Columbia Sportswear 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

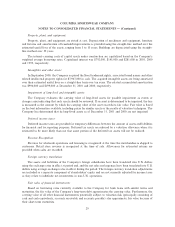

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

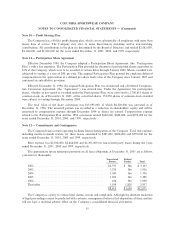

Note 10 Ì ProÑt Sharing Plan

The Company has a 401(k) proÑt-sharing plan, which covers substantially all employees with more than

ninety days of service. The Company may elect to make discretionary matching and/or non-matching

contributions. All contributions to the plan are determined by the Board of Directors and totaled $2,582,000,

$2,106,000, and $1,860,000 for the years ended December 31, 2001, 2000, and 1999, respectively.

Note 11 Ì Participation Share Agreement

EÅective December 1990, the Company adopted a Participation Share Agreement (the ""Participation

Plan'') with a key employee. The Participation Plan provided for the grant of participation shares equivalent to

10% of the Company, which were to be awarded at various dates through January 2000. Shares awarded were

subjected to vesting at a rate of 20% per year. The original Participation Plan granted the employee deferred

compensation in the appreciation of a deÑned per-share book value of the Company since January 1987 and

contained an anti-dilutive provision.

EÅective December 31, 1996, the original Participation Plan was terminated and a Deferred Compensa-

tion Conversion Agreement (the ""Agreement'') was entered into. Under the Agreement, the participation

shares, whether or not vested or awarded under the Participation Plan, were converted to 2,700,653 shares of

common stock. As of December 31, 2001, of the converted shares, 352,250 shares of common stock awarded

were subject to vesting through December 2004.

The total value of the share conversion was $15,693,000, of which $6,320,000 was unvested as of

December 31, 1996. The unvested portion was recorded as a reduction in shareholders' equity and will be

amortized to compensation expense through December 2004 as shares are earned. Compensation expense

related to the Participation Plan and the 1996 conversion totaled $682,000, $682,000, and $970,000 for the

years ended December 31, 2001, 2000, and 1999, respectively.

Note 12 Ì Commitments and Contingencies

The Company leases certain operating facilities from related parties of the Company. Total rent expense,

including month-to-month rentals, for these leases amounted to $381,000, $408,000 and $339,000 for the

years ended December 31, 2001, 2000 and 1999, respectively.

Rent expense was $2,568,000, $2,464,000 and $2,303,000 for non-related party leases during the years

ended December 31, 2001, 2000 and 1999, respectively.

The approximate future minimum payments on all lease obligations at December 31, 2001 are as follows

(amounts in thousands):

Non-related Related

Parties Parties Total

2002ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $2,737 $ 366 $ 3,103

2003ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,570 366 1,936

2004ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,340 366 1,706

2005ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,023 366 1,389

2006ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 634 366 1,000

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,109 1,828 2,937

$8,413 $3,658 $12,071

The Company is a party to various legal claims, actions and complaints. Although the ultimate resolution

of legal proceedings cannot be predicted with certainty, management believes that disposition of these matters

will not have a material adverse eÅect on the Company's consolidated Ñnancial statements.

35