Hyundai 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2004_82

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

Accounting for Lease Contracts

In case the risk and benefit from the ownership of the leased property is de facto transferred to the lessee, such lease is classified as

a financial lease, otherwise, it is classified as an operating lease.

The lease that is non-cancelable in substance for the entire lease term is classified as a financial lease if at least one of the following

conditions are met: (1) The ownership of the leased property is to be transferred to the lessee at the end or before of the lease term

for free or some agreed price; (2) The lessee has a bargain purchase option; (3) The lease term is not less than 75/100 of the

estimated economic life of the leased property; and (4) The present value of the basic lease rentals as of the inception of the lease

using the implicit interest rate is not less than 90/100 of the fair value of the leased property.

The lower of the present value after discounting basic lease rentals by the implicit interest rate and the fair value of leased property are

respectively recorded as assets and liabilities on financial lease. Leased assets are depreciated consistently with the depreciation of

the same or similar tangible assets, which the lessee owns.

In the case of an operating lease, basic lease rentals, in principle, are charged to expenses on a straight-line basis over the lease term.

However, when there is any method that better represents the procedure of allocation of expenses related to lease, this method may

be applied. Contingent rentals are charged to expenses when they are incurred. However, if payment of contingent rental is uncertain,

contingent rentals may be charged as expense when they become due for payment.

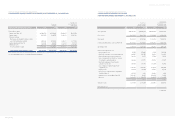

Accrued Severance Benefits

Employees and directors of the Company and its subsidiaries are entitled to receive a lump-sum payment upon termination of their

service based on the applicable severance plan of each company. The accrued severance benefits that would be payable assuming

all eligible employees of the Company and its domestic subsidiaries terminated their employment amount to 2,797,232 million

(US$2,679,854 thousand) and 2,777,405 million (US$2,660,859 thousand) as of December 31, 2004 and 2003, respectively.

Accrued severance benefits are funded through an individual severance insurance plan. Individual severance insurance deposits, of

which a beneficiary is a respective employee, are presented as deduction from accrued severance benefits. Actual payments of

severance benefits amounted to 538,361 million (US$515,770 thousand) and 406,840 million (US$389,768 thousand) in 2004

and 2003, respectively.

Accrued Warranties and Product Liabilities

The Company and its subsidiaries generally provide a warranty to the ultimate consumer with each product and accrue warranty

expense at the time of sale based on actual claims history. Also, the Company accrues potential expenses, which may occur due to

product liability suits, pending voluntary recall campaign and other obligation as of the balance sheet date. Actual costs incurred are

charged against the accrual when paid. Until 2003, the Company recognized accrued liabilities for the provision for the projected

costs for dismantling and recycling vehicles the Company sold in European Union region to comply with a European Parliament

directive regarding End-of-Life Vehicles (ELV). However, in 2004, the Company revised the contracts with most of its agents in the

European Union by which the agents are responsible for all of the costs of the dismantling and recycling the vehicles placed in service

in the future. The Company reversed the accrued liabilities exceeding the estimated expense by 305,765 million (US$292,934

thousand) in 2004.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

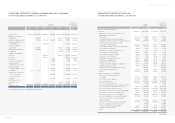

Intangibles

Intangible assets are stated at cost, net of accumulated amortization. Subsequent expenditures on intangible assets after their

purchases or completions, which will probably enable the assets to generate future economic benefits and can be measured and

attributed to the assets reliably, are treated as additions to intangible assets.

Amortization is computed using the straight-line method based on the estimated useful lives of the assets as follows:

Useful lives (years)

Goodwill (Negative goodwill) Within 20 years

Industrial property rights 3 – 40

Development costs 3 – 10

Other 3 – 40

If the recoverable amount of an intangible asset becomes less than its carrying amount as a result of obsolescence, sharp decline in

market value or other causes of impairment, the carrying amount of an intangible asset is adjusted to its recoverable amount and the

reduced amount is recognized as impairment loss. If the recoverable amount of a previously impaired intangible asset exceeds its

carrying amount in subsequent periods, an amount equal to the excess is recorded as reversal of impairment loss; however, it cannot

exceed the carrying amount that would have been determined had no impairment loss been recognized in prior years.

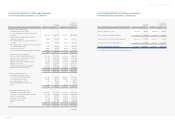

Financing Costs

The Company recognizes all financing costs including interest expense and similar expenses in current operations.

Valuation of Receivables and Payables at Present Value

Receivables and payables arising from long-term installment transactions, long-term cash loans (borrowings) and other similar loan

(borrowing) transactions are stated at present value, if the difference between nominal value and present value is material. The present

value discount is amortized using the effective interest rate method.

Discount on Debentures

Discount on debentures is the difference between the issued amount and the face value of debentures. It is presented as a deduction

from to the face value of debentures and amortized over the redemption period of the debentures using the effective interest rate

method. Amortization of discount is recognized as interest expense on the debentures.