GE 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

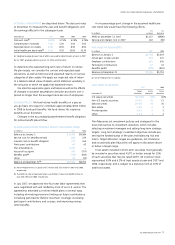

68 ge 2007 annual report

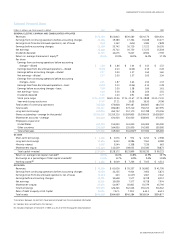

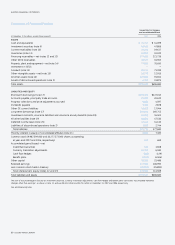

Statement of Cash Flows

General Electric Company

and consolidated affi liates

For the years ended December 31 (In millions)

2007 2006 2005

CASH FLOWS — OPERATING ACTIVITIES

Net earnings $ 22,208 $ 20,742 $ 16,720

Loss (earnings) from discontinued operations 260 (1,362) 634

Adjustments to reconcile net earnings to cash provided from operating activities

Depreciation and amortization of property, plant and equipment 10,278 8,459 7,841

Earnings from continuing operations retained by GECS — — —

Deferred income taxes 623 1,710 (1,063)

Decrease (increase) in GE current receivables 980 (2,205) (1,090)

Decrease (increase) in inventories (1,494) (1,481) (556)

Increase (decrease) in accounts payable 469 (36) 240

Increase in GE progress collections 4,458 927 510

Provision for losses on GECS financing receivables 4,546 3,130 3,239

All other operating activities 657 2,152 3,628

Cash from operating activities — continuing operations

42,985 32,036 30,103

Cash from (used for) operating activities — discontinued operations 2,982 (1,390) 7,588

CASH FROM OPERATING ACTIVITIES 45,967 30,646 37,691

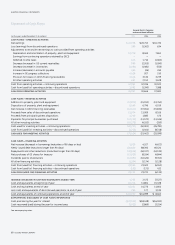

CASH FLOWS — INVESTING ACTIVITIES

Additions to property, plant and equipment (17,870) (15,912) (13,762)

Dispositions of property, plant and equipment 8,460 6,796 6,019

Net increase in GECS financing receivables (47,121) (37,651) (15,834)

Proceeds from sales of discontinued operations 11,574 11,009 8,106

Proceeds from principal business dispositions 2,746 1,883 476

Payments for principal businesses purchased (17,215) (11,573) (11,436)

All other investing activities (10,275) (4,553) (350)

Cash used for investing activities — continuing operations

(69,701) (50,001) (26,781)

Cash from (used for) investing activities — discontinued operations (2,723) (1,401) (8,318)

CASH USED FOR INVESTING ACTIVITIES (72,424) (51,402) (35,099)

CASH FLOWS — FINANCING ACTIVITIES

Net increase (decrease) in borrowings (maturities of 90 days or less) 2,339 4,527 (4,622)

Newly issued debt (maturities longer than 90 days) 100,866 88,360 66,524

Repayments and other reductions (maturities longer than 90 days) (49,826) (49,337) (53,130)

Net purchases of GE shares for treasury (12,319) (8,554) (4,844)

Dividends paid to shareowners (11,492) (10,420) (9,352)

All other financing activities (1,204) (1,174) (1,128)

Cash from (used for) financing activities — continuing operations

28,364 23,402 (6,552)

Cash from (used for) financing activities — discontinued operations (152) (171) 433

CASH FROM (USED FOR) FINANCING ACTIVITIES 28,212 23,231 (6,119)

INCREASE (DECREASE) IN CASH AND EQUIVALENTS DURING YEAR 1,755 2,475 (3,527)

Cash and equivalents at beginning of year 14,276 11,801 15,328

Cash and equivalents at end of year

16,031 14,276 11,801

Less cash and equivalents of discontinued operations at end of year 284 177 3,139

Cash and equivalents of continuing operations at end of year

$ 15,747 $ 14,099 $ 8,662

SUPPLEMENTAL DISCLOSURE OF CASH FLOWS INFORMATION

Cash paid during the year for interest $(23,340) $(18,438) $(16,593)

Cash recovered (paid) during the year for income taxes (2,912) (2,869) (3,254)

See accompanying notes.