Hyundai 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

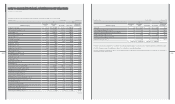

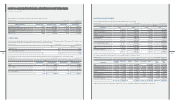

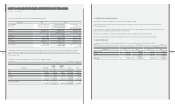

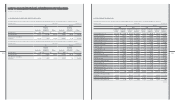

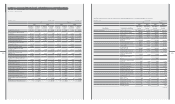

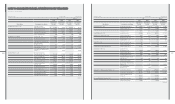

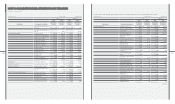

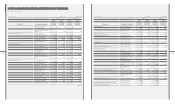

The components of accumulated temporary differences and deferred tax assets (liabilities) as of December 31, 2010 are as follows:

₩$ (Note 2)

2010 2009 2010 2009

Description Accumulated Deferred Accumulated Deferred

temporary tax assets temporary tax assets

differences (liabilities) differences (liabilities)

Accrued warranties ₩ 5,140,100 ₩ 1,227,499 $ 4,513,215 $ 1,077,793

Long-term investment securities (761,769) (245,841) (668,864) (215,858)

Allowance for doubtful accounts 383,942 79,741 337,117 70,016

Investments in subsidiaries and associates (7,055,697) (1,397,004) (6,195,186) (1,226,626)

Reserve for research and manpower development (526,200) (118,008) (462,025) (103,616)

Derivative assets (275,668) (61,237) (242,048) (53,769)

Development cost 31,768 7,230 27,894 6,348

Depreciation (1,649,017) (490,681) (1,447,903) (430,838)

Accrued income 145,141 62,338 127,440 54,735

Advanced depreciation provisions (505,570) - (443,911) -

Loss on foreign exchange translation 237,636 49,604 208,654 43,554

Provision for other liabilities 463,587 104,615 407,048 91,856

Other 1,839,127 554,785 1,614,827 487,126

Accumulated temporary differences (2,532,620) (226,959) (2,223,742) (199,279)

Carry over tax deduction 301,145 301,145 264,417 264,417

₩ (2,231,475) ₩ 74,186 $ (1,959,325) $ 65,138

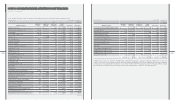

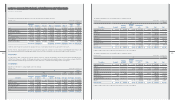

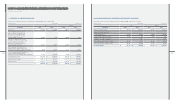

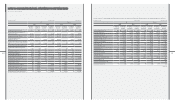

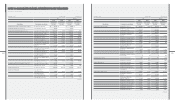

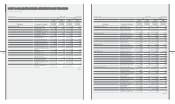

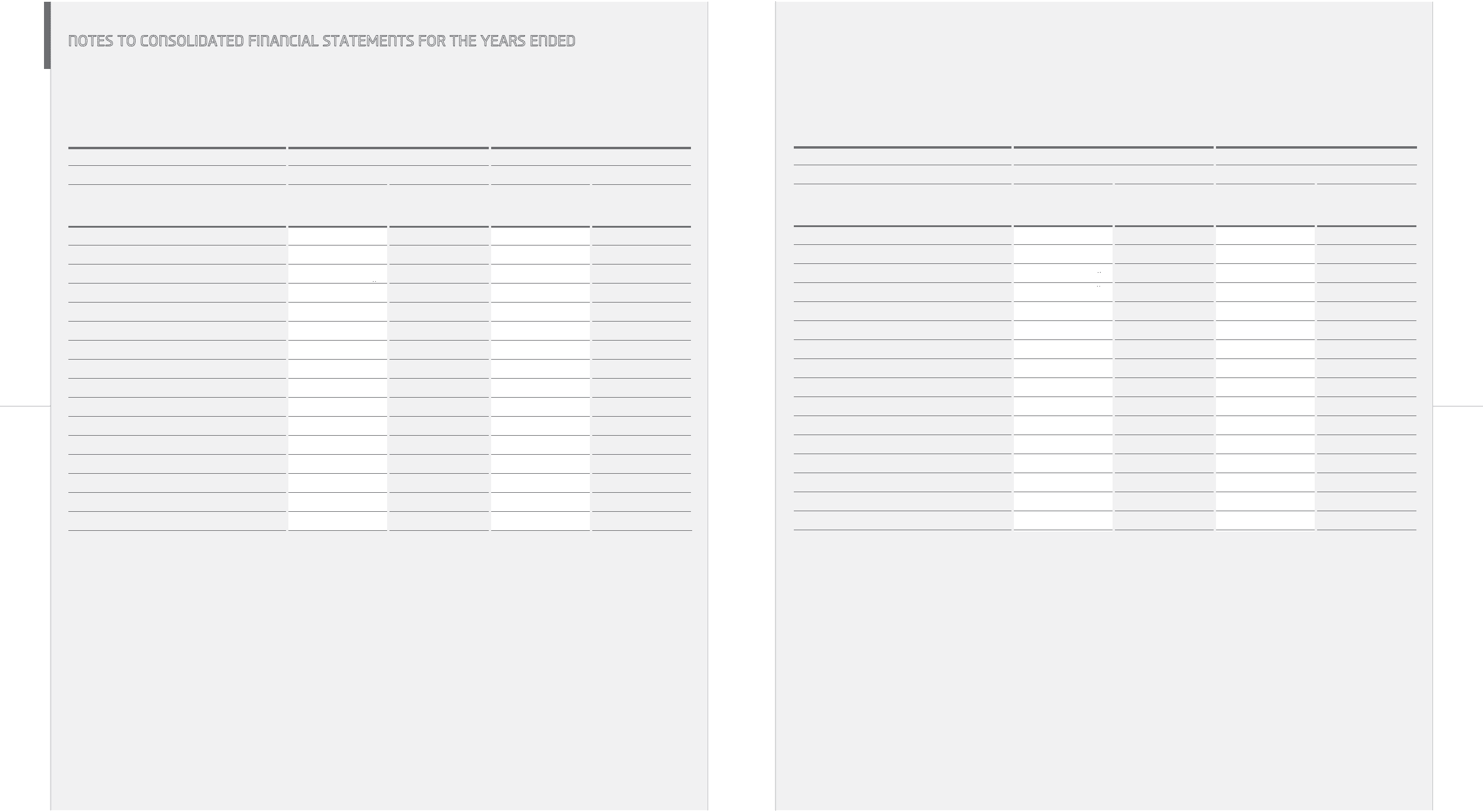

The components of accumulated temporary differences and deferred tax assets (liabilities) as of December 31, 2009 are as follows:

₩$ (Note 2)

2010 2009 2010 2009

Description Accumulated Deferred Accumulated Deferred

temporary tax assets temporary tax assets

differences (liabilities) differences (liabilities)

Accrued warranties ₩ 4,379,835 ₩ 1,070,008 $ 3,845,671 $ 939,510

Long-term investment securities (88,199) (97,287) (77,442) (85,422)

Allowance for doubtful accounts 557,193 126,548 489,238 111,114

Investments in subsidiaries and associates (3,559,783) (905,055) (3,125,633) (794,675)

Reserve for research and manpower development ₩ (319,511) ₩ (74,989) $ (280,544) $ (65,843)

Derivative assets (838,981) (207,813) (736,659) (182,468)

Development cost 29,969 7,201 26,314 6,323

Depreciation (1,422,179) (481,589) (1,248,730) (422,855)

Accrued income 53,031 12,838 46,563 11,272

Advanced depreciation provisions (509,377) (2,291) (447,253) (2,012)

Loss on foreign exchange translation 1,109,559 265,203 974,237 232,859

Provision for other liabilities 414,510 94,000 363,956 82,536

Other 1,954,569 757,515 1,716,191 665,130

Accumulated temporary differences 1,760,636 564,289 1,545,909 495,469

Carry over tax deduction 402,934 400,499 353,792 351,654

₩ 2,163,570 ₩ 964,788 $ 1,899,701 $ 847,123

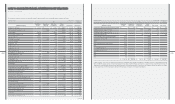

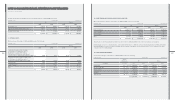

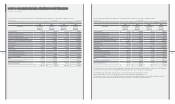

The temporary differences of ₩ 330,217 million (US$289,944 thousand) and ₩ 174,514 million (US$153,230 thousand) as of December 31, 2010 and 2009,

respectively, are not recognized since it is not probable that the temporary difference will be reversed in the foreseeable future.

The Company recognizes deferred tax assets based on its assessment that the sum of average taxable income and

taxable temporary differences in the coming years will exceed the amount of deductable temporary differences to

be extinguished every year. The tax rate used by the Company and its subsidiaries in calculating deferred tax assets or liabilities arising from temporary

differences is 24.2% (22% is applied to deferred tax assets or liabilities which are realized after 2012) including resident tax.

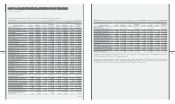

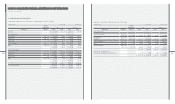

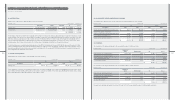

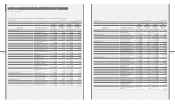

[in millions of KRW]Hyundai Motor Company [in thousands of US$] [in millions of KRW]Hyundai Motor Company [in thousands of US$]

December 31, 2010 and 2009