Hasbro 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 In Review

In 2012, we made significant strides toward accomplishing

many objectives we set and communicated for Hasbro.

We grew 2012 EPS to $2.81 versus $2.74 per share

in 2011, including a ten cent negative impact of

foreign exchange. This excludes restructuring

charges in both years and a tax benefit in 2011.*

We returned the U.S. & Canada segment to

historical operating profit margins, despite

recording lower revenues in the year. In turn,

overall operating profit margin for Hasbro

increased to 14.7% excluding charges.*

We leveraged our international investments,

growing our emerging markets’ revenues by 16%.

These are markets in which we have significantly

invested over the past several years. Importantly,

we delivered better than break even profit for all

major emerging markets, outside of China, one

year ahead of plan.

We grew the Games category against an

objective of stabilization and improved operating

profit margins in the category.

We grew revenue in our Girls category, driven by

innovation and immersive experiences across the

FURBY and MY LITTLE PONY brands.

Although we did not originally state this goal,

we grew Entertainment and Licensing segment

revenues and operating profit in a year following

a major TRANSFORMERS motion picture.

Our full-year 2012 net revenues were $4.09 billion and included

a $98.5 million negative impact from foreign exchange and

a more than $100 million reduction in retail inventories.

During the year, we faced challenging economic conditions

in developed economies and a dicult comparison with 2011,

when we had recorded nearly $1 billion in revenues from the

TRANSFORMERS and BEYBLADE brands.

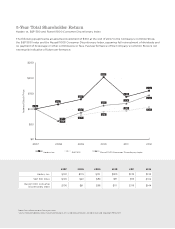

Over the past several years, we have shared

with you our vision and our plan to develop

Hasbro into a global, branded-play company.

Together, we are building an industry-

leading organization with global reach and

multi-faceted competencies. This begins

with our unmatched portfolio of Hasbro and

partner brands and reaches across consumer

experiences, including innovative and fun toys,

games, digital engagement, lifestyle licensing

and entertainment experiences.

We are still in the early stages of unlocking

the full potential of our brands, but our

brand blueprint strategy is working. Our

infrastructure to execute this strategy is in

place and everyone at Hasbro is focused on

brand building that resonates globally with

consumers and retailers.

We have streamlined our organization

and identified the highest-potential, global

opportunities for our teams. Today, we are in

a strong financial and competitive position

to achieve this potential. Through the global

execution of our branded-play strategy,

the Hasbro team is working to deliver long-

term, profitable growth and enhanced total

shareholder return.

To Our Fellow

Shareholders