Holiday Inn 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

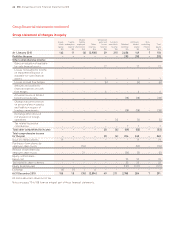

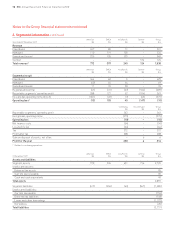

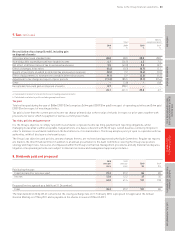

76 IHG Annual Report and Financial Statements 2010

Americas EMEA Asia Pacific Central Group

Year ended 31 December 2010 $m $m $m $m $m

Revenue

Franchised 465 81 12 – 558

Managed 119 130 155 – 404

Owned and leased 223 203 136 – 562

Central – – – 104 104

Total revenue* 807 414 303 104 1,628

Americas EMEA Asia Pacific Central Group

$m $m $m $m $m

Segmental result

Franchised 392 59 7 – 458

Managed 21 62 73 – 156

Owned and leased 13 40 35 – 88

Regional and central (57) (36) (26) (139) (258)

Reportable segments’ operating profit 369 125 89 (139) 444

Exceptional operating items (note 5) 14 3 (2) – 15

Operating profit* 383 128 87 (139) 459

Continuing Discontinued Group

$m $m $m

Reportable segments’ operating profit 444 – 444

Exceptional operating items 15 – 15

Operating profit 459 – 459

Net finance costs (62) – (62)

Profit before tax 397 – 397

Tax (106) – (106)

Profit after tax 291 – 291

Gain on disposal of assets, net of tax – 2 2

Profit for the year 291 2 293

* Relates to continuing operations.

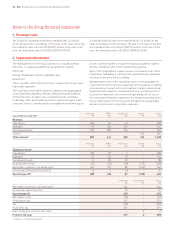

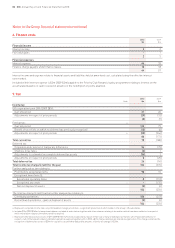

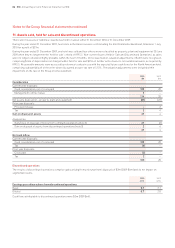

1. Exchange rates

The results of operations have been translated into US dollars

at the average rates of exchange for the year. In the case of sterling,

the translation rate is $1=£0.65 (2009 $1=£0.64). In the case of the

euro, the translation rate is $1=€0.76 (2009 $1=€0.72).

Assets and liabilities have been translated into US dollars at the

rates of exchange on the last day of the year. In the case of sterling,

the translation rate is $1=£0.64 (2009 $1=£0.62). In the case of the

euro, the translation rate is $1=€0.75 (2009 $1=€0.69).

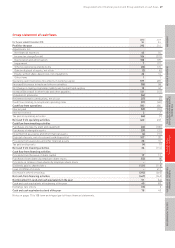

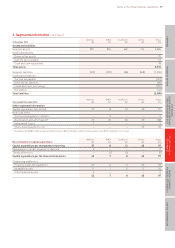

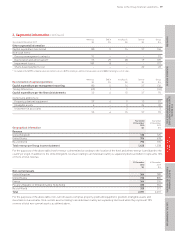

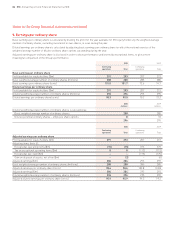

2. Segmental information

The management of the Group’s operations, excluding Central

functions, is organised within three geographical regions:

Americas;

Europe, Middle East and Africa (EMEA); and

Asia Pacific.

These, together with Central functions, comprise the Group’s four

reportable segments.

The Asia Pacific reportable segment comprises the aggregation

of two operating segments, Greater China and Asia Australasia.

Central functions include costs of global functions, including

technology, sales and marketing, finance, human resources and

corporate services; revenue arises principally from technology fee

income. Central liabilities include the loyalty programme liability

and the cumulative short-term System Fund surplus.

Each of the geographical regions derives its revenues from either

franchising, managing or owning hotels and additional segmental

disclosures are provided accordingly.

Management monitors the operating results of the geographical

regions and Central functions separately for the purpose of making

decisions about resource allocation and performance assessment.

Segmental performance is evaluated based on operating profit or

loss and is measured consistently with operating profit or loss in

the consolidated financial statements, excluding exceptional items.

Group financing and income taxes are managed on a group basis

and are not allocated to reportable segments.

Notes to the Group financial statements