Columbia Sportswear 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

Advertising costs:

Advertising costs are expensed as incurred. Advertising expense was $35,011,000, $27,343,000, and

$20,725,000 for the years ended December 31, 2001, 2000, and 1999, respectively.

Product warranty:

Substantially all of the Company's products carry lifetime limited warranty provisions for defects in

quality and workmanship. A reserve is established at the time of sale to cover estimated warranty costs based

on the Company's history of warranty repairs and replacements. Warranty expense was approximately

$2,672,000, $3,325,000, and $3,127,000 for the years ended December 31, 2001, 2000 and 1999, respectively.

Recent Accounting Pronouncements

In June 2001, the Financial Accounting Standards Board (""FASB'') issued Statement of Financial

Accounting Standards (""SFAS'') No. 142, ""Goodwill and Other Intangible Assets.'' The statement

eliminates amortization of goodwill and certain intangible assets with indeÑnite useful lives and instead sets

forth methods to periodically evaluate these assets for impairment. SFAS No. 142 becomes eÅective for the

Company beginning January 1, 2002. Management has evaluated the impact of the adoption of SFAS No. 142

and has determined that this standard will not have a material impact on the Company's Ñnancial position or

the results of operations.

In August 2001, the FASB issued SFAS No. 144, ""Accounting for the Impairment or Disposal of Long-

Lived Assets.'' SFAS No. 144 establishes a single accounting model for long-lived assets to be disposed of and

replaces SFAS No. 121, ""Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to

Be Disposed Of,'' and APB Opinion No. 30, ""Reporting Results of Operations Ì Reporting the EÅects of

Disposal of a Segment of a Business.'' The provisions of this statement are eÅective beginning with Ñscal years

starting after December 15, 2001. Management has evaluated the impact of the adoption of this standard and

has determined that this standard will not have a material impact on the Company's Ñnancial position or the

results of operations.

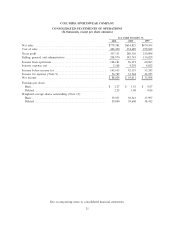

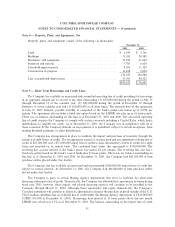

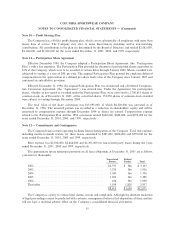

Note 3 Ì Inventories, Net

Inventories consist of the following (in thousands):

December 31,

2001 2000

Raw materialsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 4,209 $ 4,298

Work in process ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,156 9,217

Finished goods ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 109,221 94,828

119,586 108,343

Less inventory valuation allowance ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (4,697) (3,055)

$114,889 $105,288

30