Columbia Sportswear 2001 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2001 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

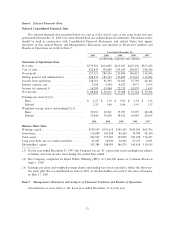

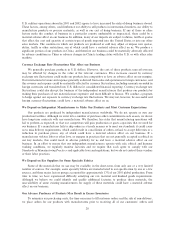

Results of Operations

The following table sets forth, for the periods indicated, the percentage relationship to net sales of certain

items in our consolidated statements of operations:

2001 2000 1999

Net sales ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 100.0% 100.0% 100.0%

Cost of sales ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 54.2 54.4 55.2

Gross proÑt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 45.8 45.6 44.8

Selling, general and administrative ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 26.8 29.9 32.1(1)

Income from operations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 19.0 15.7 12.7

Interest expense, netÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.3 0.7 1.0

Income before income tax ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 18.7 15.0 11.7

Income tax expense ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7.3 5.5 4.7

Net income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11.4% 9.5% 7.0%

(1) Includes a one-time charge of $1.5 million related to the closure of the Company's manufacturing facility

in ChaÅee, Missouri.

Year Ended December 31, 2001 Compared to Year Ended December 31, 2000

Net sales: Net sales increased 26.8% to $779.6 million in 2001 from $614.8 million in 2000. Domestic

sales increased 25.6% to $551.2 million in 2001 from $438.9 million in 2000. Canadian sales increased 28.8%

to $81.3 million in 2001 from $63.1 million in 2000 and European direct sales increased 39.5% to $82.3 million

in 2001 from $59.0 million in 2000. Net international sales, excluding Canadian sales and European direct

sales, increased 20.3% to $64.7 million in 2001 from $53.8 million in 2000. Overall, sales growth was driven by

the increased penetration of the Columbia brand within the existing customer base in all markets as well as the

introduction of Sorel branded footwear, primarily in North America, in the fall of 2001. SpeciÑcally, domestic

department store sales increased to approximately 35.2% in 2001 from approximately 30.5% in 2000. By

product category, the growth is attributable to increased sales of outerwear and footwear units, including Sorel,

predominantly in the United States, Canada and Europe as well as increased sales of sportswear units

primarily in the United States and Europe.

Gross ProÑt: Gross proÑt as a percentage of net sales was 45.8% and 45.6% for 2001 and 2000,

respectively. This increase was due to the following factors including: (1) higher margins on spring outerwear

and reduction of close-out product shipments for the three months ended March 31, 2001 when compared to

the same period in 2000, (2) reduced impact of currency Öuctuation, timely receipt of goods from factories,

and minimal oÅ-priced selling for three months ended September 30, 2001 when compared to same period in

2000, and (3) strong margins on outerwear closeout activity during the three months ended December 31,

2001. These increases were tempered by an increase in sales of spring close-out products which produce lower

margins and negative eÅects of Euro currency during the six months ended June 30, 2001.

Selling, General and Administrative Expense: Selling, general, and administrative expense (SG&A)

increased 13.8% to $209.0 million in 2001 from $183.7 million in 2000, primarily as a result of an increase in

variable selling and operating expenses to support the higher level of sales. As a percentage of sales, SG&A

decreased to 26.8% for the year ended December 31, 2001 from 29.9% for the comparable period in 2000. This

change was primarily due to strong sales growth in 2001, coupled with continued operating eÇciencies from

global infrastructure investments and maintenance of prudent cost control measures given the current

economic environment.

Interest Expense: Interest expense decreased by 39.4% in 2001 from the comparable period in 2000. This

decrease was attributable to our increased cash position during the Ñrst, second and fourth quarters of 2001 as

compared to the same periods in 2000 combined with our decreased borrowings and an overall reduction in the

short-term rates in 2001 when compared to 2000.

13