Hyundai 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2004_70

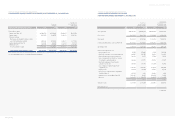

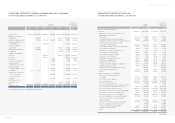

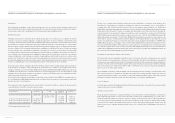

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003

2004 2003 2004 2003

Cash flows from operating activities:

Net income 1,686,831 1,792,655 $1,616,048 $1,717,432

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation 1,622,192 1,437,823 1,554,121 1,377,489

Loss (gain) on foreign currency translation, net (201,308) 65,305 (192,861) 62,565

Loss (gain) on disposal of investments and other assets, net

15,990 (118,791) 15,319 (113,806)

Gain on valuation of investments accounted

for using the equity method, net (284,264) (219,571) (272,336) (210,357)

Loss on disposal of property, plant and equipment, net 137,193 269,723 131,436 258,405

Loss on valuation of inventories 23,795 15,002 22,797 14,372

Loss (gain) on redemption of debentures, net (3,144) 115 (3,012) 110

Loss on impairment of investments 232,476 45,617 222,721 43,703

Loss on disposal of trade receivables 114,365 77,926 109,566 74,656

Impairment loss on intangibles 472,906 3,232 453,062 3,096

Amortization of discount on debentures 38,294 41,193 36,687 39,464

Amortization of intangibles, net 387,433 488,954 371,176 468,436

Provision for severance benefits 558,188 591,737 534,765 566,906

Provision for warranties and product liability, net 872,706 1,463,308 836,085 1,401,905

Provision for doubtful accounts 934,865 1,533,664 895,636 1,469,308

Amortization of present value discount accounts - (107,948) - (103,418)

Net income on minority interests 176,103 268,605 168,713 257,334

Others (55,416) (20,757) (53,091) (19,884)

Changes in operating assets and liabilities:

Decrease in trade notes and accounts

receivable 129,784 2,104,701 124,338 2,016,383

Decrease (increase) in advances (51,189) 136,828 (49,041) 131,086

Increase in inventories (1,341,159) (1,412,848) (1,284,881) (1,353,562)

Increase in other current assets (537,866) (94,041) (515,296) (90,094)

Decrease in long-term notes and accounts receivables - 4,346 - 4,164

Decrease (increase) in deferred income tax assets 102,091 (1,152,582) 97,807 (1,104,217)

Increase in other financial business assets (1,329,469) (1,666,097) (1,273,682) (1,596,185)

Increase (decrease) in trade notes and accounts payable 815,166 (464,741) 780,960 (445,240)

Increase (decrease) in accounts payable-other 200,316 (385,383) 191,910 (369,212)

Increase (decrease) in other current liabilities (298,882) 487,079 (286,340) 466,641

Increase in individual severance insurance deposits (69,580) (19,526) (66,660) (18,707)

Increase (decrease) in accrued warranties and

product liabilities 163,314 (129,315) 156,461 (123,889)

Decrease in accrued loss on valuation of derivatives (152,035) (961) (145,655) (921)

Increase in cumulative translation debits, net - (70,830) - (67,858)

Increase in deferred income tax liabilities 124,962 786,795 119,718 753,779

Payment of severance benefits (538,361) (406,840) (515,770) (389,768)

Others 67,495 (83,717) 64,664 (80,203)

4,013,792 5,260,660 3,845,365 5,039,912

(continued)

Korean won

(in millions)

Translation into

U. S. dollars (Note 2)

(in thousands)

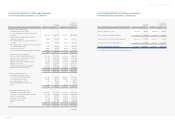

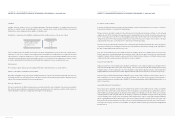

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (CONTINUED)

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2003

Korean won

(in millions)

Translation into

U.S. dollars (Note 2)

(in thousands)

Capital Capital Retained Capital Minority Total Total

stock surplus earnings adjustments interests amount amount

January 1, 2004 1,478,603 5,328,775 5,188,818 (28,357) 3,461,008 15,428,847 $14,781,421

Additional investment in

subsidiaries - (84,296) - - (42,096) (126,392) (121,088)

Disposal of subsidiaries’ stock 95,489 (13,041) (78,622) 241,929 245,755 235,443

Extinguishment of treasury

stock by surplus - - (65,092) - - (65,092) (62,361)

Increase in subsidiaries’

capital-stock - (60,965) - - 287,517 226,552 217,045

Merger between subsidiaries - (32,409) - - (506) (32,915) (31,534)

Consolidation ----14,942 14,942 14,315

Payment of cash dividends

(Note 20) - - (285,674) - (70,096) (355,770) (340,841)

Net income - - 1,686,831 - - 1,686,831 1,616,048

Treasury stock - - - (5,280) - (5,280) (5,058)

Discount on stock issuance - - - (230) - (230) (220)

Gain on valuation of

available-for-sale securities - - - 141,089 - 141,089 135,169

Gain on valuation of

investment equity securities - - - (53,678) - (53,678) (51,426)

Stock options 2,149 8,197 - 2,512 - 12,858 12,318

Cumulative effect of foreign

currency translation - - - (180,962) - (180,962) (173,368)

Loss on transaction of

derivatives - - - 64,463 - 64,463 61,758

Effect of change in the

minority interests ----176,103 176,103 168,713

Others - (92,916) 18,402 - 27,228 (47,286) (45,303)

December 31, 2004

1,480,752

5,161,875

6,530,244

(139,065)

4,096,029

17,129,835 $16,411,031

See accompanying notes to consolidated financial statements.