Hasbro 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

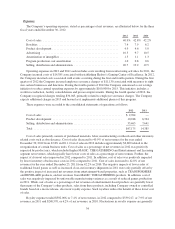

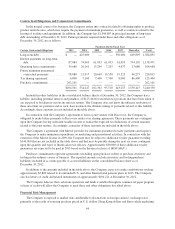

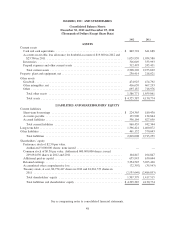

Contractual Obligations and Commercial Commitments

In the normal course of its business, the Company enters into contracts related to obtaining rights to produce

product under license, which may require the payment of minimum guarantees, as well as contracts related to the

leasing of facilities and equipment. In addition, the Company has $1,384,895 in principal amount of long-term

debt outstanding at December 30, 2012. Future payments required under these and other obligations as of

December 30, 2012 are as follows:

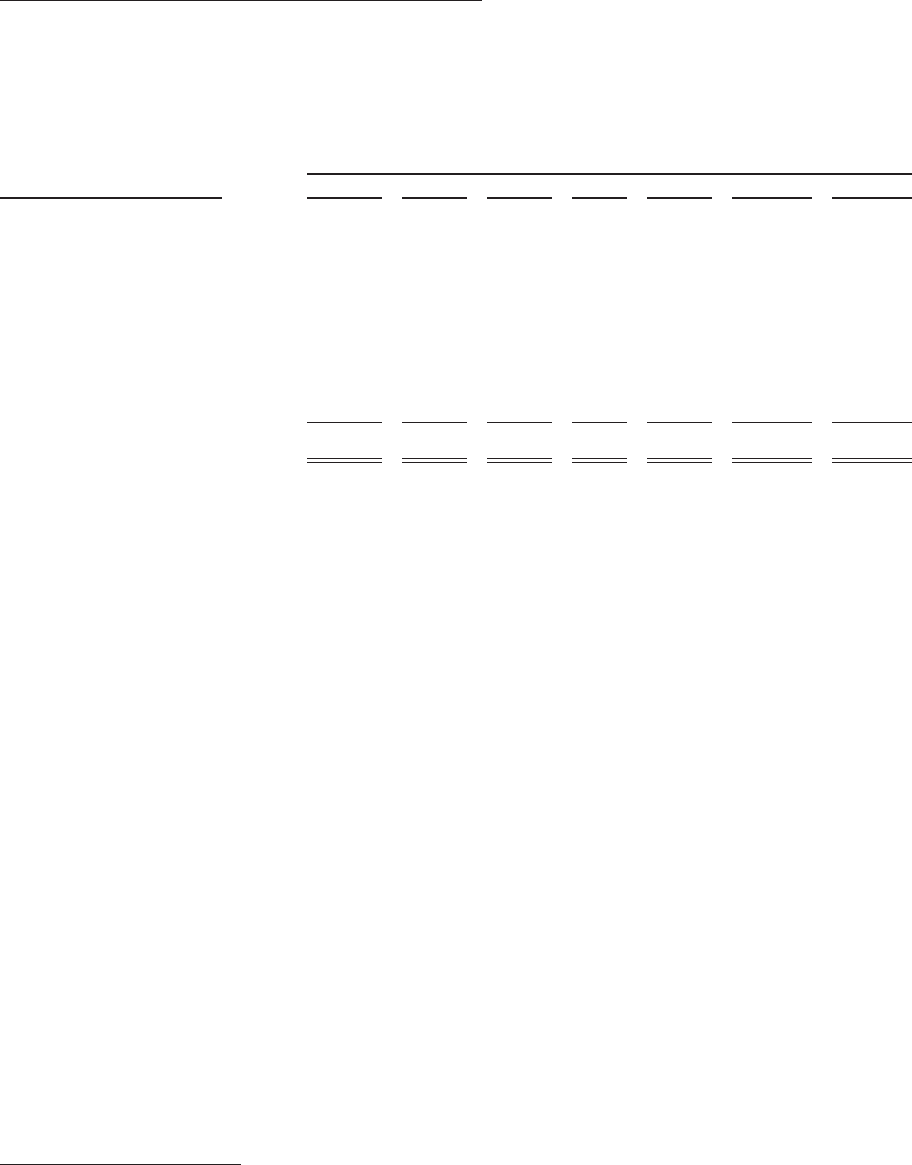

Payments due by Fiscal Year

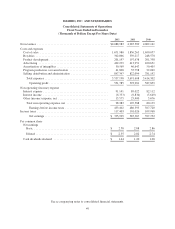

Certain Contractual Obligations 2013 2014 2015 2016 2017 Thereafter Total

Long-term debt ................ $ — 425,000 — — 350,000 609,895 1,384,895

Interest payments on long-term

debt ....................... 87,084 74,069 61,053 61,053 61,053 794,159 1,138,471

Operating lease commitments .... 39,688 26,161 13,249 7,207 4,677 13,686 104,668

Future minimum guaranteed

contractual payments ......... 98,888 21,917 20,660 19,550 19,525 46,275 226,815

Tax sharing agreement .......... 6,800 7,100 7,400 7,700 8,000 86,400 123,400

Purchase commitments .......... 262,101 — — — — — 262,101

$494,561 554,247 102,362 95,510 443,255 1,550,415 3,240,350

Included in other liabilities in the consolidated balance sheets at December 30, 2012, the Company has a

liability, including potential interest and penalties, of $123,444 for uncertain tax positions that have been taken or

are expected to be taken in various income tax returns. The Company does not know the ultimate resolution of

these uncertain tax positions and as such, does not know the ultimate timing of payments related to this liability.

Accordingly, these amounts are not included in the table above.

In connection with the Company’s agreement to form a joint venture with Discovery, the Company is

obligated to make future payments to Discovery under a tax sharing agreement. These payments are contingent

upon the Company having sufficient taxable income to realize the expected tax deductions of certain amounts

related to the joint venture. Accordingly, estimates of these amounts are included in the table above.

The Company’s agreement with Marvel provides for minimum guaranteed royalty payments and requires

the Company to make minimum expenditures on marketing and promotional activities. In connection with the

extension of the Marvel license in 2009, the Company may be subject to additional royalty guarantees totaling

$140,000 that are not included in the table above and that may be payable during the next six years contingent

upon the quantity and types of theatrical movie releases. Approximately $30,000 of these additional royalty

guarantees are expected to be paid in 2013 based on the theatrical release of IRON MAN 3.

Purchase commitments represent agreements (including open purchase orders) to purchase inventory and

tooling in the ordinary course of business. The reported amounts exclude inventory and tooling purchase

liabilities included in accounts payable or accrued liabilities on the consolidated balance sheet as of

December 30, 2012.

In addition to the amounts included in the table above, the Company expects to make contributions totaling

approximately $5,800 related to its unfunded U.S. and other International pension plans in 2013. The Company

also has letters of credit and related instruments of approximately $194,221 at December 30, 2012.

The Company believes that cash from operations and funds available through its commercial paper program

or lines of credit will allow the Company to meet these and other obligations described above.

Financial Risk Management

The Company is exposed to market risks attributable to fluctuations in foreign currency exchange rates

primarily as the result of sourcing products priced in U.S. dollars, Hong Kong dollars and Euros while marketing

44