Hyundai 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

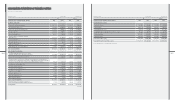

Principles of Consolidation

The accompanying nancial statements include the accounts of the Company and its subsidiaries. Under nancial accounting standards for consolidated

nancial statements in the Republic of Korea, a company is regarded as a subsidiary of another company if more than 50% of its issued share capital is held

by the other company, or more than 30% of its issued share capital is held by the other company and that company is the largest shareholder, or substantially

controlled by the other company. Investments of 20% to 50% in afliated companies or investments in afliated companies over which the Company exerts

a signicant inuence are accounted for using the equity method. Under the equity method, the original investment is recorded at cost and adjusted by the

Company’s share on the undistributed earnings or losses of these companies.

The scal year of the consolidated subsidiaries is the same as that of the Company. Differences in accounting policy between the Company and consolidated

subsidiaries are adjusted in the consolidation.

Investments and equity accounts of subsidiaries were eliminated at the dates the Company obtained control of the subsidiaries. The difference between the

cost of acquisition and the book value of the subsidiary is amortized using the straight-line method within twenty years from the year the acquisition occurred or

reversed over the remaining weighted average useful life of the identiable acquired depreciable assets for negative goodwill using the straight-line method.

When the Company acquires additional interests in a subsidiary after obtaining control over the subsidiary, the difference between incremental price paid by

the Company and the amount of incremental interest in the shareholders’ equity of the subsidiary is reected in the consolidated capital surplus. In case a

subsidiary still belongs to a consolidated economic entity after the Company disposes a portion of the stocks of subsidiaries to non-subsidiary parties, gain or

loss on disposal of the subsidiary’s stock is accounted for as consolidated capital surplus or capital adjustments.

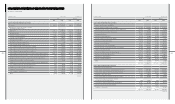

Intragroup balances and transactions, including income, expenses and dividends are eliminated in full. Prots or losses resulting from intragroup transactions

that are recognised in assets are eliminated in full. Unrealized gains and losses arising from sales by a controlling company to its subsidiary (downstream

sales) are eliminated entirely and charged (credited) to controlling interest, and unrealized gains and losses arising from sales by a subsidiary to its controlling

company or from transactions among subsidiaries (upstream sales) are eliminated entirely and allocated to controlling interest and minority interest.

Minority interest is the part of net operation results and net assets of a subsidiary other than controlling interest. When net loss attributable to minority

shareholders exceeds the minority interest, the excess and any further losses attributable to the minority interest is allocated to the minority interest and

presented as negative in equity. Where, under an arrangement, the allocation of interest to the parent and the minority resulting from the losses is not based

on their ownership interest, losses attributable to minority interest are determined according to such arrangement.

When the Company acquires new subsidiaries during the year, the results of operations are reected in the statement of income on an annual basis. However,

total net income (loss) of the consolidated subsidiaries until the acquisition date is deducted from net income after income tax and accounted for as net

income (loss) of newly consolidated subsidiaries before acquisition. In addition, when the Company disposes shares of subsidiaries during the year and the

subsidiaries do not belong to the consolidation entity, the Company applies SKAS No. 11 - “Discontinuing Operation” which requires the Company not to

present the income (loss) of the subsidiaries until the disposal date item-by-item but to present the total net income (loss) of the subsidiaries as a line item in

the consolidated statement of income.

When translating the nancial statements of the afliates operating overseas, the Company applies the foreign exchange rate at the end date of the investor’s

reporting period to the associate’s assets and liabilities, the foreign exchange rate at the date on which the investor acquired its equity interest in the associate

to the investor’s share of the associate’s equity interest, the foreign exchange rate at each transaction date to the remaining equity interest in the associate

after excluding any increase in retained earnings after the investor’s acquisition of its equity interest in the associate, and the foreign exchange rate at the

average rate for the pertinent period to the items in the associate’s statement of income. In addition, when translating the statements of cash ows of the

afliates operating overseas, the Company applies the foreign exchange rate at the beginning date of the investor’s reporting period to the beginning balance

of cash and cash equivalents, the foreign exchange rate at the end date of the investor’s reporting period to the ending balance of cash and cash equivalents

and the foreign exchange rate at the average rate for the pertinent period to the items which explain the changes of cash and cash equivalents for the period.

Differences derived from applying different foreign exchange rates are presented as effect of exchange rate on cash and cash equivalents in the consolidated

statements of cash ows.

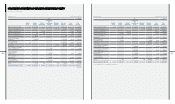

Revenue Recognition

Sales of goods is recognized at the time of shipment only if it meets the conditions that signicant risks and rewards of ownership of the goods have been

transferred to the customer, and neither continuing managerial involvement nor effective control over the goods sold is retained. Revenue arising from

rendering of services is generally recognized by the percentage-of-completion method at the date of the end of the reporting period. In addition, revenue

arising from interest, dividends or royalties is recognized when it is probable that future economic benets will ow into the Company and those benets can

be measured reliably.

In the case of subsidiaries in nancial business, interest revenues earned on nancial assets are recognized as time passes using the level yield method, and

fees and commissions in return for services rendered are recognized as services are provided.

Allowance for Doubtful Accounts

The Company provides an allowance for doubtful accounts based on management’s estimate of the collectibility of receivables.

Inventories

Inventories are stated at the lower of cost or net realizable value, cost being determined by the moving average method, except for materials in transit for which

cost is determined using the specic identication method. Valuation loss incurred when the market value of an inventory falls below its carrying amount is

added to the cost of goods sold.

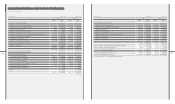

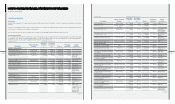

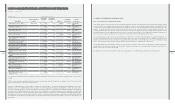

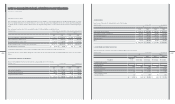

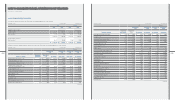

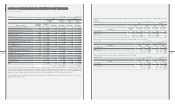

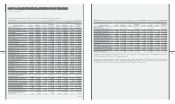

December 31, 2010 and 2009