Holiday Inn 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW

THE BOARD,

SENIOR MANAGEMENT AND

THEIR RESPONSIBILITIES

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS USEFUL INFORMATION

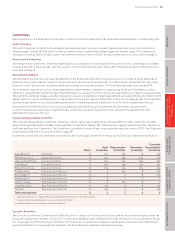

Outcomes in 2010 and progress on all current LTIP cycles

The specific vesting performance conditions and position as at 31 December 2010 for all conditional LTIP awards made between 2008 and

2010 are set out in the following table:

Performance

measure

Threshold

performance

Maximum

performance

Threshold1

vesting

Maximum1

vesting Weighting

Maximum

award

Outcome/

current position

2008/2010 cycle

TSR Growth equal to

the index

Growth exceeds the

index by 8% or more

20% 100% 50% 135% Growth outperformance

of 8.0%

EPS Growth of 6% pa Growth of 16% pa

or more

20% 100% 50% 135% Growth of 9.6% pa

Total vesting 73.8% of maximum

award

2009/2011 cycle2

TSR Growth equal to

the index

Growth exceeds the

index by 8% or more

20% 100% 66.7% 102.5% Growth outperformance

of 6.1%

EPS Growth of 0% pa Growth of 10% pa

or more

0% 100% 33.3% 102.5% Growth of –1.0% pa

2010/2012 cycle3

TSR Growth equal to

the index

Growth exceeds the

index by 8% or more

20% 100% 50% 102.5% Growth outperformance

of –5.4%

EPS Growth of 5% pa Growth of 15% pa

or more

20% 100% 50% 102.5% Growth of 26% pa

1 Vesting between threshold and maximum occurs on a straight-line basis.

2 Two years of cycle completed.

3 One year of cycle completed.

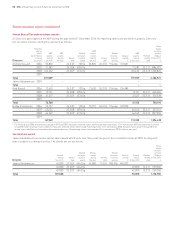

6. Performance graph

Throughout 2010, the Company was a member of the FTSE 100 index and, for remuneration purposes, used a TSR comparator group of the

Dow Jones World Hotels index. Accordingly, the Committee has determined that these are the most appropriate market indices against

which to test the Company’s performance. The graph below shows the TSR performance of IHG from 31 December 2005 to 31 December

2010, assuming dividends are reinvested, compared with the TSR performance achieved by the FTSE 100 index and the Dow Jones World

Hotels index. Over the five-year period, IHG outperformed the FTSE 100 index by 39.6% and the Dow Jones World Hotels index by 18.5%.

Total Shareholder Return: InterContinental Hotels Group PLC v FTSE 100 and v Dow Jones World Hotels index

Source: Datastream

InterContinental Hotels Group PLC –

Total Shareholder Return Index

FTSE 100 –

Total Shareholder Return Index

Dow Jones World Hotels –

Total Shareholder Return Index

31 Dec 201031 Dec 200931 Dec 200831 Dec 200731 Dec 200631 Dec 2005

250

200

150

100

50

0

Remuneration report 53