GE 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 ge 2007 annual report

are not exchange-traded with internal market-based valuation

models. When necessary, we also obtain information from our

derivative counterparties to validate our models and to value the

few products that our internal models do not address.

We use interest rate swaps, currency derivatives and com-

modity derivatives to reduce the variability of expected future cash

fl ows associated with variable rate borrowings and commercial

purchase and sale transactions, including commodities. We use

interest rate swaps, currency swaps and interest rate and currency

forwards to hedge the fair value effects of interest rate and cur-

rency exchange rate changes on local and non functional currency

denominated fi xed-rate borrowings and certain types of fi xed-

rate assets. We use currency swaps and forwards to protect our

net investments in global operations conducted in non-U.S. dollar

currencies. We intend all of these positions to qualify as hedges

and to be accounted for as hedges.

We use swaps, futures and option contracts, including caps,

fl oors and collars, as economic hedges of changes in interest

rates, currency exchange rates and equity prices on certain types

of assets and liabilities. We sometimes use credit default swaps

to economically hedge the credit risk of various counterparties

with which we have entered into loan or leasing arrangements.

We occasionally obtain equity warrants as part of sourcing or

fi nancing transactions. Although these instruments are derivatives,

their economic risks are similar to, and managed on the same

basis as, risks of other equity instruments we hold. These instru-

ments are marked to market through earnings.

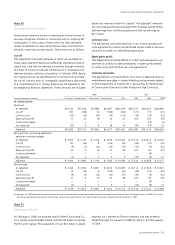

Earnings effects of derivatives designated as hedges

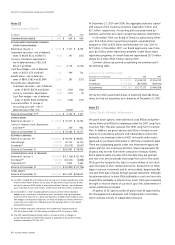

At December 31, 2007, approximately 53% of our total interest rate

swaps designated as hedges were exempt from ongoing tests of

effectiveness. The following table provides information about the

earnings effects of derivatives designated and qualifying as hedges,

but not qualifying for the assumption of no ineffectiveness.

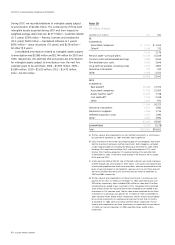

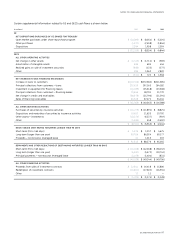

PRE-TAX GAINS (LOSSES)

December 31 (In millions) 2007 2006 2005

CASH FLOW HEDGES

Ineffectiveness $ (3) $ 10 $(27)

Amounts excluded from the measure

of effectiveness (17) (16) 17

FAIR VALUE HEDGES

Ineffectiveness 7 (47) 4

Amounts excluded from the measure

of effectiveness (13) 33 (8)

In 2007, 2006 and 2005, we recognized insignifi cant gains and

losses related to hedged forecasted transactions and fi rm

commitments that did not occur by the end of the originally

specifi ed period.

Additional information regarding the use of derivatives is

provided in note 17 and note 22.

Investment contract benefits

Based on expected future cash fl ows, discounted at currently

offered rates for immediate annuity contracts or cash surrender

values for single premium deferred annuities.

Guaranteed investment contracts

Based on present value of future cash fl ows, discounted using

current benchmark interest rates.

All other instruments

Based on comparable market transactions, discounted future

cash fl ows, quoted market prices, and/or estimates of the cost to

terminate or otherwise settle obligations. The fair values of our

cost method investments that are not exchange traded represent

our best estimates of amounts we could have received other

than on a forced or liquidation basis.

Assets and liabilities that are refl ected in the accompanying

fi nancial statements at fair value are not included in the above

disclosures; such items include cash and equivalents, investment

securities and derivative fi nancial instruments.

Additional information about certain categories in the table

above follows.

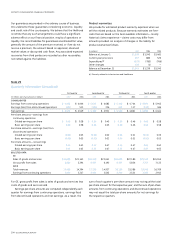

Insurance — credit life

Certain insurance affi liates, primarily in GE Money, issue credit

life insurance designed to pay the balance due on a loan if the

borrower dies before the loan is repaid. As part of our overall risk

management process, we cede to third parties a portion of this

associated risk, but are not relieved of our primary obligation to

policyholders.

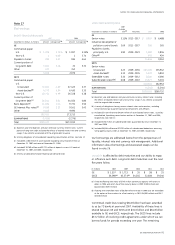

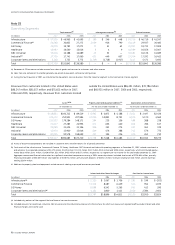

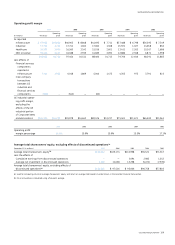

LOAN COMMITMENTS

Notional amount

December 31 (In millions) 2007 2006

Ordinary course of business

lending commitments (a) $ 12,854 $ 9,945

Unused revolving credit lines (b)

Commercial 26,305 24,963

Consumer — principally credit cards 454,089 476,831

(a) Excluded investment commitments of $4,393 million and $2,881 million as of

December 31, 2007 and 2006, respectively.

(b) Excluded inventory fi nancing arrangements, which may be withdrawn at our

option, of $12,848 million and $11,044 million as of December 31, 2007 and 2006,

respectively.

Derivatives and hedging

We conduct our business activities in diverse markets around

the world, including countries where obtaining local funding is

sometimes ineffi cient. The nature of our activities exposes us to

changes in interest rates and currency exchange rates. We manage

such risks using various techniques including debt whose terms

correspond to terms of the funded assets, as well as combinations

of debt and derivatives that achieve our objectives. We also are

exposed to various commodity price risks and address certain of

these risks with commodity contracts. We value derivatives that