GE 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 ge 2007 annual report

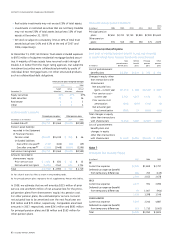

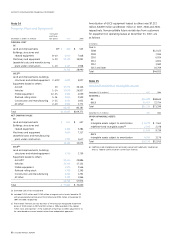

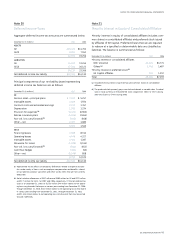

During 2007, we recorded additions to intangible assets subject

to amortization of $4,286 million. The components of fi nite-lived

intangible assets acquired during 2007 and their respective

weighted-average useful lives are: $2,277 million — Customer-related

(17.5 years); $299 million — Patents, licenses and trademarks

(20.2 years); $590 million — Capitalized software (4.2 years);

$992 million — Lease valuations (7.6 years); and $128 million —

All other (9.9 years).

Consolidated amortization related to intangible assets subject

to amortization was $2,080 million and $1,744 million for 2007 and

2006, respectively. We estimate that annual pre-tax amortization

for intangible assets subject to amortization over the next fi ve

calendar years to be as follows: 2008 — $1,969 million; 2009 —

$1,804 million; 2010 — $1,635 million; 2011 — $1,470 million;

2012 — $1,320 million.

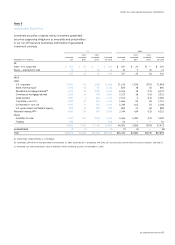

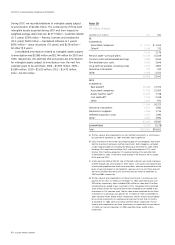

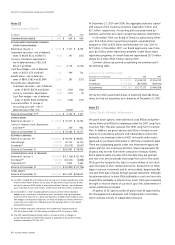

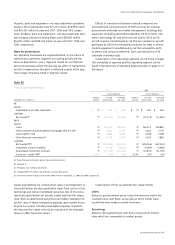

Note 16

All Other Assets

December 31 (In millions) 2007 2006

GE

Investments

Associated companies $ 1,871 $ 1,543

Other

(a)

1,243 733

3,114 2,276

Pension asset — principal plans 20,190 15,019

Contract costs and estimated earnings 5,983 5,164

Film and television costs 4,143 3,646

Long-term receivables, including notes 2,331 2,892

Derivative instruments

279 193

Other 4,568 4,252

40,608 33,442

GECS

Investments

Real estate (b) 40,488 27,252

Associated companies 17,026 12,053

Assets held for sale

(c) 10,690 7,738

Cost method

(d) 2,742 2,348

Other 1,020 931

71,966 50,322

Derivative instruments 3,271 1,981

Advances to suppliers 2,046 1,714

Deferred acquisition costs 1,282 1,380

Other 4,840 3,990

83,405 59,387

ELIMINATIONS (1,152) (1,178)

Tot al $122,861 $91,651

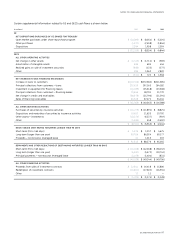

(a) The fair value of and unrealized loss on cost method investments in a continuous

loss position at December 31, 2007 and 2006, were insignifi cant.

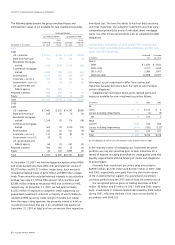

(b) GECS investment in real estate consisted principally of two categories: real estate

held for investment and equity method investments. Both categories contained

a wide range of properties including the following at December 31, 2007: offi ce

buildings (49%), apartment buildings (14%), industrial properties (11%), retail

facilities (9%), franchise properties (7%), parking facilities (2%) and other (8%).

At December 31, 2007, investments were located in the Americas (48%), Europe

(33%) and Asia (19%).

(c) Assets were classifi ed as held for sale on the date a decision was made to dispose

of them through sale, securitization or other means. Such assets consisted primarily

of real estate properties and credit card receivables, and were accounted for at the

lower of carrying amount or estimated fair value less costs to sell. These amounts

are net of valuation allowances of $153 million and $3 million at December 31,

2007 and 2006, respectively.

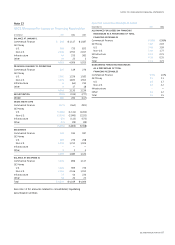

(d) The fair value of and unrealized loss on those investments in a continuous loss

position for less than 12 months at December 31, 2007, were $546 million and

$93 million, respectively, which included $282 million fair value and $15 million

unrealized losses related to our investment in FGIC Corporation (FGIC) preferred

stock and $36 million fair value and $29 million unrealized losses related to our

investment in FGIC common stock. The fair value of and unrealized loss on those

investments in a continuous loss position for 12 months or more at December 31,

2007, were $18 million and $8 million, respectively. The fair value of and unrealized

loss on those investments in a continuous loss position for less than 12 months

at December 31, 2006, were $113 million and $25 million, respectively. The fair

value of and unrealized loss on those investments in a continuous loss position for

12 months or more at December 31, 2006, were $38 million and $8 million,

respectively.