GE 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 ge 2007 annual report

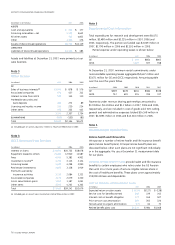

Note 1

Summary of Significant Accounting Policies

Accounting principles

Our fi nancial statements are prepared in conformity with U.S.

generally accepted accounting principles (GAAP).

Consolidation

Our fi nancial statements consolidate all of our affi liates — companies

that we control and in which we hold a majority voting interest.

Associated companies are companies that we do not control but

over which we have signifi cant infl uence, most often because we

hold a shareholder voting position of 20% to 50%. Results of asso-

ciated companies are presented on a one-line basis. Investments

in and advances to associated companies are presented on a

one-line basis in the caption “All other assets” in our Statement

of Financial Position, net of allowance for losses that represents

our best estimate of probable losses inherent in such assets.

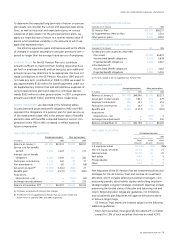

Financial statement presentation

We have reclassifi ed certain prior-year amounts to conform to

the current year’s presentation.

Financial data and related measurements are presented in

the following categories:

• GE This represents the adding together of all affi liates other

than General Electric Capital Services, Inc. (GECS), whose

operations are presented on a one-line basis.

• GECS This affi liate owns all of the common stock of General

Electric Capital Corporation (GE Capital). GE Capital and its

respective affi liates are consolidated in the accompanying

GECS columns and constitute the majority of its business.

• CONSOLIDATED This represents the adding together of GE and

GECS, giving effect to the elimination of transactions between

GE and GECS.

• OPERATING SEGMENTS These comprise our six businesses,

focused on the broad markets they serve: Infrastructure,

Commercial Finance, GE Money, Healthcare, NBC Universal

and Industrial. For segment reporting purposes, certain GECS

businesses including Aviation Financial Services, Energy

Financial Services and Transportation Finance are reported in

the Infrastructure segment because Infrastructure actively

manages such businesses and reports their results for internal

performance measurement purposes. During the fourth quarter

of 2007, we transferred the Equipment Services business from

the Industrial segment to the Commercial Finance segment,

where a portion of the business is reported in Capital Solutions.

Prior period information has been reclassifi ed to be consistent

with the current organization.

Unless otherwise indicated, information in these notes to con-

solidated fi nancial statements relates to continuing operations.

Certain of our operations have been presented as discontinued.

See note 2.

The effects of translating to U.S. dollars the fi nancial statements

of non-U.S. affi liates whose functional currency is the local currency

are included in shareowners’ equity. Asset and liability accounts

are translated at year-end exchange rates, while revenues and

expenses are translated at average rates for the respective periods.

Preparing fi nancial statements in conformity with GAAP

requires us to make estimates and assumptions that affect

reported amounts and related disclosures. Actual results could

differ from those estimates.

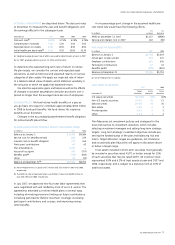

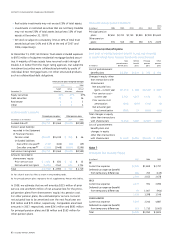

Sales of goods and services

We record all sales of goods and services only when a fi rm sales

agreement is in place, delivery has occurred or services have been

rendered and collectibility of the fi xed or determinable sales price

is reasonably assured. If customer acceptance of goods is not

assured, we record sales only upon formal customer acceptance.

Sales of goods in the Industrial segment typically do not

include multiple product and/or services elements. In contrast,

sales of goods in the Infrastructure and Healthcare segments

sometimes include multiple components. In such agreements,

the amount assigned to each component is based on the total

price and the undelivered component’s objectively determined

fair value, determined from sources such as the separate selling

price for that or a similar component or from competitor prices

for similar components. If fair value of the undelivered component

cannot be determined satisfactorily, we defer sales recognition

until it is delivered. When an undelivered performance obligation

is inconsequential or perfunctory, we recognize sales on the total

contract and provide for the cost of the unperformed obligation.

Except as otherwise noted, we do not provide for anticipated

losses before we record sales. We often sell consumer products,

home videos and computer hardware and software products with

a right of return. We use our accumulated experience to estimate

and provide for such returns when we record the sale. Except for

goods sold under long-term agreements, we recognize sales of

goods under the provisions of U.S. Securities and Exchange

Commission Staff Accounting Bulletin 104, Revenue Recognition

(SAB 104). Among other things, we recognize such sales when

we have no risk of transit damage, a policy that in certain cases

requires us to delay recognition of otherwise qualifi ed sales until

the goods have been physically delivered.

We account for revenue recognition on agreements for sales

of goods and services under power generation unit and uprate

contracts; nuclear fuel assemblies; larger oil drilling equipment

projects; turbo-machinery unit contracts; military development

contracts; and long-term construction projects, including con-

struction of information technology systems in our Healthcare

segment, under AICPA Statement of Position (SOP) 81-1, Accounting

for Performance of Construction-Type and Certain Production-Type

Contracts. Under SOP 81-1, we estimate total contract revenue

net of price concessions as well as total contract costs. For goods

sold under power generation unit and uprate contracts, nuclear

fuel assemblies, turbo-machinery unit contracts and military

development contracts, we recognize sales as we complete major

contract-specifi ed deliverables, most often when customers

receive title to the goods or accept the services as performed.