GE 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 ge 2007 annual report

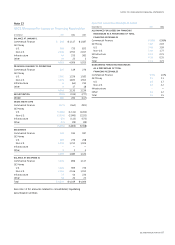

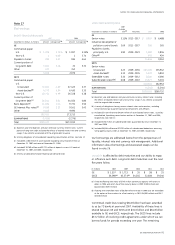

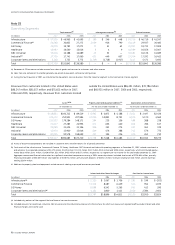

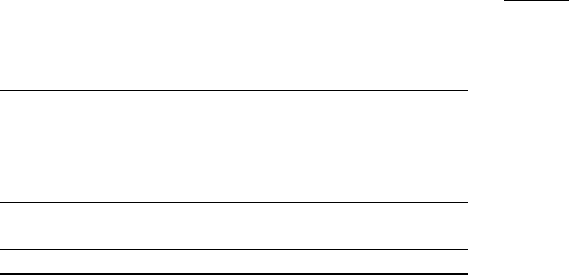

OTHER STOCK-BASED COMPENSATION

Weighted

average

remaining Aggregate

contractual intrinsic

Shares term value

(In thousands) (In years) (In millions)

RSUs outstanding at

January 1, 2007 34,327

Granted 10,145

Vested (5,105)

Forfeited (2,238)

RSUs outstanding at

December 31, 2007 37,129 3.2 $1,376

RSUs expected to vest 33,723 3.1 $1,250

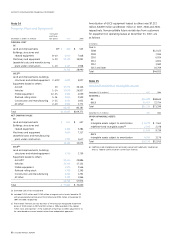

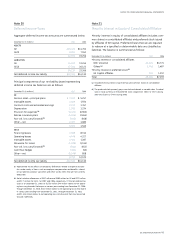

The fair value of each restricted stock unit is the market price of

our stock on the date of grant. The weighted average grant-date

fair value of RSUs granted during 2007, 2006 and 2005 amounted

to $38.48, $33.95 and $34.72, respectively. The total intrinsic

value of RSUs vested during 2007, 2006 and 2005 amounted to

$181 million, $132 million and $90 million, respectively. As of

December 31, 2007, there was $638 million of total unrecognized

compensation cost related to nonvested RSUs. That cost is

expected to be recognized over a weighted average period of

two years and two months. As of December 31, 2007, 1.3 million

PSUs with a weighted average remaining contractual term of two

years, an aggregate intrinsic value of $49 million and $14 million

of unrecognized compensation cost were outstanding.

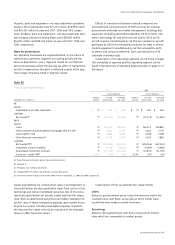

Note 24

Supplemental Cash Flows Information

Changes in operating assets and liabilities are net of acquisitions

and dispositions of principal businesses.

Amounts reported in the “Payments for principal businesses

purchased” line in the Statement of Cash Flows is net of cash

acquired and included debt assumed and immediately repaid in

acquisitions.

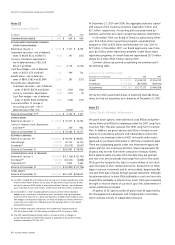

Amounts reported in the “All other operating activities” line

in the Statement of Cash Flows consists primarily of adjustments

to current and noncurrent accruals and deferrals of costs and

expenses, adjustments for gains and losses on assets, increases

and decreases in assets held for sale and adjustments to assets.

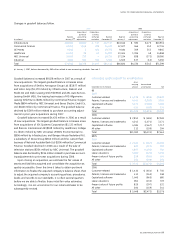

There were no signifi cant non-cash transactions in 2007. Signifi cant

non-cash transactions in 2006 and 2005 include the following:

in 2006, in connection with our sale of GE Insurance Solutions,

Swiss Re assumed $1,700 million of debt, and GE received

$2,238 million of newly issued Swiss Re common stock. See note 2.

In 2005, NBC Universal acquired IAC/InterActiveCorp’s 5.44%

common interest in VUE for a total purchase price that included

$115 million of non-cash consideration, representing the fair value

of future services to be performed by NBC Universal.