Hyundai 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2004_118

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

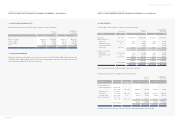

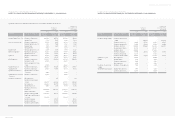

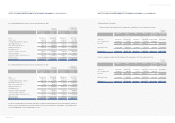

(2) As of December 31, 2004, the outstanding balance of accounts receivable discounted with recourse and transferred by the

Company and its subsidiaries amounts to 145,737 million (US$139,622 thousand).

(3) The Company and its subsidiaries have used a customer financing system related to a long-term installment sales system and have

provided guarantees to related banks amounting to 201,018 million (US$192,583 thousand) as of December 31, 2004.

These guarantees are all covered by insurance contracts, which specify the customer and the Company and its subsidiaries as

contractor and beneficiary, respectively.

(4) The Company accrues estimated product liabilities expenses and carries the products and completed operations liability insurance

(see Note 8) in order to cover the potential loss, which may occur due to the lawsuits related to its operation such as product

liabilities. The Company expects that the resolution of cases pending against the Company as of December 31, 2004 will not have

any material effect on its financial position.

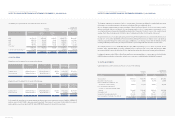

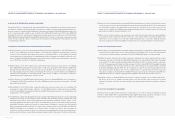

Kia Motors Corporation, a domestic subsidiary, is a defendant pertaining to its claim in the in-court reorganization proceeding, the

lawsuits related to its operation such as product liabilities, lawsuits for compensation of losses or damages. KIA also has a pending

lawsuit in a Brazilian court pertaining to the disputes with the Brazilian Government and the Brazilian shareholders of Asia Motors Do

Brasil S.A. (AMB), which was established as a joint venture by Asia Motors with a Brazilian investor. Also, in 2002, KIA brought the

case to the International Court of Arbitration to settle the disputes. KIA, a stockholder of AMB, had already written off its investment

of 14,057 million (US$13,467 thousand) and estimates that the above matter does not and will not affect its financial statements at

this time. The outcome of the creditors’ claims in relation to KIA’s denial of their claims in the in-court reorganization proceedings is not

currently determinable.

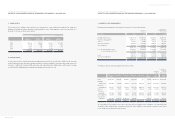

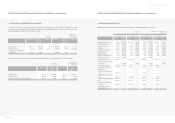

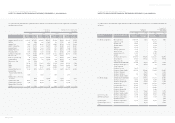

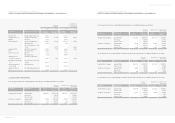

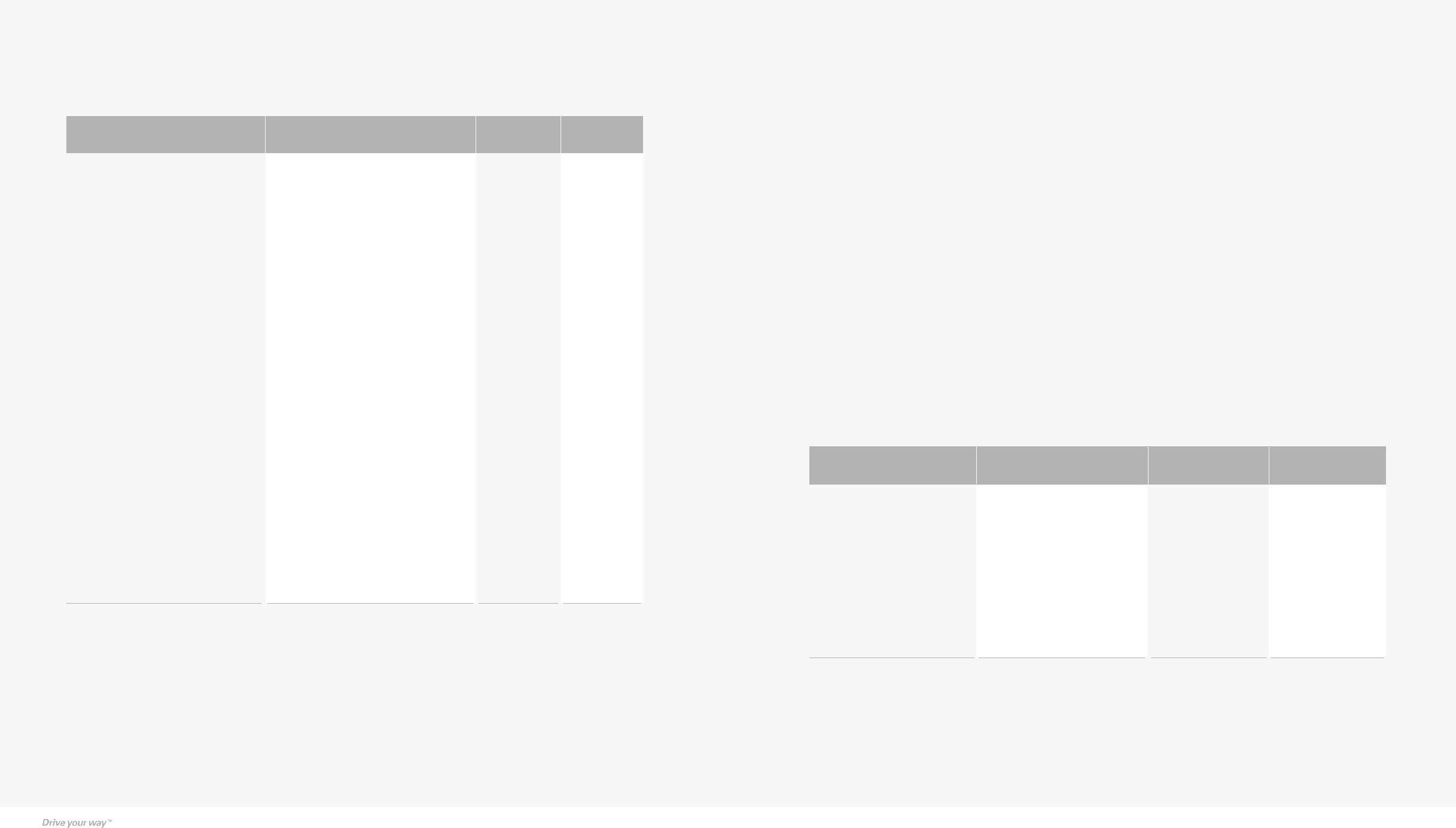

(5) As of December 31, 2004, the Company’s consolidated subsidiaries have been provided for payment guarantee by other

companies as follows:

Consolidated Subsidiaries Company providing Amounts of Translation into

guarantee of indebtedness guarantee U.S. dollars (Note 2)

(in thousands)

Dymos Inc. The Korea Exchange Bank & other KRW 19,291 $18,482

KEFICO Corporation The Korea Exchange Bank USD 417,000 417

and other JPY 834,170,000 8,088

EUR 228,000 311

SEK 7,228,000 1,093

ROTEM The Korea Development Bank KRW 683,204 654,535

and other USD 64,360,947 64,361

EUR 4,031,040 5,495

NTD 19,340,000 606

HKD 45,138,196 5,805

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

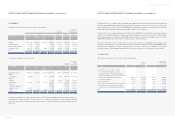

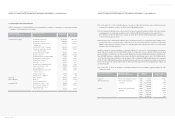

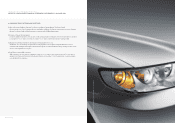

24. COMMITMENTS AND CONTINGENCIES:

(1)The Company and its consolidated subsidiaries are contingently liable for guarantees of indebtedness of related parties including

subsidiaries as of December 31, 2004 as follows:

Company providing Beneficiary Companies Korean won Translation into

guarantee of indebtedness (in millions) U.S. dollars (Note 2)

(in thousands)

Hyundai Motor Company Hyundai Merchant Marine 294,484 $282,127

Hyundai Motor America 223,185 213,820

Hyundai Motor Manufacturing 417,520 400,000

Alabama LLC

Hyundai Motor Finance Company 396,644 380,000

Hyundia Assan Otomotiv Sanayi Ve 78,285 75,000

Ticaret Anonim Sirketi

Hyundai Motor Europe GmbH 73,994 70,889

Hyundai Translead 145,088 139,000

Hyundai Machine Tool Europe GmbH 1,044 1,000

Hyundai Motor Poland Sp.Zo.O 12,095 11,587

Hyundai Motor Japan Co. 35,422 33,936

HMJ R&D Center Inc . 2,631 2,521

Hyundai Motor Company Australia 12,194 11,682

Equus Cayman Finance Ltd. 417,520 400,000

Smart Alabama LLC 37,577 36,000

Beijing Jingxian Motor Safeguard 2,610 2,500

Service Co., Ltd.

Hyundai Card Co., Ltd. 4,175 4,000

Other domestic companies 305 292

Dymos Inc. WIA Corporation 64,778 62,060

WIA Corporation Dymos Inc. 19,099 18,298

Other foreign subsidiaries 24 23

Hyundai HYSCO Hyundai Pipe of America, Inc. 10,438 10,000

Hysco America Company, Inc 15,657 15,000

Bejing Hyundai Hysco Steel

Process Co., Ltd. 31,361 30,045