Columbia Sportswear 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

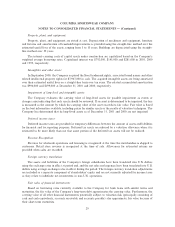

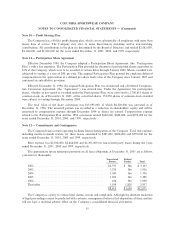

There were no adjustments to net income in computing diluted earnings per share for the years ended

December 31, 2001, 2000 and 1999. A reconciliation of the common shares used in the denominator for

computing basic and diluted earnings per share is as follows (in thousands, except per share amounts):

Year Ended December 31,

2001 2000 1999

Weighted average common shares outstanding, used in computing basic

earnings per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 39,051 38,541 37,997

EÅect of dilutive stock options ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 789 1,067 415

Weighted-average common shares outstanding, used in computing

diluted earnings per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 39,840 39,608 38,412

Earnings per share of common stock:

BasicÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 2.27 $ 1.52 $ 0.87

Diluted ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2.23 1.48 0.86

Earnings per share and weighted average shares outstanding above have been restated to reÖect the

three-for-two stock split that was distributed on June 4, 2001, to all shareholders of record at the close of

business on May 17, 2001.

Options to purchase an additional 34,000, 16,000, and 667,000 shares of common stock were outstanding

at December 31, 2001, 2000 and 1999, respectively, but were not included in the computation of diluted

earnings per share because their eÅect would be anti-dilutive.

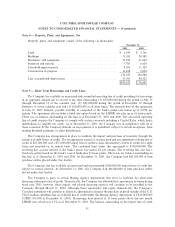

Note 16 Ì Financial Risk Management and Derivatives

Our foreign currency risk management objective is to protect cash Öows resulting from sales, purchases

and other costs from the impact of exchange rate movements. The Company manages a portion of these

exposures with short-term strategies after giving consideration to market conditions, contractual agreements,

anticipated sale and purchase transactions, and other factors. Firmly committed and anticipated transactions

and the related receivables and payables may be hedged with forward exchange contracts or purchased

options. Premiums paid on purchased options are included in prepaid expenses and are recognized in earnings

ratably over the life of the option. Gains and losses arising from foreign currency forward and purchased option

contracts, and cross-currency swap transactions are recognized in cost of goods sold or selling, general and

administrative expenses as oÅsets of gains and losses resulting from the underlying hedged transactions. Hedge

eÅectiveness is determined by evaluating whether gains and losses on hedges will oÅset gains and losses on the

underlying exposures. This evaluation is performed at inception of the hedge and periodically over the life of

the hedge.

At December 31, 2001 and 2000, the Company had approximately $53,974,000 and $47,201,000

(notional) in forward exchange contracts. The net derivative gain (loss) included in the Company's liabilities

and deferred in other comprehensive income was $844,000 and $(1,615,000) at December 31, 2001 and 2000,

respectively.

The counterparties to derivative transactions are major Ñnancial institutions with high investment grade

credit ratings. However, this does not eliminate the Company's exposure to credit risk with these institutions.

This credit risk is generally limited to the unrealized gains in such contracts should any of these counterparties

fail to perform as contracted and is immaterial to any one institution at December 31, 2001 and 2000. To

manage this risk, the Company has established strict counterparty credit guidelines, which are continually

monitored and reported to Senior Management according to prescribed guidelines. As a result, the Company

considers the risk of counterparty default to be minimal.

39