Holiday Inn 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review 31

OVERVIEW BUSINESS REVIEW

THE BOARD,

SENIOR MANAGEMENT AND

THEIR RESPONSIBILITIES

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS USEFUL INFORMATION

Risk management

As a business, IHG manages and takes risks every day. However,

we recognise that by managing risks effectively, particularly

the major risks that may affect our business plans and strategic

objectives, we are able to protect or enhance our key assets

appropriately. Amongst our key assets, we have:

• brands and market position;

• financial strength and performance;

• business capability and systems including people, IT systems

and ways of working; and

• business reputation and relationships with our stakeholders.

Accordingly, we have established a risk management framework

applied to IHG’s Business and Hotel Safety risks. The aim in 2011

is to embed and mature this approach to risk management

even further.

Business risk management

Capability, process and framework

In 2010, the Group improved its risk management capability across

the business by fine-tuning the process and focusing on emerging

risks. For all key risks, existing controls were identified and

assessed as well as the ability, benefit and cost to improve them.

The work is documented in ‘heat maps’ and risk action plans which

support the risks.

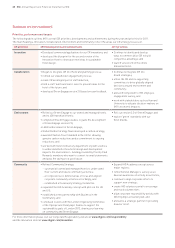

The process for identifying and managing key risks to IHG begins

with risk assessments involving a wide range of stakeholder inputs.

These result in risk profiles and actions for all regions and

functions, which are monitored and reported regularly by senior

leadership teams.

The region and function risks are consolidated, refined and

calibrated with a strategic view of risks at the Risk Working Group

chaired by the Company Secretary and comprising the heads of

IHG’s strategy, risk management and internal audit functions.

The resultant set of risks and action plans are discussed and

further refined at the Executive Committee and finally considered

and agreed by the Board. The Audit Committee focuses on the

robustness of the risk management process and the effectiveness

of actions in managing these risks. This may include calling on risk

owners to report on progress in managing key risks and actions.

At each stage of the process communications are two way,

facilitated by the Risk Management department and nominated

risk coordinators embedded in the business.

This process is referred to as the Major Risk Review, the key

elements of which are represented in the diagram below:

Working together to manage corporate risk

The development of IHG’s risk management culture and capability

is a collaborative effort led by the Company Secretary. IHG’s vision

for risk management is to foster a culture that becomes instinctive,

well-informed, curious, alert, responsive, consistent and

accountable.

Risk management activity permeates the whole Group and

is embedded in our business processes. For example, risk

management is included in the strategic review process between

the Chief Executive and individual Executive Committee members

twice a year. This ‘tone from the top’ support for risk management

is cascaded into the business.

In addition, the strategy, risk management, internal audit and legal

and regulatory compliance teams are all represented at the Risk

Working Group to align activities, leverage skills and relationships

and provide consistent key messages to the Executive Committee

and the Board.

Strategy:

The strategy function provides a strong link to forward-looking

value creation opportunities and asset protection requirements

of the business.

Risk Management:

The risk management function focuses on driving action to support

the strategy and protect assets by building a risk-aware and

proactive culture and capability amongst management, focusing

on risks prioritised by the business leaders.

EXECUTIVE COMMITTEE

BOARD/AUDIT COMMITTEE

RISK WORKING GROUP

MAJOR RISK REVIEW

REGION AND FUNCTION RISKS

GROUP LEVEL RISKS