Hyundai 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2004_92

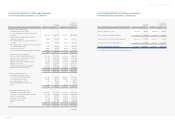

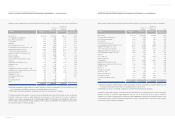

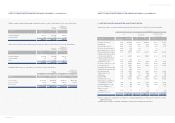

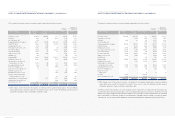

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

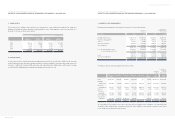

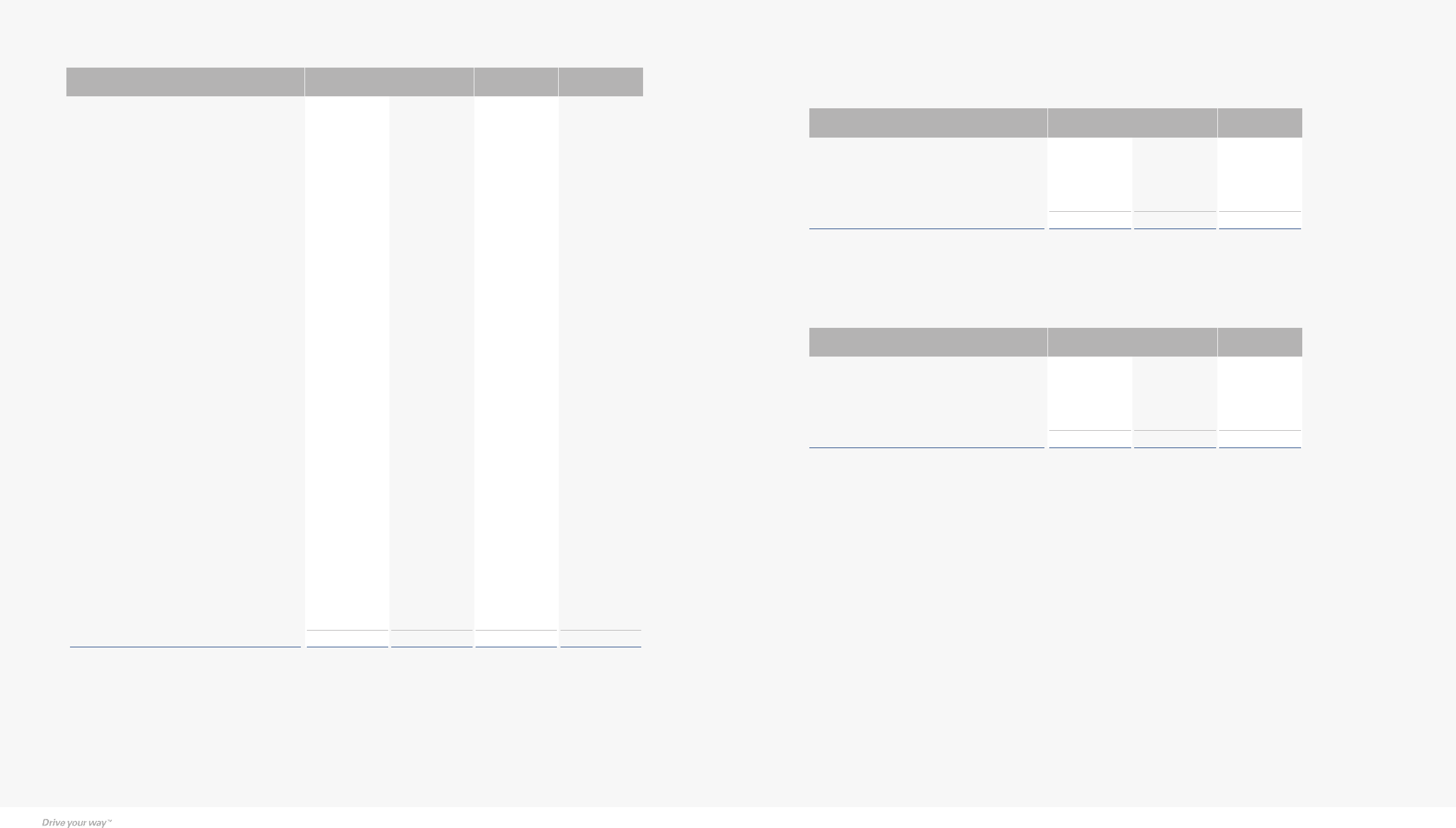

(4) Debt securities, classified into available-for-sale securities, included in long-term investment securities as of December 31,

2004 consist of the following:

Description Acquisition Book value Book value

cost

Government bonds 6,046 6,501 $6,228

Corporate bonds 6,085 6,085 5,830

Asset backed securities 2,302,323 2,107,097 2,018,679

Other 1,153 357 342

2,315,607 2,120,040 $2,031,079

Korean won

(in millions)

Translation into

U.S. dollars (Note 2)

(in thousands)

Debt securities, classified into available-for-sale securities, included in long-term investment securities as of December 31, 2003

consist of the following:

Description Acquisition Book value Book value

cost

Government bonds 6,683 6,683 $6,402

Corporate bonds 8,584 6,204 5,944

Asset backed securities 1,735,478 1,690,816 1,619,866

Other 1,153 350 335

1,751,898 1,704,053 $1,632,547

Korean won

(in millions)

Translation into

U.S. dollars (Note 2)

(in thousands)

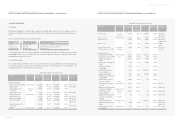

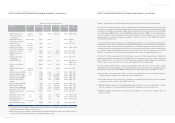

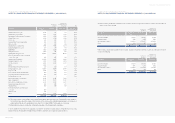

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

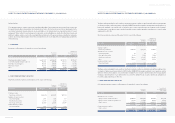

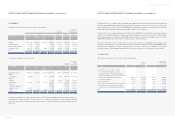

Hyundai Unicorns Co., Ltd. 5,795 137 131 14.90

Hyundai Research Institute 1,359 1,271 1,218 14.90

Gyeongnam Credit Guarantee Foundation 2,500 2,500 2,395 13.66

Kihyup Finance, Inc. 3,700 3,700 3,545 12.75

3Gcore, Inc. 225 225 216 10.43

Hyundai Motor Deutschland GmbH 863 863 827 10.00

Wisco Co., Ltd. 348 280 268 9.68

Hyundai Finance Corporation 9,888 9,888 9,473 9.29

Namyang Industrial Co., Ltd. 200 200 192 8.00

KOENTECH 1,550 1,550 1,485 7.50

Hankyoreh Plus Inc. 4,800 284 272 7.41

Hyundai Oil refinery Co., Ltd. 88,857 88,857 85,128 7.24

Korea Credit-card Electronic-settlement

Service Co., Ltd. 484 255 244 6.72

Hyundai Asan Corporation 22,500 8,861 8,489 5.00

Dongwon Capital Co., Ltd. 3,000 3,000 2,874 4.62

U.S. Electrical Inc. 2,204 2,204 2,112 3.80

ROTIS 1,000 - - 3.76

KIS Information & Communication, Inc. 220 220 211 1.67

Yonhap Capital Co., Ltd. 10,500 10,500 10,059 1.49

Koryo Co., Ltd. 6,625 727 697 1.02

Korea Software Financial Cooperative 500 500 479 0.60

Cheju International Convention Center 500 500 479 0.59

Daewoo Motor Co., Ltd. 2,213 - - 0.02

Machinery Insurance Cooperative 8,188 8,188 7,844 -

Space Imaging LLC 5,319 5,319 5,096 -

Korea Defense Industry Association 4,690 4,690 4,493 -

Daejoo Heavy Industry Co. Ltd. 650 650 623 -

Hyundai RB Co. 550 550 527 -

Yonhi Information & Communication

Co., Ltd. 500 - - -

Toba Telecom 405 - - -

Other 5,332 2,634 2,523 -

210,155 173,243 $165,973

(*1) The equity securities of these affiliates were excluded from using the equity method since the Company believes the changes in

the investment value due to the changes in the net assets of the investee, whose individual beginning balance of total assets or

paid-in capital at the date of its establishment is less than 7,000 million (US$6,706 thousand), are not material.

(*2) Ownership percentage is calculated by combining the ownership of the Company and its subsidiaries.

In 2003, impairment loss between the acquisition cost and the estimated recoverable amount of Hyundai Unicorns Co., Ltd.,

Hankyoreh Plus Inc. (formerly Internet Hankyoreh Inc.), ROTIS Inc. and others are recognized in current operations.

Companies Acquisition Book value Book value Ownership

cost percentage (*2)

Korean won

(in millions)

Translation into

U.S. dollars (Note 2)

(in thousands)

(%)