Holiday Inn 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW

THE BOARD,

SENIOR MANAGEMENT AND

THEIR RESPONSIBILITIES USEFUL INFORMATION

GROUP FINANCIAL

STATEMENTS

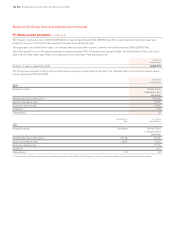

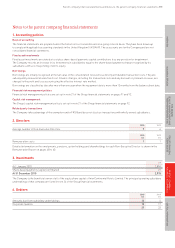

8. Reconciliation of movements in shareholders’ funds

2010 2009

£m £m

Earnings available for shareholders (29) 167

Dividends (77) (78)

(106) 89

Issue of ordinary shares 12 7

Share-based payments capital contribution 21 16

Net movement in shareholders’ funds (73) 112

Shareholders’ funds at 1 January 620 508

Shareholders’ funds at 31 December 547 620

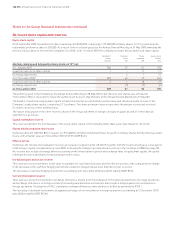

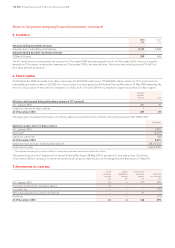

9. Profit and dividends

Loss on ordinary activities after tax amounts to £29m (2009 profit of £167m).

A final dividend, declared in the previous year, of 18.7p (2009 20.2p) per share was paid during the year, amounting to £54m (2009 £57m).

An interim dividend of 8.0p (2009 7.3p) per share was paid during the year, amounting to £23m (2009 £21m). A final dividend of 22.0p

(2009 18.7p) per share, amounting to £63m (2009 £54m), is proposed for approval at the Annual General Meeting. The proposed final

dividend is payable on shares in issue at 25 March 2011.

The audit fee of £0.02m (2009 £0.02m) was borne by a subsidiary undertaking in both years.

10. Contingencies

Contingent liabilities of £134m (2009 £356m) in respect of guarantees of the liabilities of subsidiaries have not been provided for in the

financial statements.

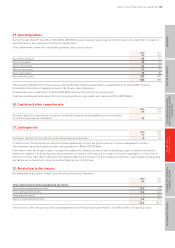

Statement of Directors’ responsibilities

In relation to the parent company

financial statements

The following statement, which should be read in conjunction with

the independent auditor’s report set out on the following page, is

made with a view to distinguishing for shareholders the respective

responsibilities of the Directors and of the auditor in relation to the

Company financial statements.

The Directors are responsible for preparing the parent company

financial statements and Remuneration Report in accordance with

applicable United Kingdom law and United Kingdom Generally

Accepted Accounting Practice (UK GAAP).

The Directors are required to prepare Company financial

statements for each financial year which present fairly the financial

position of the Company and the financial performance of the

Company for that period.

In preparing these financial statements, the Directors are required to:

• select suitable accounting policies and apply them consistently;

• make judgements and accounting estimates that are reasonable

and prudent;

• state whether applicable UK Accounting Standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

• prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors have responsibility for ensuring that the Company

keeps accounting records which disclose with reasonable accuracy

the financial position of the Company and which enable them to

ensure that the Company financial statements comply with the

Companies Act 2006.

The Directors have general responsibility for taking such steps

as are reasonably open to them to safeguard the assets of the

Company and to prevent and detect fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the Group’s

website. Legislation in the United Kingdom governing the

preparation and dissemination of financial statements may differ

from legislation in other jurisdictions.

PARENT COMPANY

FINANCIAL STATEMENTS

Notes to the parent company financial statements and Statement of Directors’ responsibilities 113