GE 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ge 2007 annual report 73

When we repossess collateral in satisfaction of a loan, we

write down the receivable against the allowance for losses.

Repossessed collateral is included in the caption “All other assets”

in the Statement of Financial Position and carried at the lower

of cost or estimated fair value less costs to sell.

The remainder of our commercial loans and leases are portfolios

of smaller balance homogenous commercial and equipment

positions that we evaluate collectively by portfolio for impairment

based upon various statistical analyses considering historical

losses and aging.

Partial sales of business interests

We record gains or losses on sales of their own shares by affi liates

except when realization of gains is not reasonably assured, in which

case we record the results in shareowners’ equity. We record gains

or losses on sales of interests in commercial and military engine

and turbo-machinery equipment programs.

Cash and equivalents

Debt securities with original maturities of three months or less

are included in cash equivalents unless designated as available-

for-sale and classifi ed as investment securities.

Investment securities

We report investments in debt and marketable equity securities,

and equity securities in our insurance portfolio, at fair value based

on quoted market prices or, if quoted prices are not available,

discounted expected cash fl ows using market rates commensurate

with the credit quality and maturity of the investment. Unrealized

gains and losses on available-for-sale investment securities are

included in shareowners’ equity, net of applicable taxes and

other adjustments. We regularly review investment securities for

impairment based on both quantitative and qualitative criteria

that include the extent to which cost exceeds market value, the

duration of that market decline, our intent and ability to hold to

maturity or until forecasted recovery, and the fi nancial health of

and specifi c prospects for the issuer. Unrealized losses that are

other than temporary are recognized in earnings. Realized gains

and losses are accounted for on the specifi c identifi cation method.

Unrealized gains and losses on investment securities classifi ed

as trading and certain retained interests are included in earnings.

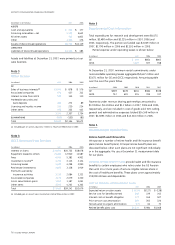

Inventories

All inventories are stated at the lower of cost or realizable values.

Cost for a signifi cant portion of GE U.S. inventories is determined

on a last-in, fi rst-out (LIFO) basis. Cost of other GE inventories is

determined on a fi rst-in, fi rst-out (FIFO) basis. LIFO was used for

56% and 49% of GE inventories at December 31, 2007 and 2006,

respectively. GECS inventories consist of fi nished products held

for sale; cost is determined on a FIFO basis.

Intangible assets

We do not amortize goodwill, but test it annually for impairment

using a fair value approach at the reporting unit level. A reporting

unit is the operating segment, or a business one level below that

operating segment (the component level) if discrete fi nancial

information is prepared and regularly reviewed by segment

management. However, components are aggregated as a single

reporting unit if they have similar economic characteristics.

We recognize an impairment charge for any amount by which

the carrying amount of a reporting unit’s goodwill exceeds its

fair value. We use discounted cash fl ows to establish fair values.

When available and as appropriate, we use comparative market

multiples to corroborate discounted cash fl ow results. When all or

a portion of a reporting unit is disposed of, goodwill is allocated to

the gain or loss on disposition using the relative fair value method.

We amortize the cost of other intangibles over their estimated

useful lives unless such lives are deemed indefi nite. The cost of

intangible assets is amortized on a straight-line basis over the

asset’s estimated economic life, except that individually signifi -

cant customer-related intangible assets are amortized in relation

to total related sales. Amortizable intangible assets are tested for

impairment based on undiscounted cash fl ows and, if impaired,

written down to fair value based on either discounted cash fl ows

or appraised values. Intangible assets with indefi nite lives are

tested annually for impairment and written down to fair value as

required.

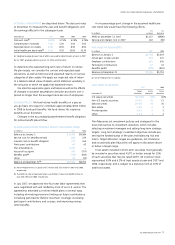

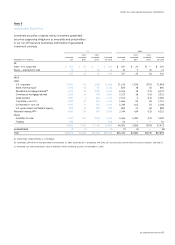

GECS investment contracts, insurance liabilities and

insurance annuity benefits

Certain entities, which we consolidate, provide guaranteed invest-

ment contracts to states, municipalities and municipal authorities.

Our insurance activities also include providing insurance and

reinsurance for life and health risks and providing certain annuity

products. Three product groups are provided: traditional insurance

contracts, investment contracts and universal life insurance con-

tracts. Insurance contracts are contracts with signifi cant mortality

and/or morbidity risks, while investment contracts are contracts

without such risks. Universal life insurance contracts are a particu-

lar type of long-duration insurance contract whose terms are not

fi xed and guaranteed.

For short-duration insurance contracts, including accident and

health insurance, we report premiums as earned income over the

terms of the related agreements, generally on a pro-rata basis.

For traditional long-duration insurance contracts including term,

whole life and annuities payable for the life of the annuitant, we

report premiums as earned income when due.

Premiums received on investment contracts (including annui-

ties without signifi cant mortality risk) and universal life contracts

are not reported as revenues but rather as deposit liabilities.

We recognize revenues for charges and assessments on these

contracts, mostly for mortality, contract initiation, administration

and surrender. Amounts credited to policyholder accounts are

charged to expense.

Liabilities for traditional long-duration insurance contracts

represent the present value of such benefi ts less the present value

of future net premiums based on mortality, morbidity, interest

and other assumptions at the time the policies were issued or

acquired. Liabilities for investment contracts and universal life

policies equal the account value, that is, the amount that accrues

to the benefi t of the contract or policyholder including credited

interest and assessments through the fi nancial statement date.

Liabilities for unpaid claims and claims adjustment expenses