GE 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ge 2007 annual report 93

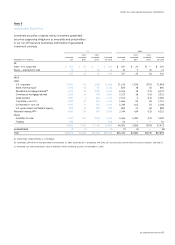

Note 20

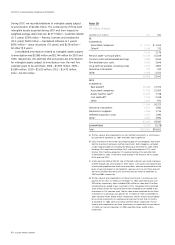

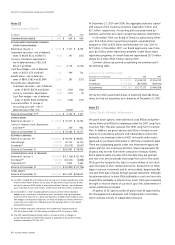

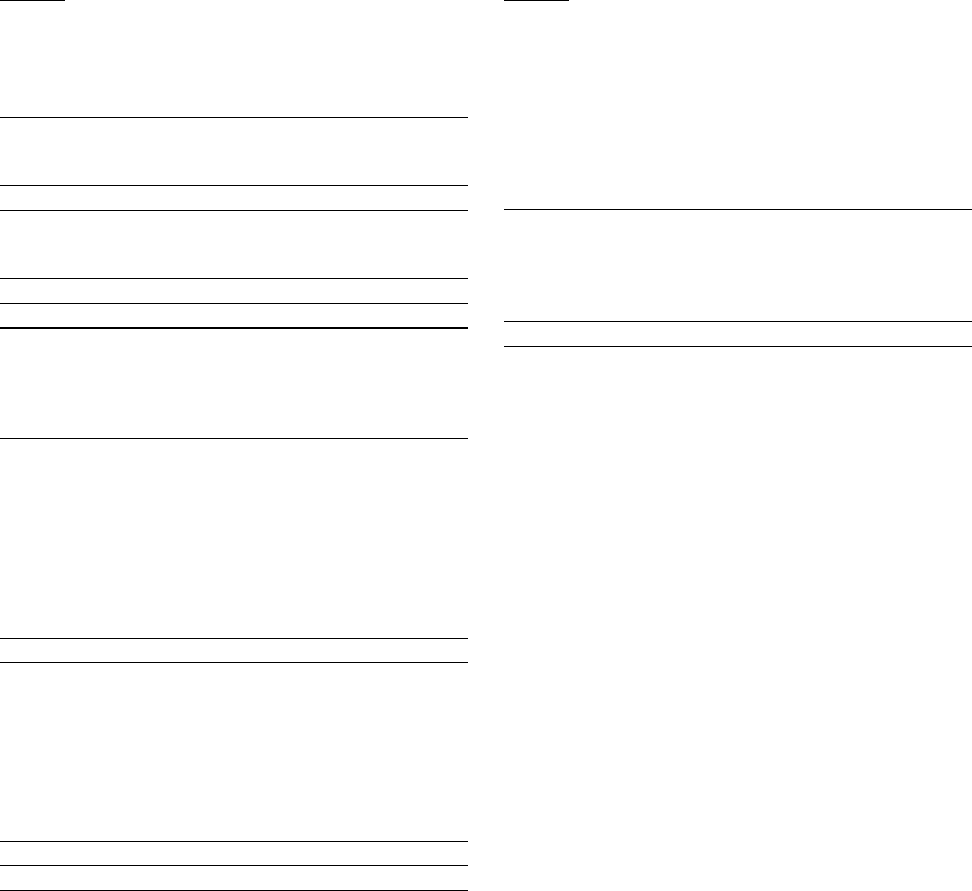

Deferred Income Taxes

Aggregate deferred income tax amounts are summarized below.

December 31 (In millions) 2007 2006

ASSETS

GE $13,122 $11,704

GECS 8,951 7,552

22,073 19,256

LIABILITIES

GE 16,513 13,244

GECS 17,704 20,122

34,217 33,366

Net deferred income tax liability

$12,144 $14,110

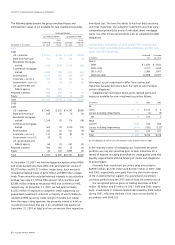

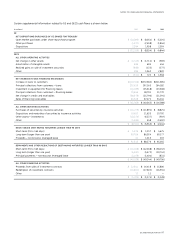

Principal components of our net liability (asset) representing

deferred income tax balances are as follows:

December 31 (In millions) 2007 2006

GE

Pension asset — principal plans $ 7,067 $ 5,257

Intangible assets 2,609 1,934

Contract costs and estimated earnings 2,215 1,767

Depreciation 1,360 1,334

Provision for expenses

(a) (6,426) (6,965)

Retiree insurance plans (4,616) (2,654)

Non-U.S. loss carryforwards

(b) (925) (818)

Other — net 2,107 1,685

3,391 1,540

GECS

Financing leases 7,089 8,314

Operating leases 4,478 4,327

Intangible assets 1,426 1,287

Allowance for losses (1,588) (1,514)

Non-U.S. loss carryforwards

(b) (810) (652)

Cash fl ow hedges (494) (50)

Other — net (1,348) 858

8,753 12,570

Net deferred income tax liability

$12,144 $14,110

(a) Represented the tax effects of temporary differences related to expense accruals

for a wide variety of items, such as employee compensation and benefi ts, interest

on tax liabilities, product warranties and other sundry items that are not currently

deductible.

(b) Net of valuation allowances of $557 million and $509 million for GE and $225 million

and $171 million for GECS, for 2007 and 2006, respectively. Of the net deferred tax

asset as of December 31, 2007, of $1,735 million, $49 million relates to net operat-

ing loss carryforwards that expire in various years ending from December 31, 2008,

through December 31, 2010, $141 million relates to net operating losses that expire

in various years ending from December 31, 2011, through December 31, 2022,

and $1,545 million relates to net operating loss carryforwards that may be carried

forward indefi nitely.

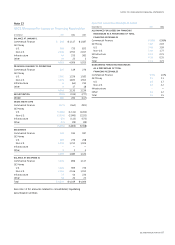

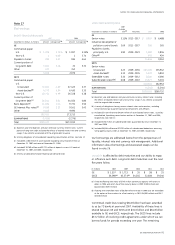

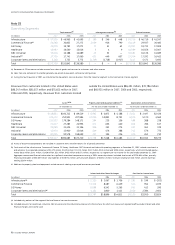

Note 21

Minority Interest in Equity of Consolidated Affiliates

Minority interest in equity of consolidated affi liates includes com-

mon shares in consolidated affi liates and preferred stock issued

by affi liates of GE Capital. Preferred shares that we are required

to redeem at a specifi ed or determinable date are classifi ed as

liabilities. The balance is summarized as follows:

December 31 (In millions) 2007 2006

Minority interest in consolidated affi liates

NBC Universal $5,025 $4,774

Others

(a) 2,748 1,487

Minority interest in preferred stock

(b)

GE Capital affi liates 231 1,232

Total

$8,004 $7,493

(a) Included minority interest in partnerships and common shares of consolidated

affi liates.

(b) The preferred stock primarily pays cumulative dividends at variable rates. Dividend

rates in local currency on the preferred stock ranged from 3.88% to 5.52% during

2007 and 3.28% to 5.49% during 2006.