GE 2007 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2007 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

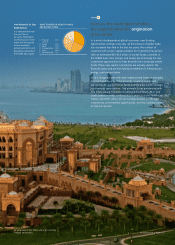

WHAT SOVEREIGN WEALTH FUNDS

ARE BUYING TODAY

A. Financial 32%

services

B. Energy 24%

C. Retail 14%

D. Transportation 13%

E. Other 10%

F. Manufacturing 7%

ge 2007 annual report 21

theme 6

Even as the world gets smaller —

the opportunities for origination

grow larger.

In a more interdependent global economy, new funding

opportunities emerge every day. As the amount of global trade

has increased four-fold in the last ten years, the number of

countries with excess capital available for investment has grown.

With an estimated $10 –$15 trillion in excess funds, countries in

the Middle East, Asia, Europe, and Russia are all looking for new

investment opportunities to help diversify their sovereign wealth

funds. These new capital instruments are actively used in the

fi nancial sector and are also fueling investments in infrastructure,

energy, and transportation.

GE is a unique partner, with both industrial and fi nancial strengths.

Our multi-business portfolio presents a natural investment

opportunity for many of these funds and the potential for strategic

joint-venture opportunities. One example is our partnership with

Abu Dhabi-based Mubadala Development Company PSJC and

Credit Suisse to invest in infrastructure projects in the Middle East,

Turkey, and North Africa. GE will continue to look for strategic

investments, co-investment opportunities, and new funding sources

to help fuel growth.

Investments to top

$300 billion

It is expected that over

the next fi ve to

ten years, $300 billion

of infra structure invest-

ments will be required

to accommodate

growing economic and

population demands in

the Middle East region.

An aerial view of Abu Dhabi, where GE is forming

strategic partnerships