Hasbro 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

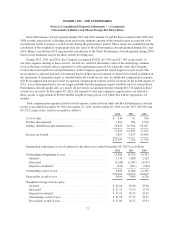

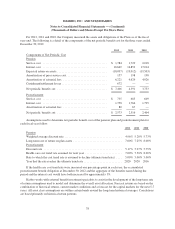

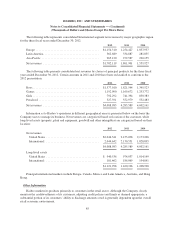

The Company has a master agreement with each of its counterparties that allows for the netting of

outstanding forward contracts. The fair values of the Company’s foreign currency forward contracts designated

as cash flow hedges are recorded in the consolidated balance sheet at December 30, 2012 and December 25, 2011

as follows:

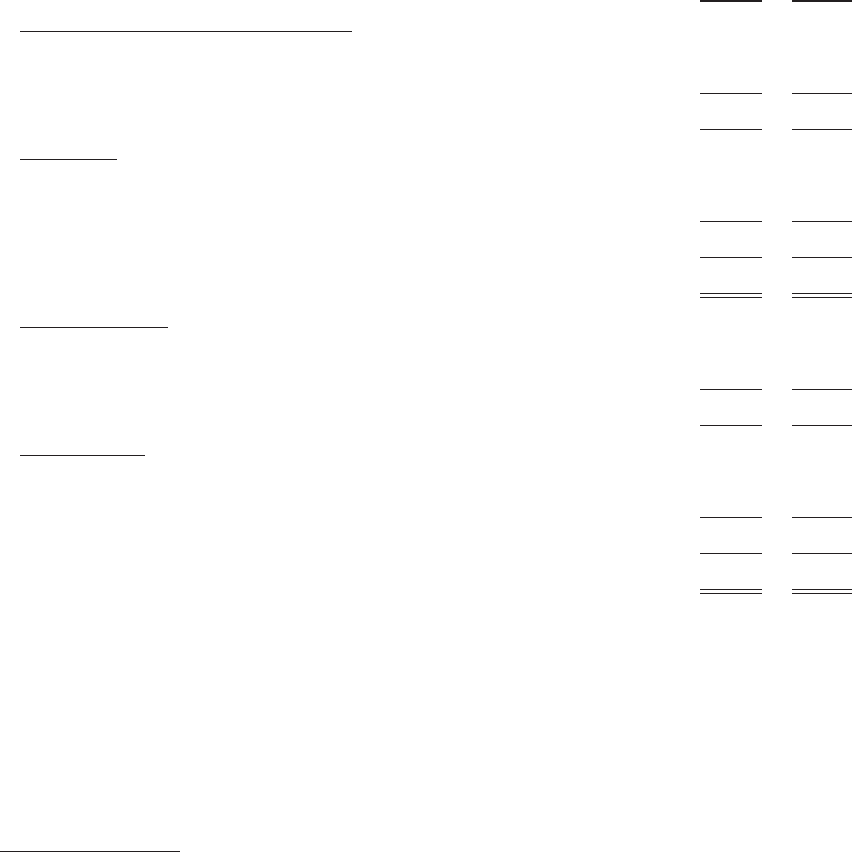

2012 2011

Prepaid expenses and other current assets

Unrealized gains ................................................... $2,802 11,965

Unrealized losses .................................................. (1,073) (4,187)

Net unrealized gain ................................................. 1,729 7,778

Other assets

Unrealized gains ................................................... 12 2,113

Unrealized losses .................................................. — (92)

Net unrealized gain ................................................. 12 2,021

Total asset derivatives ............................................... $1,741 9,799

Accrued liabilities

Unrealized gains ................................................... $1,466 12

Unrealized losses .................................................. (4,245) (50)

Net unrealized loss ................................................. (2,779) (38)

Other liabilities

Unrealized gains ................................................... 20 —

Unrealized losses .................................................. (375) (21)

Net unrealized loss ................................................. (355) (21)

Total liability derivatives ............................................ $(3,134) (59)

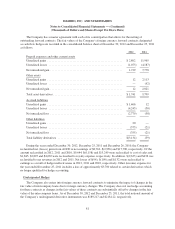

During the years ended December 30, 2012, December 25, 2011 and December 26, 2010, the Company

reclassified net (losses) gains from AOCE to net earnings of $8,762, $(2,936) and $17,780, respectively. Of the

amount reclassified in 2012, 2011 and 2010, $9,644, $(6,158) and $13,249 were reclassified to cost of sales and

$1,845, $2,895 and $4,663 were reclassified to royalty expense, respectively. In addition, $(2,633) and $436 was

reclassified to net revenues in 2012 and 2011. Net losses of $(94), $(109) and $(132) were reclassified to

earnings as a result of hedge ineffectiveness in 2012, 2011 and 2010, respectively. Other (income) expense for

the year ended December 25, 2011 includes a loss of approximately $3,700 related to certain derivatives which

no longer qualified for hedge accounting.

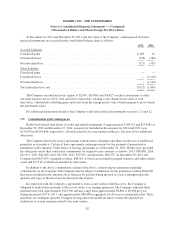

Undesignated Hedges

The Company also enters into foreign currency forward contracts to minimize the impact of changes in the

fair value of intercompany loans due to foreign currency changes. The Company does not use hedge accounting

for these contracts as changes in the fair values of these contracts are substantially offset by changes in the fair

value of the intercompany loans. As of December 30, 2012 and December 25, 2011, the total notional amount of

the Company’s undesignated derivative instruments was $189,217 and $218,122, respectively.

81