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

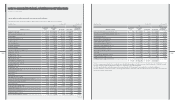

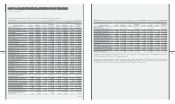

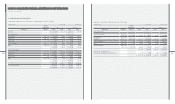

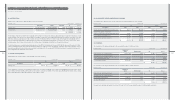

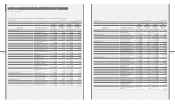

19. INCOME TAX EXPENSE AND DEFERRED INCOME TAX ASSETS (LIABILITIES):

Income tax expense for the year ended December 31, 2010 and 2009 consists of the following:

₩$ (Note 2)

Description 2010 2009 2010 2009

Income tax currently payable ₩ 1,761,734 ₩ 1,053,257 $ 1,546,873 $ 924,802

Changes in deferred taxes due to:

Temporary differences 791,248 433,351 694,748 380,500

Carry forward of unused tax credits 99,354 326 87,237 286

Change in consolidated subsidiaries - 13,537 - 11,886

Deferred tax charged or credited to equity (142,783) 27,735 (125,369) 24,352

Income tax charged or credited to equity (40,359) (10,930) (35,437) (9,597)

Income tax expense ₩ 2,469,194 ₩ 1,517,276 $ 2,168,052 $ 1,332,229

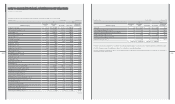

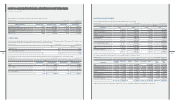

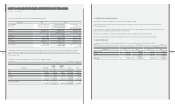

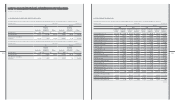

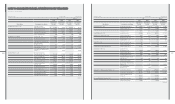

18. STATEMENTS OF COMPREHENSIVE INCOME:

Statements of comprehensive income as of December 31, 2010 and 2009 consist of the following:

₩$ (Note 2)

Description 2010 2009 2010 2009

Net income ₩ 7,982,924 ₩ 4,043,436 $ 7,009,328 $ 3,550,299

Other comprehensive income (loss):

Gain on valuation of available-for-sale

securities, net of deferred tax effect

₩144,671 million and ₩1,713 million

in 2010 and 2009, respectively. 512,926 6,074 450,370 5,333

Gain (loss) on valuation of investment

securities accounted for using the equity

method, net of deferred tax effect

₩18,481 million and ₩21,976 million

in 2010 and 2009, respectively. (65,524) 90,975 (57,533) 79,880

Gain on valuation of derivatives, net of

deferred tax effect ₩23,812 million and

₩81,554 million in 2010 and 2009, respectively. 83,789 281,861 73,570 247,485

Loss on overseas operation translation, net

of deferred tax effect ₩8,832 million

and ₩136,782 million in 2010 and 2009, respectively. (31,309) (466,046) (27,490) (409,207)

Comprehensive income ₩ 8,482,806 ₩ 3,956,300 $ 7,448,245 $ 3,473,790

Equity holders of the parent ₩ 5,926,515 ₩ 2,861,134 $ 5,203,719 $ 2,512,191

Minority interests 2,556,291 1,095,166 2,244,526 961,599

₩ 8,482,806 ₩ 3,956,300 $ 7,448,245 $ 3,473,790

[in millions of KRW]Hyundai Motor Company [in thousands of US$]

December 31, 2010 and 2009

[in millions of KRW]Hyundai Motor Company [in thousands of US$]