Hasbro 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

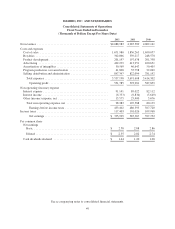

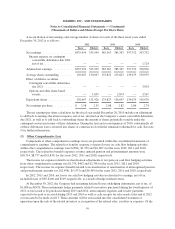

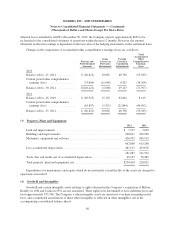

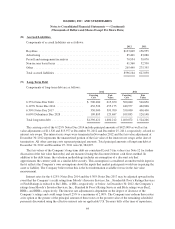

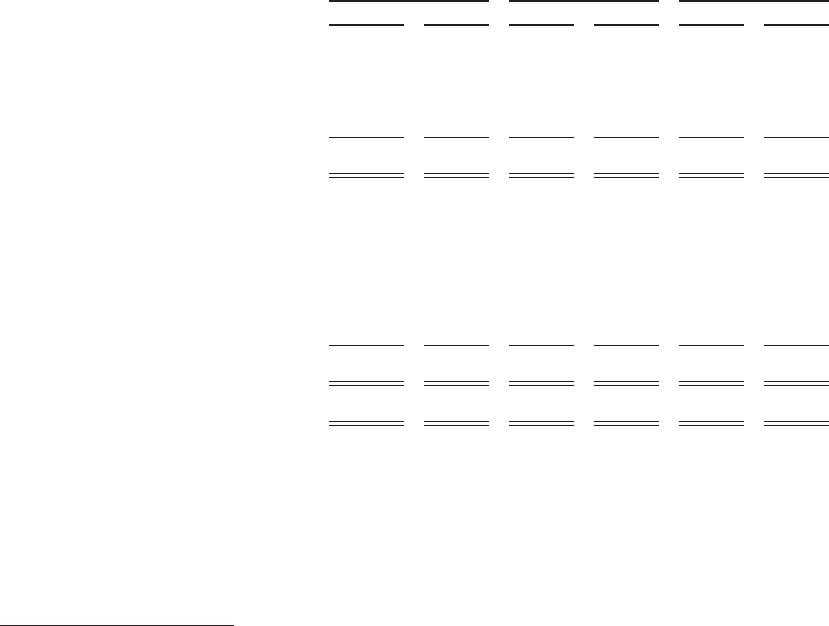

A reconciliation of net earnings and average number of shares for each of the three fiscal years ended

December 30, 2012 is as follows:

2012 2011 2010

Basic Diluted Basic Diluted Basic Diluted

Net earnings ..................... $335,999 335,999 385,367 385,367 397,752 397,752

Interest expense on contingent

convertible debentures due 2021,

netoftax ................... —————1,124

Adjusted net earnings ............. $335,999 335,999 385,367 385,367 397,752 398,876

Average shares outstanding ......... 130,067 130,067 133,823 133,823 139,079 139,079

Effect of dilutive securities:

Contingent convertible debentures

due 2021 ................... —————3,024

Options and other share-based

awards ..................... — 1,859 — 2,874 — 3,567

Equivalent shares ................. 130,067 131,926 133,823 136,697 139,079 145,670

Net earnings per share ............. $ 2.58 2.55 2.88 2.82 2.86 2.74

The net earnings per share calculation for the fiscal year ended December 26, 2010 includes an adjustment

to add back to earnings the interest expense, net of tax, incurred on the Company’s senior convertible debentures

due 2021, as well as to add back to outstanding shares the amount of shares potentially issuable under the

contingent conversion feature of these debentures. During the first and second quarters of 2010, substantially all

of these debentures were converted into shares of common stock with the remainder redeemed for cash. See note

9 for further information.

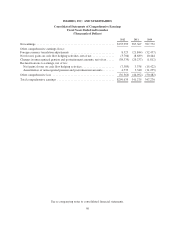

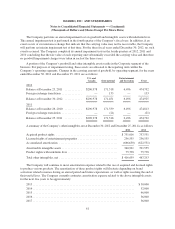

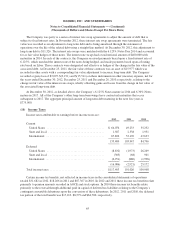

(2) Other Comprehensive Loss

Components of other comprehensive earnings (loss) are presented within the consolidated statements of

comprehensive earnings. The related tax benefits (expense) of gains (losses) on cash flow hedging activities

within other comprehensive earnings were $(384), $1,395 and $(1,607) for the years 2012, 2011 and 2010,

respectively. The related tax benefit (expense) on unrecognized pension and postretirement amounts were

$18,714, $8,757 and $(1,833) for the years 2012, 2011 and 2010, respectively.

The income tax expense related to reclassification adjustments of net gains on cash flow hedging activities

from other comprehensive earnings was $1,378, $402 and $2,358 for the years 2012, 2011 and 2010,

respectively. The income tax expense (benefit) related to reclassification of amortization of unrecognized pension

and postretirement amounts was $(2,498), $(1,973) and $6,409 for the years 2012, 2011 and 2010, respectively.

In 2012, 2011 and 2010, net losses on cash flow hedging activities reclassified to earnings, net of tax,

included losses of $90, $100 and $109, respectively, as a result of hedge ineffectiveness.

At December 30, 2012, the Company had remaining deferred losses on hedging instruments, net of tax, of

$1,008 in AOCE. These instruments hedge payments related to inventory purchased during the fourth quarter of

2012 or forecasted to be purchased during 2013 and 2014, intercompany expenses and royalty payments

expected to be paid or received during 2013 and 2014 as well as cash receipts for sales made at the end of 2012

or forecasted to be made in 2013. These amounts will be reclassified into the consolidated statement of

operations upon the sale of the related inventory or recognition of the related sales, royalties or expenses. Of the

59