Hyundai 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2004_102

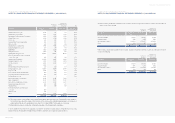

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

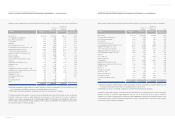

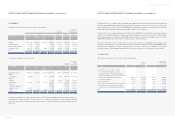

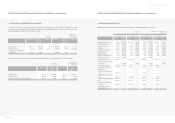

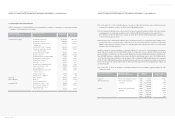

14. LONG-TERM DEBT:

Long-term debt as of December 31, 2004 and 2003 consists of the following:

Description 2004 2004 2003 2004 2003

Debentures 2.60 ~ 9.40 10,028,072 10,543,894 $9,607,273 $10,101,450

Won currency loans

Capital lease 9.68 ~ 11.75 14,772 46,214 14,152 44,275

Reorganization claims (*) 328,136 434,895 314,367 416,646

Composition obligation - - 25,968 - 24,878

General loans 1.00 ~ 8.90 451,022 369,778 432,096 354,261

793,930 876,855 760,615 840,060

Foreign currency loans

Capital lease L+0.98 ~ 4.18 1,643 156,654 1,574 150,080

Reorganization claims (*) 84,994 121,596 81,427 116,494

Other L+1.1 ~ 5.58 773,870 386,451 741,397 370,236

860,507 664,701 824,398 636,810

11,682,509 12,085,450 11,192,286 11,578,320

Less: Current maturities

(3,998,768) (5,653,180) (3,830,971) (5,415,961)

7,683,741 6,432,270 $7,361,315 $6,162,359

(*) 3 year non-guaranteed bond circulating earning rate at the end of every quarter

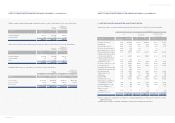

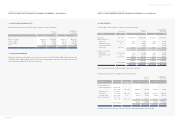

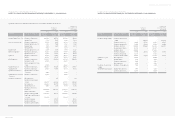

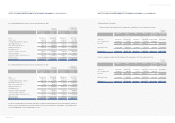

Debentures as of December 31, 2004 and 2003 consist of the following:

Korean won

(in millions)Interest rate (%)

Translation into

U.S. dollars (Note 2)

(in thousands)

Description Maturity Annual 2004 2003 2004 2003

interest rate (%)

Domestic debentures

Guaranteed debentures 18 Mar, 2005 ~

18 Dec, 2007 3.95 ~ 6.80 220,000 10,000 $210,768 $9,580

Non-guaranteed 29 Oct, 2004 ~

debentures 11 Oct, 2009 2.60 ~ 9.20 8,608,332 8,568,260 8,247,109 8,208,718

Convertible bonds 31 Jan, 2009 4.0 135,120 299,946 129,450 287,360

Overseas debentures 18 Oct, 2004 ~

19 Dec, 2008 5.30 ~ 9.40 1,098,887 1,741,601 1,052,775 1,668,520

10,062,339 10,619,807 9,640,102 10,174,178

Discount on debentures

(34,267) (75,913) (32,829) (72,728)

10,028,072 10,543,894 $9,607,273 $10,101,450

Convertible bonds as of December 31, 2004 and 2003 are all issued by Hyundai Card Co., Ltd., a subsidiary.

Korean won

(in millions)

Translation into

U.S. dollars (Note 2)

(in thousands)

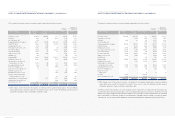

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 AND 2003

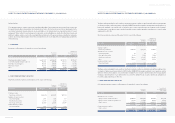

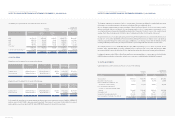

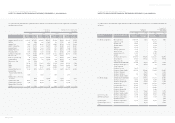

12. OTHER FINANCIAL BUSINESS ASSETS:

Other financial business assets as of December 31, 2004 and 2003 consist of the following:

Korean won

(in millions)

Translation into

U. S. dollars (Note 2)

(in thousands)

2004 2003 2004 2003

Finance receivables 4,836,945 5,303,541 $4,633,977 $5,080,993

Lease receivables 1,078,509 680,011 1,033,252 651,476

Card receivables 1,700,092 1,294,349 1,628,753 1,240,036

Other 8,390 9,107 8,038 8,725

7,623,936 7,287,008 $7,304,020 $6,981,230

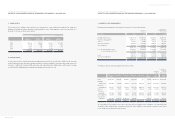

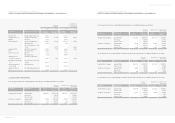

13. SHORT-TERM BORROWINGS:

Short-term borrowings as of December 31, 2004 and 2003 amount to 10,571,772 million (US$10,128,159 thousand) and

9,457,854 million (US$9,060,983 thousand), respectively, and consist primarily of bank loans and export financing loans with

annual interest rates ranging from 0.25 percent to 3.45 percent.