GE 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ge 2007 annual report 99

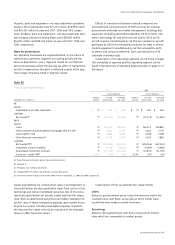

Assets and liabilities not carried at fair value in our Statement of

Financial Position are discussed below. Apart from certain of our

borrowings and certain marketable securities, few of the instru-

ments discussed below are actively traded and their fair values

must often be determined using fi nancial models. Realization of

the fair value of these instruments depends upon market forces

beyond our control, including marketplace liquidity. Therefore,

the disclosed fair values may not be indicative of net realizable

value or refl ect future fair values.

A description of how we estimate fair values follows.

Loans

Based on quoted market prices, recent transactions and/or dis-

counted future cash fl ows, using rates at which similar loans

would have been made to similar borrowers.

Borrowings

Based on discounted future cash fl ows using current market

rates which are comparable to market quotes.

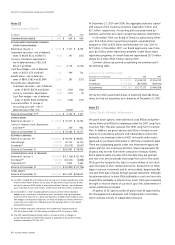

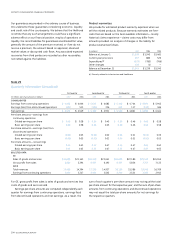

Note 26

Financial Instruments

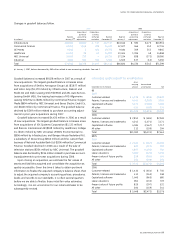

2007 2006

Assets (liabilities) Assets (liabilities)

Notional Carrying Estimated Notional Carrying Estimated

December 31 (In millions) amount amount (net) fair value amount amount (net) fair value

GE

Assets

Investments and notes receivable

$(a) $ 538 $ 538 $

(a) $ 481 $ 481

Liabilities

Borrowings (b)

(a)

(15,762) (15,819) (a) (11,119) (11,026)

GECS

Assets

Loans

(a)

311,160 309,065 (a) 260,412 259,883

Other commercial and residential mortgages held for sale (a) 4,891 4,939 (a) 2,644 2,703

Loans held for sale (a) 3,808 3,809 (a) 3,498 3,498

Other fi nancial instruments

(c)

(a) 2,778 3,164 (a) 2,439 2,883

Liabilities

Borrowings

(b)(d)

(a)

(500,925) (503,610) (a) (426,266) (432,261)

Investment contract benefi ts

(a) (4,536) (4,914) (a) (5,089) (5,080)

Guaranteed investment contracts (a) (11,705) (11,630) (a) (11,870) (11,756)

Insurance — credit life (e) 1,500 (35) (24) 2,634 (81) (61)

(a) These fi nancial instruments do not have notional amounts.

(b) See note 17.

(c) Principally cost method investments.

(d) Included effects of interest rate and cross-currency derivatives.

(e) Net of reinsurance of $2,815 million and $840 million at December 31, 2007 and 2006, respectively.

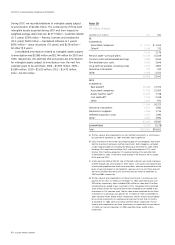

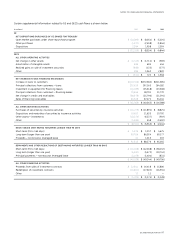

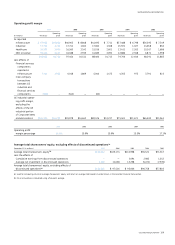

Property, plant and equipment — net associated with operations

based in the United States were $27,213 million, $25,699 million

and $24,262 million at year-end 2007, 2006 and 2005, respec-

tively. Property, plant and equipment — net associated with oper-

ations based outside the United States were $50,682 million,

$44,951 million and $38,106 million at year-end 2007, 2006 and

2005, respectively.

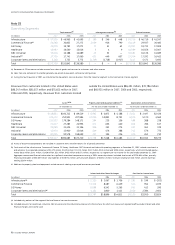

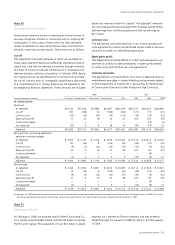

Basis for presentation

Our operating businesses are organized based on the nature of

markets and customers. Segment accounting policies are the

same as described in note 1. Segment results for our fi nancial

services businesses refl ect the discrete tax effect of transactions,

but the intraperiod tax allocation is refl ected outside of the seg-

ment unless otherwise noted in segment results.

Effects of transactions between related companies are

eliminated and consist primarily of GECS services for material

procurement and trade receivables management; buildings and

equipment (including automobiles) leased by GE from GECS; infor-

mation technology (IT) and other services sold to GECS by GE;

aircraft engines manufactured by GE that are installed on aircraft

purchased by GECS from third-party producers for lease to others;

medical equipment manufactured by GE that is leased by GECS

to others; and various investments, loans and allocations of GE

corporate overhead costs.

A description of our operating segments can be found on page

106 and details of segment profi t by operating segment can be

found in the Summary of Operating Segments table on page 47 of

this report.