GE 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 ge 2007 annual report

Our guarantees are provided in the ordinary course of business.

We underwrite these guarantees considering economic, liquidity

and credit risk of the counterparty. We believe that the likelihood

is remote that any such arrangements could have a signifi cant

adverse effect on our fi nancial position, results of operations or

liquidity. We record liabilities for guarantees at estimated fair value,

generally the amount of the premium received, or if we do not

receive a premium, the amount based on appraisal, observed

market values or discounted cash fl ows. Any associated expected

recoveries from third parties are recorded as other receivables;

not netted against the liabilities.

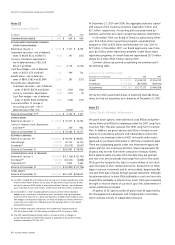

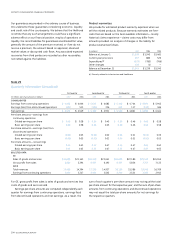

Product warranties

We provide for estimated product warranty expenses when we

sell the related products. Because warranty estimates are fore-

casts that are based on the best available information — mostly

historical claims experience — claims costs may differ from

amounts provided. An analysis of changes in the liability for

product warranties follows.

(In millions)

2007 2006 2005

Balance at January 1 $1,339 $1,240 $1,481

Current year provisions 637 885 525

Expenditures

(a) (573) (785) (766)

Other changes 138 (1) —

Balance at December 31

$1,541 $1,339 $1,240

(a) Primarily related to Infrastructure and Healthcare.

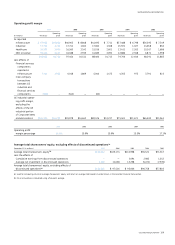

For GE, gross profi t from sales is sales of goods and services less

costs of goods and services sold.

Earnings-per-share amounts are computed independently each

quarter for earnings from continuing operations, earnings (loss)

from discontinued operations and net earnings. As a result, the

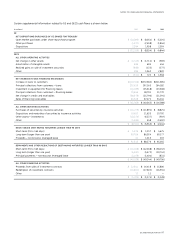

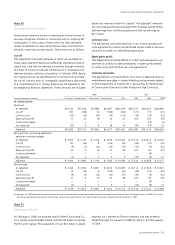

Note 29

Quarterly Information (Unaudited)

First quarter Second quarter Third quarter Fourth quarter

(In millions; per-share amounts in dollars) 2007 2006 2007 2006 2007 2006 2007 2006

CONSOLIDATED

Earnings from continuing operations $ 4,928 $ 4,006 $ 5,613 $ 4,685 $ 5,106 $ 4,744 $ 6,821 $ 5,945

Earnings (loss) from discontinued operations (357) 513 (231) 236 453 117 (125) 496

Net earnings

$ 4,571 $ 4,519 $ 5,382 $ 4,921 $ 5,559 $ 4,861 $ 6,696 $ 6,441

Per-share amounts — earnings from

continuing operations

Diluted earnings per share

$ 0.48 $ 0.38 $ 0.54 $ 0.45 $ 0.50 $ 0.46 $ 0.68 $ 0.58

Basic earnings per share 0.48 0.38 0.55 0.45 0.50 0.46 0.68 0.58

Per-share amounts — earnings (loss) from

discontinued operations

Diluted earnings per share (0.03) 0.05 (0.02) 0.02 0.04 0.01 (0.01) 0.05

Basic earnings per share (0.03) 0.05 (0.02) 0.02 0.04 0.01 (0.01) 0.05

Per-share amounts — net earnings

Diluted earnings per share 0.44 0.43 0.52 0.47 0.54 0.47 0.66 0.62

Basic earnings per share 0.44 0.43 0.52 0.47 0.55 0.47 0.67 0.63

SELECTED DATA

GE

Sales of goods and services $21,688 $21,143 $24,269 $22,041 $24,690 $22,180 $29,149 $24,555

Gross profi t from sales 5,660 5,394 6,537 6,192 6,357 5,836 7,757 7,133

GECS

Total revenues 17,485 14,394 17,235 14,937 18,120 15,586 19,346 16,709

Earnings from continuing operations 3,424 2,317 2,421 2,505 3,214 2,521 3,369 2,912

sum of each quarter’s per-share amount may not equal the total

per-share amount for the respective year; and the sum of per-share

amounts from continuing operations and discontinued operations

may not equal the total per-share amounts for net earnings for

the respective quarters.