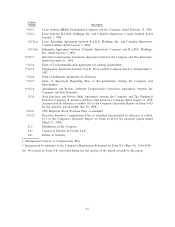

Columbia Sportswear 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

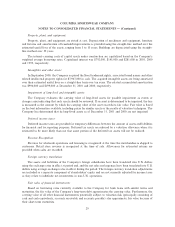

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

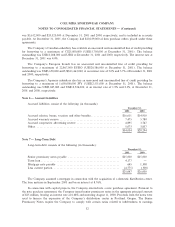

before interest, taxes, depreciation and amortization (""EBITDA'') and tangible net worth. As of Decem-

ber 31, 2001, the Company was in compliance with these covenants.

In June 2001, the Company's Japanese subsidiary borrowed 550,000 million Japanese yen

(US$4,177,000 at December 31, 2001), bearing an interest rate of 1.73% at December 31, 2001, for general

working capital requirements. Principal and interest are paid semi-annually during the period July 2001

through June 2006.

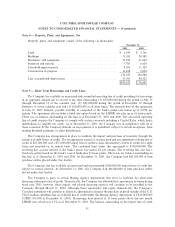

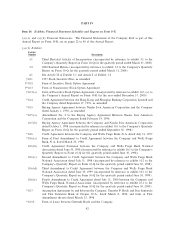

Principal payments due on these notes as of December 31, 2001 were as follows (in thousands):

Year Ending December 31,

2002 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 4,775

2003 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4,682

2004 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4,406

2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4,407

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4,407

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,145

$29,822

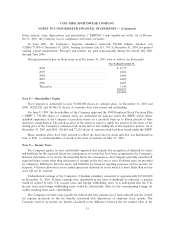

Note 8 Ì Shareholders' Equity

The Company is authorized to issue 50,000,000 shares of common stock. At December 31, 2001 and

2000, 39,282,921 and 38,564,171 shares of common stock were issued and outstanding.

On June 9, 1999, the shareholders of the Company approved the 1999 Employee Stock Purchase Plan

(""ESPP''). 750,000 shares of common stock are authorized for issuance under the ESPP, which allows

qualiÑed employees of the Company to purchase shares on a quarterly basis up to Ñfteen percent of their

respective compensation. The purchase price of the shares is equal to eighty Ñve percent of the lesser of the

closing price of the Company's common stock on the Ñrst or last trading day of the respective quarter. As of

December 31, 2001 and 2000, 120,685 and 72,125 shares of common stock had been issued under the ESPP.

Share amounts above have been restated to reÖect the three-for-two stock split that was distributed on

June 4, 2001, to all shareholders of record at the close of business on May 17, 2001.

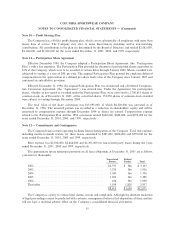

Note 9 Ì Income Taxes

The Company applies an asset and liability approach that requires the recognition of deferred tax assets

and liabilities for the expected future tax consequences of events that have been recognized in the Company's

Ñnancial statements or tax returns. In estimating future tax consequences, the Company generally considers all

expected future events other than enactment of changes in the tax laws or rates. Deferred taxes are provided

for temporary diÅerences between assets and liabilities for Ñnancial reporting purposes and for income tax

purposes. Valuation allowances are recorded against net deferred tax assets when it is more likely than not the

asset will not be realized.

Undistributed earnings of the Company's Canadian subsidiary amounted to approximately $17,400,000

on December 31, 2001. If those earnings were distributed in the form of dividends or otherwise, a portion

would be subject to both U.S. income taxes and foreign withholding taxes. It is anticipated that the U.S.

income taxes and foreign withholding taxes would be substantially oÅset by the corresponding foreign tax

credits resulting from such a distribution.

The Company's income taxes payable for federal and state purposes have been reduced and the current

tax expense increased, by the tax beneÑts associated with dispositions of employee stock options. The

Company receives an income tax beneÑt calculated as the diÅerence between the fair market value of the

33