GE 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ge 2007 annual report 103

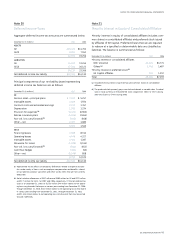

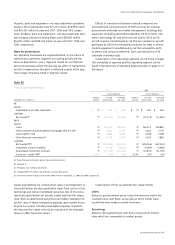

Key assumptions used in measuring the fair value of retained

interests in securitizations and the sensitivity of the current fair

value of residual cash fl ows to changes in those assumptions

related to all outstanding retained interests as of December 31,

2007 and 2006, are noted in the following table.

Commercial Credit card Other

(Dollars in millions) Equipment real estate receivables assets

2007

Discount rate

(a)

12.8% 15.2% 14.8% 14.5%

Effect of

10% Adverse change $ (7) $(20) $ (36) $ (5)

20% Adverse change (13) (38) (72) (9)

Prepayment rate

(a)(b) 11.7% 3.4% 10.8% 16.2%

Effect of

10% Adverse change $ (2) $ (5) $ (80) $ (3)

20% Adverse change (3) (9) (148) (5)

Estimate of credit losses (a) 1.7% 1.0% 9.0% 0.5%

Effect of

10% Adverse change $ (5) $ (8) $ (110) $ (1)

20% Adverse change (8) (13) (222) (2)

Remaining weighted

average lives (in months) 22 53 8 26

Net credit losses $ 36 $ 1 $ 941 $ 19

Delinquencies 51 12 1,514 4

2006

Discount rate

(a) 8.9% 13.2% 11.2% 6.4%

Effect of

10% Adverse change $ (10) $(19) $ (15) $ (5)

20% Adverse change (21) (35) (30) (10)

Prepayment rate

(a)(b) 11.7% 3.0% 12.0% 12.7%

Effect of

10% Adverse change $ (5) $ (7) $ (59) $ (5)

20% Adverse change (9) (13) (110) (10)

Estimate of credit losses (a) 2.3% 0.8% 6.6% 0.2%

Effect of

10% Adverse change $ (7) $ (6) $ (48) $ (3)

20% Adverse change (14) (8) (95) (6)

Remaining weighted

average lives (in months) 31 47 8 18

Net credit losses $ 58 $ — $ 576 $ —

Delinquencies 121 13 741 12

(a) Based on weighted averages.

(b) Represented a payment rate on credit card receivables.

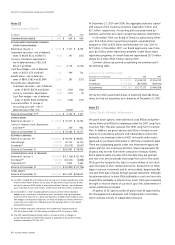

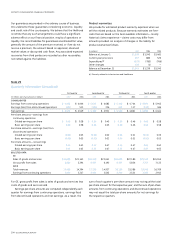

Note 28

Commitments and Guarantees

Commitments, including guarantees

In our Aviation business of Infrastructure, we had committed to

provide fi nancial assistance on $1,607 million of future customer

acquisitions of aircraft equipped with our engines, including

commitments made to airlines in 2007 for future sales under our

GE90 and GEnx engine campaigns. The Aviation Financial Services

business of Infrastructure had placed multiple-year orders for

various Boeing, Airbus and other aircraft with list prices approxi-

mating $20,046 million and secondary orders with airlines for

used aircraft of approximately $910 million at December 31, 2007.

At December 31, 2007, NBC Universal had $9,722 million of

commitments to acquire motion picture and television program-

ming, including U.S. television rights to future Olympic Games

and National Football League games, contractual commitments

under various creative talent arrangements and various other

arrangements requiring payments through 2014.

At December 31, 2007, we were committed under the follow-

ing guarantee arrangements beyond those provided on behalf of

securitization entities. See note 27.

• CREDIT SUPPORT. We have provided $8,126 million of credit

support on behalf of certain customers or associated compa-

nies, predominantly joint ventures and partnerships, using

arrangements such as standby letters of credit and performance

guarantees. These arrangements enable these customers and

associated companies to execute transactions or obtain desired

fi nancing arrangements with third parties. Should the customer

or associated company fail to perform under the terms of the

transaction or fi nancing arrangement, we would be required

to perform on their behalf. Under most such arrangements,

our guarantee is secured, usually by the asset being purchased

or fi nanced, but possibly by certain other assets of the customer

or associated company. The length of these credit support

arrangements parallels the length of the related fi nancing

arrangements or transactions. The liability for such credit

support was $57 million for December 31, 2007.

• INDEMNIFICATION AGREEMENTS. These are agreements that

require us to fund up to $608 million under residual value

guarantees on a variety of leased equipment and $1,718 million

of other indemnifi cation commitments arising primarily from

sales of businesses or assets. Under most of our residual value

guarantees, our commitment is secured by the leased asset at

termination of the lease. The liability for these indemnifi cation

agreements was $51 million at December 31, 2007.

• CONTINGENT CONSIDERATION. These are agreements to provide

additional consideration in a business combination to the seller

if contractually specifi ed conditions related to the acquired

entity are achieved. At December 31, 2007, we had total max-

imum exposure for future estimated payments of $220 million,

of which none was earned and payable.